In my last post I talked about the four major things we set out to accomplish with the new reports. This time I want to focus on the first goal, “Combine charts and reports so that you do not have to create a chart to get a report.” On the surface this sounds trivial but there are a bunch of goals behind this one. We want reports and the charts they contain to be readable both on screen and on paper. We want to convey the information that people are looking for without being overwhelming. We want to provide explanations where necessary. We want to be able to group related concepts.

So with this in mind we looked at various examples. We looked at the Standard & Poor’s reports. We looked at Microsoft Excel. We looked at competitors’ reports. All of these had elements of what we wanted. Standard & Poor’s looked nice but had too much information density. Microsoft Excel had great charts but gave poor context to the information. Some of competitors had decent on screen layout but poor printing, or the reverse. We kept coming back to Apple’s Numbers and the beautiful templates that they provide. The problem is that Numbers’ templates show relatively static data. So our challenge was to create a report layout system that would look as good as Numbers, but would handle variable-sized data sets.

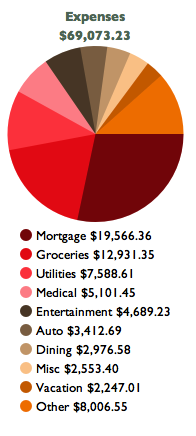

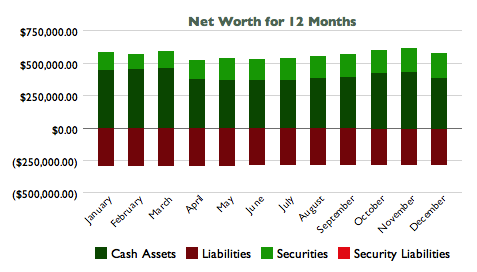

We decided on having four building blocks for the reports: bar graphs, pie charts, text and tables. We designed the system so that we could “plug in” other items when we need them. Let me show you some:

Text you can imagine, and since this blog is full of it (“it” being text…), I’ll omit an example for now.

So we have some nice looking pieces, but it really shines when we add the page layout. With our page layout engine you get the same reports on screen and in print. Our challenge for doing page layout was getting the data to flow to multiple pages without leaving some of the data hanging. For example you don’t want to have a table flow across two pages if the only thing on the second page is the totals. So far I think we have done a good job but we are still doing some polishing. Want to see it?

So we have some nice looking pieces, but it really shines when we add the page layout. With our page layout engine you get the same reports on screen and in print. Our challenge for doing page layout was getting the data to flow to multiple pages without leaving some of the data hanging. For example you don’t want to have a table flow across two pages if the only thing on the second page is the totals. So far I think we have done a good job but we are still doing some polishing. Want to see it?

This PDF is generated from our new reporting engine running in iBank using “real” testing data. The layout and all of the calculations, charts and tables are real. This is what you see on screen and on paper.

Once again I have to emphasize: we present this info is so that our development process is somewhat transparent. I can’t make any promises as to how soon these elements will be incorporated into a release, and we’re still a long way from setting a release date. So please try not to ask — we really can’t answer that yet — but do let us know what you think.

Finally, let me give a “hats off” to Brad and Brian for answering last post’s trivia question. The movie quote was from “Sneakers.” Extra credit to CT Barbarian for pointing out that the line is also in “The Manhattan Project.” And since I had forgotten that one, I need to rent it and watch it again.

- Direct Access 2 and Open Banking Support in the UK and EU - February 17, 2021

- A chunk of sync update - June 27, 2014

- 2013 In Review - December 17, 2013

Give me the bar chart feature, with tracking of net worth (not just cash accounts) over time, and I’ll be a very happy camper.

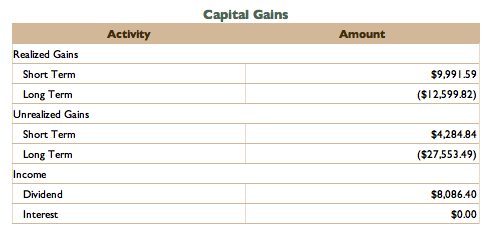

The capital gains breakdown is nice, too.

How about some info on how you’d go about selecting categories, etc, to go in a report/chart/etc. This is another area I’ve found very confusing. Seems like I should just be able to indicate with a checkbox I want something included.

Also, any chance of getting search to allow you to specify a date range in the next release? Unless I don’t see how, I can’t specify a date before my CPU starts smoking as iBank cranks through every transaction I have.

I criticize because I like iBank – it’s good stuff, thanks for all the hard work.

Simplicity is key. Keep it simple.

It’d be nice to have an Overview screen that shows budget progress, account totals, income v. expenses and upcoming bills. Not a report per se, but related in my mind.

