My last blog post covered the history of Banktivity (formerly called iBank). This blog post will briefly touch on some things we are working on for the future.

Banktivity 5 has a lot of great features in it, like Bill Pay and Cloud Sync. But if you read my previous post, you know that software is never done. Our dedicated team is always working on fixing bugs, implementing features and keeping the underlying architecture modern and running smoothly as new operating systems are released.

Before I go into talking about a major overhaul to one of our existing features I want to say a bit about this blog. We started this blog to have a medium to let people know what we are working on. This gets tricky sometimes when we want to talk about a new feature, but don’t necessarily want our competitors to know. Sometimes we start working on a feature a year or more before it will even make it into a shipping product. If we announce we are working on something like that, we don’t want to mislead people in thinking that some feature is going to be released in the next month or so. Similarly, when we are working on a feature we don’t want to peg it to a release date because we don’t want to ship it until we think it is ready. I’m saying all of this to try and manage expectations. With all of that being said, for the following features that I’m going to talk about, let it be noted that we have no dates to announce at this time.

Reports

We’ve heard our customers loud and clear; most of you want improved reports. This means a lot of different things to different users. Often when we prod on the details of what customers want, it’s really across the board. Some people want to be able to compare year to year, others want to be able to tag a transaction to report on it later. Others want reports that are easier to generate. And some want reports that allow for greater customization. I can’t promise we’ve solved every situation, but let me tell you about the great things we have done.

Ad-Hoc Reports.

Ad-Hoc reporting works by allowing you to save any report you are looking at. In Banktivity 5 you can drill into reports to see more detailed data, but you can ONLY see it by drilling in, there is no easy way to get back to it without a bunch of clicks. With Ad-Hoc reporting, you can save any drill down report and it will appear in the sidebar/sourcelist. I’ll talk about some of the new data you can see when drilling down into reports in a another post. But the take home point here is that Ad-Hoc reports are convenient, light weight and powerful.

Grouping.

With it being so easy now to generate a report, we imagine that customers might want to manage many more. A flat list of reports can quickly get cumbersome, so yes, in the future, you’ll just be able to group them into “folders” and organize them however you want. And yes, you will be able to make groups within groups too. I know my flat list of reports for the IGG books is way too long. I can’t wait to start using the new report grouping feature!

Tags.

This might be the single biggest improvement I’m going to talk about in this blog post – the new reports, where appropriate, allow customers to refine results based on Tags. Droves of customers have been requesting this for a long time and I’m really excited that we have it built-in to the accounting engine now. I want to be clear, this isn’t some feature we sloppily tacked on at the last minute, we baked this into the core and foundation of our product. You can add any number of tags to transactions or splits, and report on them. This exposes a powerful new dimension to reports and will let customers slice and dice and understand their financial data in a whole new way. For customers who haven’t been able to leave Quicken because of their support for classes, you will finally be able to say goodbye.

Comparison Amounts.

For almost every report, there will be a new option to show comparison data. This means you can easily compare spending for say, 2016 to 2015, or July 2015 to July 2014 and so on. We did put some sanity restrictions on this feature though. For example, you can’t compare all of 2016 to part of 2015; the date range length must be the same for the comparison period. However, you can shift the comparison range back in time as far back as you want to go – you could compare Q1 2016 to Q1 2006 if you wanted. It can also handle comparing months of different lengths, so you can compare March 2016 to February 2016. Displaying the comparison data is an option for any report that supports it. So it’s there if you want it, but doesn’t get in your way if you don’t want it.

