First, my apologies for not giving this blog the attention that it deserves. Since I last wrote about 2010 in review, I’ve been busy with a number of projects — the most pressing of which is the release of iBank 4.2. This new version of iBank includes a slew of enhancements and bug fixes. Here are some highlighted changes/additions that I think users will be most excited about.

1) New transactions default to the last date edited. This has been a feature request since iBank 4 came out. It was a behavior in iBank 3 and I’m happy that we’ve brought it back. Users that save up their receipts and enter a number of transactions at once will really appreciate it.

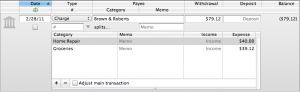

2) Improved split editing. When a user is editing splits they generally either want one of two behaviors. First, they want the “main transaction” amount to adjust itself automatically so that it equals the sums of the split items. Or two, they don’t want the “main amount” to adjust, but instead they want the split to balance automatically. And frankly, some users want both of these options, depending on whether they are editing a transaction they are about to import or adding a new transaction. So to please both camps, we’ve introduced this:

You’ll notice there is an option to “adjust main transaction” that lets you toggle between the two modes. We’ve also moved the + and – buttons to below the table and just made that table flow a little better (and now the focus ring draws as it should!).

3) In-line calculations. This is a BIG one. Ever need to put in that a total for a receipt was 23.76+44.61 ? Well now you can without having to open a third-party calculator or use Spotlight. The new in-line calculation formatter allows for addition, subtraction, multiple and division and supports multiple arithmetic operations. Just note that you should use brackets [ ] for nested operations instead of parenthese ( ) as parentheses are used for many currencies to denote a negative value — e.g., ($12.34) is -$12.34. The other good news is that you can pretty much use the built-in calculations anywhere you are editing an amount.

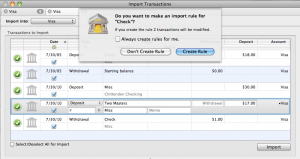

4) Complex import situations. Some banks generate QIF files that contain very little useful information. For example, a check might have for the payee “Check.” The problem with iBank 4.1.2 is that if you have two or more of these transactions in a single import session, when you go to edit one, the other can change because iBank is trying to be “smart.” This behavior was bad, because it would be too easy for users to miss what transactions where automatically changed based on the newly created import rule. To alleviate this, we’ve added a dialog to iBank asking you if iBank should create an import rule:

If you choose “Create Rule,” the other appropriate transactions will be changed. If you don’t, iBank will only change the transaction you are editing and subsequent encounters of that specific payee will NOT prompt the dialog again. For users where this is way too much control, press the checkbox to “Always create rules for me” and you won’t be bothered anymore.

5) This one is actually for us. We’ve added a built-in crash reporter to help us with those emails we get saying, “I don’t know what I was doing, iBank just crashed.” As these types of emails are a little too frequent, a built-in crash reporter will help us improve the stability of iBank. If it crashes, the next time you launch iBank you’ll be greeted with a window asking if you want to submit the crash report to us.

Those are the main features that justify the 4.x bump. But rest assured that we’ve fixed numerous bugs as well, as 4.2 will deliver improved downloading from Fidelity, improved report calculations, improved check printing, improved British “localisation” and many more enhancements.

We expect to get this release out for download within the month, with the Mac App Store update to follow (since there’s a lag between submission to Apple and approval). I hope this version really polishes the iBank 4 user experience for everyone.

-Ian

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

- Continuing Investments in Direct Access - February 26, 2024

When will we get online bill pay?

Still not a peep about an iPad version of iBank?

+1 for an iPad version. We can’t wait any more;-(

This update address my biggest complaints with iBank. Looking forward to it!

New Guy – Trying to convert from Quicken (on old PC) – Just got 4.1 downloaded to my new Mac for 30 day trial but report errors have me concerned and losing faith so I’m counting on 4.2 to get me back on board – WHEN ?? can I download a 4.2 copy to continue my 30 day trial ?

Is it possible to build in the three finger swipe when moving through report details to go forward and backward in the reports much like we do with websites?

Has Budgeting been addressed?

I hope that budgeting as well as forecasting have had an overhaul. Forecasting doesn’t ad any real benefit as is. It needs to use previous activity (averages) to forecast as well as scheduled transactions. After all, I don’t schedule my groceries, fuel or entertainment expenditures, and setting up new budgets can be confusing as it automatically budegts that I have more or sometimes less money than I actually have.

Also, I second the bill pay option. I’d love to have that option that I had a few years ago in Quicken.

Is there any news on adding Actual vs. Budgeted by period reporting?

There are a large number of posts on your forum about this! http://forums.iggsoft.com/viewtopic.php?f=5&t=20388&p=70456#p70456

+1 on budgeting, forecasting no use if it is based on scheduled transactions alone.

+1 on iPad Version – iBank is slipping way behind competitors on this one.

Also, is the Category Detail report type fixed – it only runs if ALL accounts are selected in the report?