This looks promising but what still keeps me from buying iBank are missing basics. For example, import from my Quicken Windows file still produces an inaccurate mess (though it imports perfectly into the otherwise flawed new Quicken Mac Essentials); and unlike Quicken, iBank doesn’t allow me to automatically adjust share price on a mutual fund buy when the total purchase comes out a few cents off because of rounding. So I’d end up with inaccurate totals. Fix those things and improve reports and I’ll switch. (Currently using Quicken Windows w/Boot Camp.)

I don’t understand why people need a personal finance program to keep up with detailed investment data. Most mutual fund companies and brokerage companies provide online data in great detail. If I use investment accounts at all, I would only use them to manually update account balances periodically, i.e., monthly, quarterly, annually, etc. My investment firm provides details of all of my mutual fund holdings and brokerage holdings in great detail (including capital gains and losses, cost basis, allocation pie charts, and performance graphs and records.)

I suggest emphasis on checking, savings, and credit card accounts( which most people need to follow and reconcile frequently.)

All that is needed for a Net Worth chart is Assets and Liabilities.

I’ve been using iBank for a while and I think it is a great product. I have used Quicken and Microsoft Money and some other Mac products and hands down iBank is the best.

I think it could be better though. I downloaded and looked at the new reports features and think they look great. I agree with what some of the others have said, simple easy to produce reports and selectable categories for reports.

I also think iBank should have a home page screen that loads when the software loads. It should load in the same window so there are not extra windows. It should have a scrollable accounts list with balances, a small monthly calendar with upcoming bills and reminders, a portfolio graph that updates or portfolio and investment analyst data, and a net worth chart. Clicking on an account or choosing an account from the drop-down account list will take you to the register for that account. All of the sections on the homepage would be customizable and can be removed per the user, they would be like widgets. The calendar would be selectable to click on upcoming bills and enter new ones and since iBank already has iCal sync the new entries would sync to iCal.

Better way to calculate debt to help me save money. For loans adjust the individual planned payment amounts, enter the additional payment amount, or the total monthly payment. Better forecasting and analyst to see where money is going and how to save money, so I can pay debt better. Please make iBank 64 bit for better memory management. Overall though, I think it is a great product.

Charts are pretty, give you a graphic view of where your money’s going, etc. Unfortunately, the IRS will not let me send them a nice, multi-colored chart! They (dull, paper-pushing bureaucrats that they are) seem to be quite insistent that I send them itemized data reports that not only give totals (Medical $5101.45) but an itemized breakdown of how I got that total. iBank doesn’t do this and it doesn’t sound like you’re even planning to do this. (Maybe I’m wrong; I don’t speak developer-speak.) If you’re not going to include this functionality, I’m going to have to find other software. C’mon guys! Make something we can USE!

Sarah – wait for my blog posts on “Opening up the black box” and “Create more report types” which will be coming the next few weeks. I really think that it will meet your needs and if not please let me know.

Thanks,

James

The new report features looks very promising. Don’t lose sight of the need for reports showing not only financial status (losses, gains, category totals, etc) but also for reports showing budget vs actual for categories.

I would love to be able to see more detail in the reports if I so chose. For example, I want to be able to click on the category in a pie chart and see a detailed list of transactions pop up for that category. I’d also like to be able to edit those transactions if need be from that point. I might have categorized them incorrectly by accident. Plus, it is nice to know where I spent things specifically at tax time. Plus, I would like to see the totals of the parent category and create reports for those as well. For example, I don’t want to have to see Auto:Fuel and Auto:Repairs in two separate charts all the time. Sometimes I just want to know how much in total I have spent in “Auto” and see all the transactions from it in one place.

Complexity will lead to bugs, errors, and unreliability. I suggest simplicity with emphasis on USEFUL customized reports such as those mentioned by Sarah. Almost everyone needs a detailed report of tax deductible and tax related items (itemized by transaction.) The ability to customize a report is essential. By customizing, naming and memorizing, a standard report the user can select the income or expense categories and subcategories of interest to him or her, and retain the report for instant-recall each year at tax time. A time frame of “Last Year” should be among those available for selection by the user.

I actually posted a movie a long time ago, although didn’t put it into a thread here, about report issues in iBank.

http://gallery.me.com/hallmr?fullscreen#100000&fullscreen=true

What I’d love is more interactivity on the reports (i.e. drill downs that eventually let you edit the data) and also the bar charts should have consistent scales. Some of the scaling is really odd.

All I’d like is a basic transaction report for all cash accounts, user-selectable date range, and the ability to export them to CSV files for analysis in eXcel.

It should contain every transaction (with the option to omit transfers between accounts) regardless of category with the columns selected by the user.

It would be nice if the user could request summary reports, too, with the detailed reports to back them up (i.e. Monthly totals for the past year by payee).

I am still using quicken for Mac, but I watch your development, because I would really like to leave quicken for Mac behind. I’am waiting for enough additional capability. To that point I would like to suggest that long time users of fin. software are moving into a different investment stage of life. Stock are not the only thing we invest it. Bonds make up a larger %. None of the financial software on the market handle bond investment very well if at all. I would suggest you consider adding that capability.