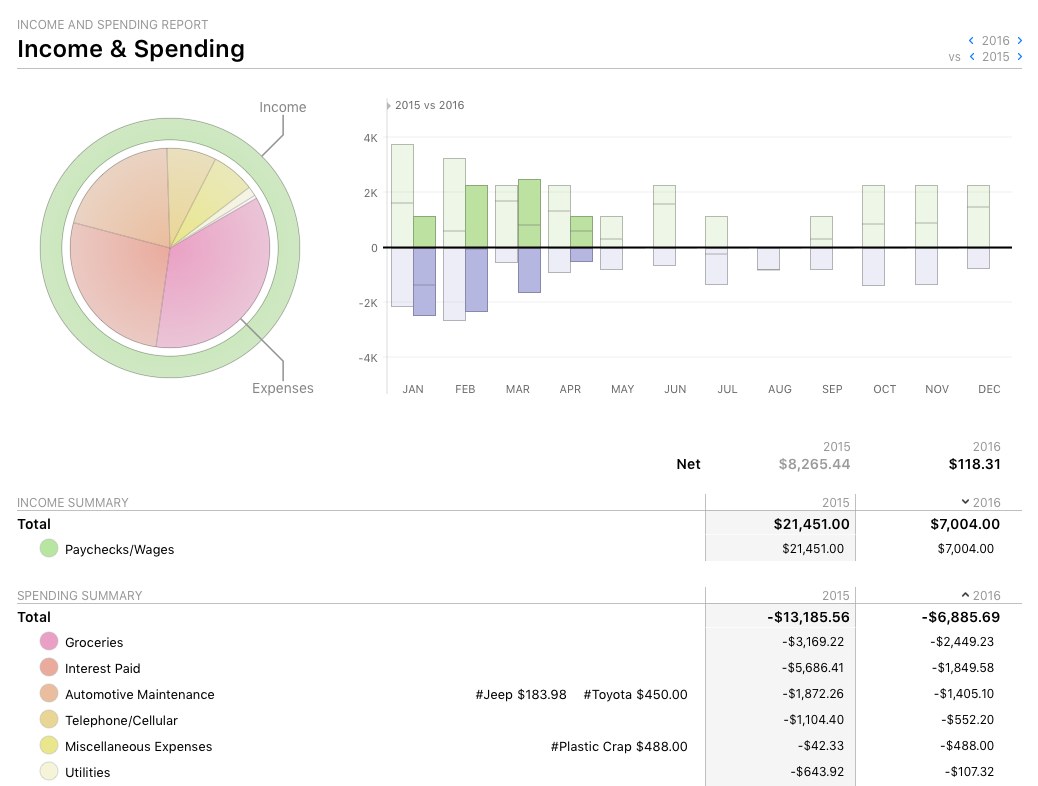

In the screenshot above you can see the 2015 and 2016 data sets side-by-side. You can also see the tags separated out on this report: Plastic Crap, Jeep and Toyota. The report is interactive as well. You can click on any category row to get more info just about that category, or you can click on a tag, to just get relevant info about spending and income for that tag. (I used Plastic Crap in the example because I’m in the process of a big move and sometimes it seems, wherever we look, there is more plastic crap to deal with. :-))

In the screenshot above you can see the 2015 and 2016 data sets side-by-side. You can also see the tags separated out on this report: Plastic Crap, Jeep and Toyota. The report is interactive as well. You can click on any category row to get more info just about that category, or you can click on a tag, to just get relevant info about spending and income for that tag. (I used Plastic Crap in the example because I’m in the process of a big move and sometimes it seems, wherever we look, there is more plastic crap to deal with. :-))

Nice Little Things.

We’ve added a lot of other niceties into reports. Here are a few:

– Not sure if want to see your sub-categories in the list or rolled up into the main category? No problem, we’ve implemented a little disclosure triangle to expand and collapse sub-categories right inline. If you hold down option key while expanding or collapsing, all categories are expanded/collapsed.

– Maybe you don’t want your results sorted alphabetically, no problem, you can now just click a header to sort data how you want it.

– Want to see data from a past interval quickly? Ok, just click the < or > arrows to change the range of data you are looking at. This works for comparison data too.

– Drill down into some more detail and want to go back, you can now two-finger swipe.