How about the app for the iphone? Sorting accts. etc. Its time for some kind of update…no?…:)

Any suggestions/explanations as to why iBank 4 is running SO SLOW for me compared to iBank 3? I’m significantly disappointed with the new version!!

We love your comments. However, if you need technical help, please visit our support page http://www.iggsoftware.com/support/

We can’t provide technical assistant on the blog 🙂

Glad to see there are continuous improvements, good stuff.

I have recently started to use this software, it works great. Only issue is I live in a area where a CSV file is ‘;’ delimited not’,’ delimited so the import doesn’t work. This is common in Europe where the ‘,’ is used a the decimal point for numbers

Any hope of this being updated?

All around, iBank is my favorite personal finance app for the Mac.

However, I am not alone in wanting an iPad version. Hopefully we will see one soon???

Would love to hear a status update – as to whether such a version is even in the works. The silence is even worse than a yay or nay. No one likes to be ignored.

Would love to see a link to British securities.

Umm, IGG is probably too polite to say so, but I’ll say it for them: there’s already an version you can use on iPad: iBank Mobile.

Did you all not know that you could use that on iPad? Or are you asking for a third version of the app?

If it’s the latter, honestly, I’d rather see IGG devote time to versions most of us are going to use, instead of catering to a small but vocal group.

When are you going to fix the “transfer” transaction fields to allow “To” and “From” account processing. Instead, we’re still left with figuring out who goes in the “Payee” category and whether we have to enter a positive or negative dollar amount. I have been requesting this fix for almost a year and was told that many others have been asking for it as well.

I would love to switch from Q07 but still not confident in iBank product. Running Quicken 07 and iBank 4.1.2 (trial) simultaneously. 2 months in a row QIF import (same file used) missed transactions (2 ATM withdrawals) with iBank but Quicken is fine and has been for many years. How could that be? Accurate data is absolutely essential. Hopefully 4.2 will resolve this.

I have been running Quicken 2006 and iBank side by side since the Jan 1, and am about ready to pull the plug on Quicken. I believe in iBank at this point and feel like IGG is committed to making it the best.

I do feel an iPad version is a necessity. And by iPad version, I am not referring to the mobile version currently available. That’s a great tool and we are using in already on our iPhones, but it is intended for a very specific purpose–to enter transactions quickly while on the go. The need for a fully functional iPad version is very real and will no doubt be growing as more households move to a multiple iPad / one Mac model as we are. Hoping to hear something definitive about this in 2011 at least. Thanks IGG for giving us a solid alternative to Intuit.

Bill Pay…. When is it coming?

Ipad version is a must. I’m using my iPad more and more each day.

Not a lame ipad version either; check out Omnifocus for how to do it right.

BILL PAY, BILL PAY, BILL PAY, Please!!!! I really want to use iBank, but Moneydance has integrated bill pay.

I need billpay in order to stop using Quicken. Please get billpay in the product, and I would convert tomorrow.

Hello,

I’m using the trial version of iBank. I have to tell you that BILL PAY is the key component that is missing from your product. It is imperative that bill pay is a part of this app in order for it to be useful for me.

Just curious. What’s the hold-up? Is Bill Pay coming soon?

Please let us all know. If I can’t get that, I will have try and find something else.

Thanks!

I am liking iBank so far but I find that I am unwilling to let go of Quicke 2007 (for Mac) for a couple of reasons:

1) I like Quicken’s way of doing the long term forecasting in which you can also put in daily incidentals (like say $50 a day) and so get a real forecast telling me when my balance might hit zero. While I can schedule things like mortgage payments, bills, etc. I don;t schedule things like groceries, gas, dining, etc. Current, I find iBank’s forecasting fairly useless without this capability.

2) While iBank will put bill payments in ical, my calendar is so full that I find I miss things. A simple calendar view in iBank with a graphical view of upcoming bill payments would be VERY nice.

3) A REAL iPad version!!!! Like many other people, I travel more and more with only my iPad and the current interface is laughable and amateurish at best. hardly an enticement to buy it!

I can get used to 2) but until 1) and 3) are implemented, I’m just not willing to fork out the cash to buy iBank.

Super loooong time Quicken user here. Love iBank simply because it does not crash. That begin said, I find the reporting features weak and inflexible. I don’t always want graphs and don’t want to print them. I also agree that budgeting calendar is sorely missed. And how about a way to manage my list of categories?

gotta have bill pay if i am going to make the switch. Long time windows Quicken user and I want to use IBank 4 but i just cannot do it until bill pay is offered.

frustrated with looking for the right option!

Is there a way to manange or refine the rules for imported transactions? Everytime I import the transactions always have the date in the payee field so the rules end up not working because it think the same payee is different because of the different date. Is there a way have rules to a “begins with” instead of an exact match? Or is there a particular format I should be downloading to that the date is seperate from the payee name?

I’ve been looking for an answer to the “bil pay” question for years. Now, as you can see above, they just ignore the question. I think that it has already been addressed before and without saying “no”, the answer is that you are not going to get bill pay anytime soon, if ever. I’m putting this out there so that they can prove me wrong. PLEASE DO!