Drilldown. It’s essential. Pretty pie charts are mildly useful at best. What I need is to be able to click on any category or subcategory or transaction and see the next layer of detail. I want to click on “Entertainment” and see what it is that adds up to X amount. I want to be able to display and PRINT that information. Real world, for tax and other purposes, this is what’s needed. Pretty charts are eye candy, not actionable information.

What I’d like is a grid to which I could drag and drop elements that are to appear in the report – I want to see what I will get. Across the top, I could for example drag years, months, etc. with the ability to filter that category to a specific range. Left side, I could drag and drop “all categories” or individual categories, or specific subcategories. “Filtering” would be for subtotals by category, subcategory, grand total only, etc. I could then save this template for re-use.

I would just like to see something similar to “Quick Report” where I can click on a category and quickly get a report showing the transactions within a selected time period without having to select accounts etc to create a chart first. That is about the only thing I miss after years of using Quicken for Mac. I am on my 2nd year using iBank and would definitely not switch back to Quicken.

By the way, when are we going to see iTax to replace Quick Tax (Turbo Tax in US)????

Brian is onto it. Reports must be able to list categories by total, together with subcategories ie Medical & full total with option to break it down subcategories say Dental Chemist, etc & then be able to itemise in detail every item within the subcategory. So one could have a broad Report by Category then a Detail Report listing every item within each category & sub category. There should be a provision to click on any item & go back to the entry in the Register. Quicken is similar to this. Once again I find charts of little interest unless perhaps they could compare income/expenditure over a number years for a quick visual of activity.

Date filtering is important & especially for countries that use July/June financial years [yes i know we’re different here] Would also like ability to use Australian stock codes without the AX prefix.I would also like to see date entry able to use the +/- for quick movement & while at it, I would also like to use tab & return buttons exclusively to directly enter in the register.

Many of the transactions I enter (manually) in my Bank Accounts are Electronic Fund Transfers (ETF) or Automatic Clearing House (ACH) transactions. If iBank could recognize and remember these types of transactions as well as ordinary types, i.e. next check, deposits, withdrawals or transfers, it would make manual data entry much more convenient.

Quicken Deluxe 98 (for Windows) recognizes EFTs and has a pop-up window associated with the Num column (check Num column) which can be edited by the user, i.e., the user can add or delete his or her own types of transactions to/from a standard list. When you click on the Num column the pop-up window appears and the list can be edited.

Still patiently waiting for the new Reports Engine.

Hooray! Glad you’re taking the time to do it right. Can’t wait for this update, it’s a crucial feature.

Image is the finished product – content is everything. For example – if you don’t add the ability to move securities between accounts and bring the history forward with the security you can not produce an accurate statement of gains and losses. This can happen for any of a number of reasons within a brokerage firm or result from changing brokerage firms.

In response to Hal’s comments wondering why people would use personal finance software to track investments, for me this is the most important part of personal finance software – and sadly the weakest part of most packages. I would offer that the same logic extended by Hal that mutual fund statements can be used to track investment accounts can be made to argue why bother with bank accounts or credit cards – since they all issue monthly statements.

The key to personal finance software is to use it to better understand all aspects of your financial situation and to provide a means to verify the statements that you receive from any financial institution. They are all capable of making errors and in fact they do.

It is tax prepare time and I am sooo frustrated with iBank’s inability to give me printouts of the information I have been logging in all year. That is mostly why I use financial software in the first place– to help me itemize and report my numbers at tax time! See SARAH ON 2/12, RYAN ON 2/16, HAL ON 2/17, BRIAN ON 3/2, DAVID ON 3/3. Especially ability to click on an item and go directly to the entry for editing. At this moment I cannot find a way to pull up a category report by transaction. I can get a yearly total but I can’t see, or easily edit, any transaction. I can tell by some of my totals that I have made errors somewhere in entry, or I have mis-categorized some entries. Trying to track backwards to find the mistaken entry, or to re-categorize a bad entry in so time consuming that it is almost not worth it. PLEASE FIX AND GET US A MORE USABLE REPORT SYSTEM soon!!!

I’m hoping that you will also include line charts in your reports. I do not think it makes it that easy to see how my expenses compared to my income using the bar chart as you present it. A line chart on the other hand would make it easy to see as I would have 1 line showing my income (green) and another one showing my expenses (red). If my green line is above my red line then I saved money, if my red line is above my green line then I spend more then money coming in.

Maybe one can then as an option also have another line (purple?) showing the difference. This line can be positive (showing me how much I saved) or negative (how much more I spend compared to income).

I also hope that you somewhat separate the collecting of the data from the actual chart creation making it easier to add different kinds of charts later on. Similar to excel, the data is in a worksheet and I can from it create a chart but then rather easily change the type of chart.