– Maybe you need a different report title? No problem, the title of the report now reflects what you name the report.

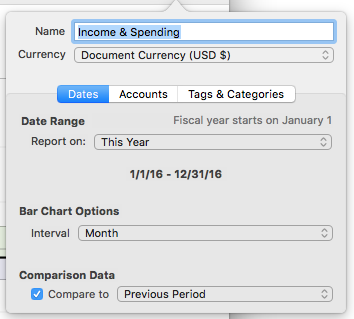

A redesigned report editor that exposes some of the new reporting capabilities like comparison data and tags.

I could go on about other features we are working on, and to be honest, I’m really tempted to. It’s an exciting time to be running IGG Software as years and years of backend work are finally coming together for our entire product line. Alas, I want to save some good fodder for future blog posts.

One last note, please keep in mind that the work I described above is a work in progress, as such, it can and will likely change.

Let me know what you think. Does it look like we are heading in the right direction with reports, or does it look like we missed the feature you wanted?

Happy Banking,

Ian

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

- Continuing Investments in Direct Access - February 26, 2024

Looking good. 🙂

I’m always wary until I see it for my own eyes, but it sounds like you folks are on the right track. One suggestion: I would love to see customizable header, footer, and font choices for printed reports.

Thanks for opening the curtain and giving us a little insight to the company and iBa… er, uh Banktivity.

Outlined enhancements sound really good. Two items on my wish list that I would dearly love to see happen (reporting was a big one.)

1) Split entry, when entering something like a paycheck, the tiny display of the split entry is terrible, if it showed 10 or so lines at a time it would be so much enter for those transactions.

2) Lack of having an option for positive confirmation on new downloaded entries is a bad feature. I download transactions and they are only marked as new for 24 hours, if I spot them soon enough and change a category then I’m set. But if I don’t get to it in time it flows down with other prior transactions. For those of us with the need, it would be great to be able to flip an option switch so that new transactions remain above the line until they’re OK’d to go below the line with other past transactions.

Thanks for the hard work, great products, and interest in feedback.

Randy

+1 for a method of confirming downloaded transactions.

Very excited about reporting and tagging and the feature to group reports (my sidebar is getting out of hand). I hope you build a basic data SEARCH option within reports.

Concur with the above suggestions on the split register and I would like to see the use of colour on the register for negatives, sidebar etc. The monochrome look has worn thin on me.

Did you mention adjustable column widths? So I can read the payee.

I didn’t mention this. We have it on our list, but it isn’t implemented yet so I didn’t want to talk about. At this point I can’t promise it, however, we’ve redone all of the reports and do a much better job of maximizing column widths.

This series of tools for preparing and viewing reports is great news, especially (for me) tags,

Note to @ Randy Harris. The split entry window can be resized. Pull down on the tiny, tiny dot in the center of that entry window.

More specifically, the dot in the center bottom of the split entry window.

Allow different financial years – not just calendar years.

I should’ve mentioned this. The plan is to support different fiscal years.

Have you considered making the fiscal year a customisable feature so that it can be altered to different countries ? AU Fiscal runs 1 July to 30 June.

The plan is to allow customers to pick the start day and month for their fiscal year for each document. Default will be 1 January.

Fantastic! Will this be able to be applied to budget periods as well as report periods?

That is the plan.

Looking good! Always great on the Aesthetics.

+1 on Tags, they are critical. I lost a lot of info when I imported here last year.

+1 on the Download confirmation and split entry functionality. Perhaps some things could become configurable? Like whether downloads go in automatically or not and whether we get that silly prompt to orphan splits when we change categories/accounts on transactions?

– And more consistency in report/selection date criteria would be helpful.

Thank you

An urgent one is merge and delete and merge payees. This has been requested for years. when the Bank changed the payee proforma slightly we end up with the same payee with many slightly differing names. It’s primitive to have to change each transaction. Otherwise reports upcoming looking good

I would like a dollar for every time I have cut and pasted PAYEE’s to keep things neat and reportable. I agree better management of Payee names would save a lot of time for me.

+1 for better Payee management. I’d love to be able to go back and edit a Payee that has a slight typo.

I’m very exciting with theses futures features. Great job!

One more thing to enhance the software is the possibility to select some rows in transactions windows and the it shows the sum of withdraws or deposits.

That’s a neat idea.

Great suggestion G ! yes I find myself doing that and then clicking on the calculator to add things up !

Not sure is this one is on the drawing board but I would love to see custom TYPE for transactions and that the types be uniform across all platforms. I make use of POS which is not supported on iPhone version. Syncs require that the Mac file be updated manually as it is often overwritten with WITHDRAWAL

This is sort of an edge case, but there’s several million of us in the US Thrift Savings Plan, so maybe not. To track share purchases every two weeks, I know the total amount of the share purchase, and the # of shares it bought, but not the $/share. Quicken allows input of any two variables and calculates the third. (purchase amt, $/share, or # of shares purchased) Would be great if y’all could build that flexibility into investment transactions. It would save a lot of calculator calcs. Thanks!

Does Quicken then assume the commission is $0.00?

I echo Jonno’s request. This was huge for me.

Have been using your products since changing to Mac 6 years ago. Having used MS Money for many years I really missed that feature when I changed to iBank. My company 401(k) provided the purchase amount and # shares. Entering biweekly purchases to several investment accounts went from a quick task to a project. I had to manually calculate share price (to many decimal places.)

I do not recall if there was an entry for commission.

yes – assumes commission is zero

The ideas sound great. Looking forward to the next version of Banktivity. I hope you will improve investment tracking – in particular the ability to look at portfolios at various points in time.

I would love to see the ability to drag and drop a transaction from one account to another. I frequently find that when I am entering transactions – I get caught up posting them all in one account and fail to realize that the third transaction involved a different credit card. It would be great to be able to drag the entry to the other account rather than delete and retype the entry.

Steve, you don’t have to retype. You can cut and paste. I make this error also.

I also love the drag and drop idea over using the cut and paste to the account.

I am investigating Banktivity now. I have used Quicken 2007 for years. In Quicken, to move a transaction from one account to another, you simply right-click on the transaction, and up pops a list of possible actions, including move transaction. If you choose move transaction, the new panel that pops up includes a list of destination accounts to choose from. To me, this is very basic functionality that I have used since Quicken 2001. I plan to attempt a free trial of Banktivity. I tried iBank several years ago and discarded it for usability reasons. I am hoping it is better now.

+1 on tags. I’ve been waiting for years to migrate from Microsoft Money — but can’t without tags. Can’t wait for the new version!

Hi All

Can someone elaborate on the advantage of “Tags” ? Please give me some examples of how to use them…..

Ron

I use the ‘note’ field to mimic tags in B5, e.g. I use the registration number of my 2 vehicles to identify Fuel costs. Genuine tags will make this reportable

Tags can help reduce heavily nested categories. For example, I might have these categories: Auto Service, Auto Fuel. But if I have two cars, there isn’t a good way to track which vehicle requires more maintenance/service costs. With tags, you can assign the category Auto Service and then tag the transaction with “Toyota” or “Honda” or whatever vehicles you have. You could then report on not just how much you spent on Auto Service, but also get a break down by Toyota and Honda.

They can also be great to tag Business vs. Personal expenses for the same category, say Travel.

Ian, the changes you described are welcome and what many of us want. Could you comment on any plans to:

1. Enhance Tax Reports, especially investment income, in Banktivity for Mac?

2. Provide at least on overview or rudimentary reporting capabilities in the iPhone and iPad versions?

3. Allow modifications to font and colors?

4. For Account Registers, the addition of one line (instead of the current two line) registers?

5. Add attachments to accounts (as opposed to individual transactions) for statements, trades, etc.?

Hi HB,

Here is the best I can do at answering:

1. I don’t want to lose fodder for future posts. Every report is being re-done and almost all show new data. What *exactly* do you want to see?

2. iPad has some reporting capabilities via the Budget/Report page where you can select multiple months. Makes sense for iPhone to get more capabilities like this eventually.

3. No plans to allow for font modification right now.

4. No comment

5. No plans to implement this, isn’t requested very much

Great news on reporting as that is the weakest Banktivity link by far. Quicken has you beat here – literally by miles.

I’d like the ability to do a register report and export to excel – choose a time period inside the account register and produce a quick report. The current reporting system is too cumbersome.

Add the ability to show or not show transfers into and out of an account.

Make it really simple to choose a category for a report – not have to scroll thru the 100s in a list.

What is the ETA for changes to reporting?

It would be nice to have a Global search for attachments or some form of indexing that you could reference thru an Icon (as many mail clients do).

Thank you very much for continuing development on your product. I enjoy using it. One suggestion on the reports (such as net worth) is having the amount (value) of each quarter (or year) appear as you put your mouse on the bar. Sometimes I don’t want to drill down, just quickly see the values each bar represents. Sorry if this was already mentioned.

We’ve implemented this.

Are there any plans to incorporate statement reconciliation into Banktivity for iPad? Given how many people are moving away from traditional computers to tablets this seems like a very logical next step, something that could allow the iPad version to sync with the desktop but substitute for the desktop in at least the critical roles like statements and basic reports. This is a key missing feature for me, I have a mac laptop but it is very old and since I rarely use it I don’t expect to replace it any time soon. I love my iPad and want to move as many of these things over to it as possible. This is one of the key things I still have to get on my computer to do.

Can you comment on your plans in this area?

Thanks,

This seems like a logical feature to add at some point (read: isn’t our highest priority at this moment).

I am with Brian. The iPad is the new computer & I could spend so much more time with my family if I could do some reconciling while waiting at various appointments & picking up kids. I have been asking for this for 2 years. I hope others will also ask for Reconciling on iPad.

PS. Thanks for tags, I also had asked for this.

Will I be able to see a Totals line for the amounts in my Smart Account(s)?

Or, will I at least be able to export the transactions to Numbers (Mac) so that I can add a Total via spreadsheet?

Smart accounts show a total of all transactions. What specifically are you looking for? I think I’m probably not quite understanding the question.

Hi…

I’ve been an iBank user for a couple of years… I would like to add a request for a simple feature. How about letting users select a default transaction type for a particular account? That is, for my checking account (where I use my debit card the most), the default transaction type would be “POS”. For my AMEX, the default transaction type would be “Charge”.

Right now, the default transaction type for both of those is “Withdrawal” so when I download transactions from my financial institutions, I have to spend a lot of type changing “Withdrawal” transactions to the appropriate type.

This may not sound like a big deal but it would be a HUGE timesaver for me.

Thanks for listening…

I am with you on this one Steve, have the same concern. And if you synch to iPhone which does not have as many TYPE of txns the problem gets exacerbated.

I’ve used Quicken in the past to do my job costing. I was able to apply categories/subcategories and class/sub-class. This allowed me to make a payment for multiple items and for multiple projects and then I was able to to pull up reports by anyone of these. It was and is important for me to be able to pull a report by class. I’ve already made the switch to Banktivity and was waiting for this feature. Is the ability to do what I’ve described what you’re talking about as a new feature in a soon to be released update?

Thanks!

“…let it be noted that we have no dates to announce at this time.”

Great to see forward movement. Too many of us suffered with Quicken and we know what lack of progress can be! It would be useful to you guys, I think, to allow us to vote on improvements needed. Starbucks and others have done this successfully. That makes it easy for us to vote on a fleshed out feature rather then sending an email to you saying “add tags”. The voting would be good for you to understand what many of us want the most.

Thanks Ian. I appreciate your transparency and continued efforts to make this product as simple, yet robust as possible. I know you might be working on this, but I would add a couple visual tweaks to the budgeting reports, as this is probably the most basic, but most commonly used report for intermediate users: (1) I’d take away the “unexpected expenses” gray bar. I think people want a simple expense vs. income snapshot, and their smart enough to know that was budgeted for and what was not. (Maybe budgeted line items wold be in bold, and unexpected line items would be non-bold, or italicized?) I think it would look a lot cleaner if you removed “unexpected” gray headers. (2) I’ve been using the budget view for about a year now, and the text next to the budget progress graph is not intuitive. I’ve alway ignored it because the numbers don’t line up. After spending some time with it tonight, I see that the “actual” number lines up with the “actual expenses” below, however, the budgeted [expenses] number does not line up with the budgeted expenses number below. (I’m not sure why – it’s slightly off.) Overall, I like the graph, but the wording on the budget page (particularly at the top) needs to be a bit more dummy proof. If I have to explain it myself, or explain it to a new friend that’s interested in the app, you’ve already lost a new customer because they’re afraid it’s going to more complicated than a simple service like Mint. Personally, I’m growing to appreciate the robust feature set in Banktivity the better I get at managing my finances (for instance, I never knew I could link my mortgage account to Banktivity!!), but some of the simple features still need a little more polish, particularly if your going to instantly win over some friends who contemplating if this app is as easy to use as their existing forms money management. Again, just small things. I like where your headed overall. Thanks again!

This is great feedback, I appreciate the details. In all seriousness, telling us what you don’t like AND why is really helpful. Then, what is even MORE helpful is what to do about it! Your comment does all of them. Thanks again, truly helpful!

Gret, glad it was helpful Ian. I just realized, in my opinion, you don’t even need the “unexpected expenses” header, because you have an “expected” expenses column in budgets. When the “Expected” parts shows “0.00”, you know you haven’t budgeted for it. So the “unexpected expenses” header seems redundant, and takes away from the polish of the overall report interface.

Could you give consideration to a Show Attachments command to list all the stored items groups by date and separated by account. I love the idea of storing receipts with txn but I think there is a lost opportunity to mine that data.

This is an interesting idea. It’s low priority now as there is a lot of work to do on some of the bigger requested items.

Can’t wait to have Tags available so I can move from Microsoft Money and pension off my old IBM laptop.

Thanks for sharing some of your upcoming features. They all sound like a move in the right direction. One suggestion I’d make is to charge more for your products and use the additional revenue to hire additional engineers and support staff. iBank is one of the most important apps on my devices and I use it almost every day. As such I’d be very happy to pay more (even a lot more) for it if that meant bug fixes and feature requests were implemented more quickly.

Ditto that Kent Akgungor, Banktivity is my most important app on the Mac. I would like to see a major release each year and I am certain most customers would be OK to fund that cost. We all need more out of this great tool and I can forego a cup of Starbucks a week to make that happen !

Great blog entry again Ian.

I have a bug fix request 🙂

Most of my accounts are in the US, but I have three overseas in a different currency. Banktivity handles this OK, except, that I have them in a separate group so I can see the total.

The currency symbol on individual accounts is OK, but on the group, it’s a ‘$’ !

Not a big issue for me, but I’m a little OCD sometimes.

There is a “document currency” that can be set in the lower-left part of the main document window. Whatever currency you select there will be used for all group accounts.

Thanks!

I stuck with iBank, now Banktivity, over the years as a replacement for Quicken because it seemed apparent that you guys were dedicated to making a good product great, and a great product greater, and my hopes have been rewarded. My one feature request at the top of my list that I would PLEAD with you to work on, is make it so you can clone or duplicate an existing Report. Why? I go to the trouble to set up a report with a lot of little check boxes checked or unchecked, and now I want to make a report JUST LIKE IT, *but* slightly different, e.g. uncheck these two categories and change the date range. But I can’t do that. I have to carefully create a new look-alike report from scratch and then make changes.

Thanks for all your hard work

I don’t want to promise something that hasn’t actually been coded yet, but I’m cautiously optimistic we will implement this.

+1 to this

Banktivity has Quicken beat by a mile. But here are 3 navigation and organization steps that Quicken is better at. They are absolutely the only things at which Quicken is better, but if you could ever fix these it would make life much simpler.

1. When a stock dividend is reinvested, it would make logical sense and be much easier if, after selecting “reinvest,” one could hit the tab key and be taken to the “number of shares” field, instead of having to use the mouse to get there.

2. When setting up a new security, if one chooses “bond” one can’t tab into the “Type” or “Risk” fields. Also, when one selects “bond” the “Risk” field should default to income, since almost everyone buys bonds for income.

3. Money Market funds are almost always priced at $1.00 per share. But Banktivity can’t be set to automatically enter this for a money market transaction. One has to enter the share price every time.

Finally, a random question: how come the file extension is still “.ibank”?

This is great feedback Rob, specifics really help us. The file extension will get changed eventually, we just wanted the name change to go as smooth as possible for step 1.

Dear Ian,

Thank you kindly for your dedication and openness regarding the future of the Bankitivity app! Software developers like yourself who are truly invested in the product give users like myself reassurance in the long-term stability of one’s financial data.

+1 for tags and sum of selected transactions!

I made the jump from Quicken about a year ago. It was a surprisingly smooth transition among a lot of trepidation after using the other product for 20 years! Banktivity is more straightforward and lacks a lot of nonsense possessed by the other. It rarely crashes, has malfunctions, and I find Direct Access to be very reliable!

I dread the work of using Bankitivity, however, because the usability is physically taxing. My wrist hurts just thinking about it. Here’s why:

• Reviewing transactions: There is no way to identify imported transactions that I have already reviewed from those that I have not without memorization, keeping a written log, or adding a special character to the note field. I know redesigns have their consequences, but it doesn’t seem too much to add an additional flag for “Reviewed.” When a transaction is imported, the flag is set to “Not Reviewed.” Once I review it, I can click the flag (dot, checkbox, whatever…). Better yet, set the flag to reviewed when it is saved from editing.

• Data entry usability: Not enough editing can be accomplished from the keyboard. Please watch someone proficient at data entry as they enter a batch of receipts with splits to see how often they have to move between keyboard and mouse. When editing splits, I cannot move from one amount field down to the next. Down Arrow takes me to the next split item and I have to then Tab four times to get there or reach for the mouse (four keystrokes instead of one.) The Tab key from the end of one split item doesn’t go to the next split. Instead it goes to the + button for splits and along the bottom row of buttons of the transaction. Unlike the rest of the OS, the highlighted button cannot be ‘pushed’ with the keyboard.

• User interface usability: There are a lot of other inefficiencies that tax my wrist. There’s no keyboard shortcut for the often-used “search” field or “Add a new statement button”. Both are in the upper right corner of the app which adds a lot of mousing mileage in full screen. That button and the statement lock are small targets on a large screen for such important functions. (I had to train myself not to use the Create transaction button which I initially assumed was new item button contextual to the current view.)

Do you consider the economy of human interaction in the app? How can it be more efficient in task completion? I understand that redesigning the app is a big undertaking, but surely there are conveniences which can be added simply. For example, when a new split item is added, why not just pre-populate the amount with the “Left to balance” total?

Anything that makes this program easier to use will help me appreciate it more! I will be happy to provide more detail on these issues and other suggestions, if desired. I am also an experienced beta tester.

Best wishes!

Thanks for the feedback. I hope to address some of these topics in future blog posts.

Good post Steve. I am meticulous at accounting for my expenses and I make use of split transactions regularly. Totally agree that it is a mouse/keyboard chore, Quicken could so this much better. I for one miss the specific function icons in the toolbar, was much easier before to get your work done that way.

Ian,

Thanks for the update on tags. However, there are 3 things that Quicken does 100% better than Banktivity. 1) Data entry for split transactions on quicken works much better – the amount left after entering one line automatically goes to the next line until the entire amount is used up. Should be able to move thru the split entries using the keyboard. Too much mouse work.

2) When transferring (for instance from savings to checking), the transaction types should automatically change on the account where $ is being transferred, i.e., when transferring from savings to checking, the type should be “withdrawal” from saving but should automatically be “deposit” into checking. It’s counter-intuitive to see a deposit in the checking register show a transaction type of withdrawal.

3) Tracking of specific stock lots in investment transactions.

Absolutely agree with Donna

So glad to hear that Tags will be added.

I’d like to add my suggestion with reports:

— when selecting the accounts to include in a report, it would be nice to have the option to ‘check all’ and ‘deselect all.’ I have 35 accounts and it takes too many keystrokes and too much time to deselect all but the one or two that I want to include. I can’t even use the ‘Command-Select’ feature with the mouse to deselect all of them.

I’ve implemented this in the new report popover editor. There is a “Toggle All” button, and a little bit of text that shows how many items are selected.

Banktivity responsiveness is slow for me, especially when reconciling. Full disclosure … my data file is probably way too big (20+ years) and I’m going to theorize that might have something to do with it. But, it would be nice if responsiveness could be improved, even when using a data file that is “too big.” Perhaps, some sort of “under the hood” archiving and retrieval?

Are there any changes coming to the iPad version? Transaction copy, for example? Sure, the iPad app is stable, works fine, but some new features and improvements would be nice.

I’m going to keep this discussion mainly to the topic at hand, which are reports as they work on the Mac. I’ll try to do a future post about our iPad version,

This is not a major deal but entering of dates and bringing up the date selector requires too much clicking. When I hit the down arrow to bring up the date selector, it always requires at least two clicks to select a date: one just to activate that little window, and then clicking the date. Even Quicken automatically activates that window as soon as it appears so you don’t have to do that.

The RSS feed for this blog is good, but my reader does not flag when an added comment has been made. Maybe that’s my reader, or RSS, I don’t know, but would it not be a good idea to use some bulletin board software for discussions like this?

I am missing the ability to archive my old data. Any chance of including that in the (near)future?

Why not just create a new Banktivity file (or duplicate an existing one)?

I have no need for archiving. I’m quite enjoying the ability to go back and look at 10 years of data (early stuff imported from MS Money/Quicken). As long as the program remains responsive I don’t have a problem with a large file.

Great to hear your plans so openly. If it is any consolation, I see no competitive threat as your products are way better for Apple than anything else I’ve used or tried.

For the UK users, can you allow security prices to be synced from the Mac? Many security prices for funds do not work consistently – I think it is a yahoo finance problem (pence and pounds or quote not available at all) rather than your software. I correct Mac security prices, but there is no option to do the same on the iPad and even if there were, I would not want to do it twice. I assume you are wedded to using yahoo finance for quotes so the source data will remain patchy for non US users. Also, I think I am right in saying that if direct access is used on an account in both the iPad and iMac versions, any change you have to make to the transaction (e.g. Adding a missing category) has to be done twice as it does not sync across. Apologies if off the reporting topic (looking forward to all you mention, particularly the ability to duplicate and edit an existing report and save a drill down report), but if you’re working on the Mac version anyway here’s hoping….

+1 for the report comparison. Really great.

1. Can we choose downloading the security data from Google instead of Yahoo? I think Google Finance has a more complete database.

2. I have some requests in terms of Budgeting features.

2.1 Allow one-time budget for irregular expenses.

2.2 It would be great to add the budgeting data as forecast into the Income&Expense Report and Net-worth Report. In this way, we would be able to see what would the financial be look like in the future given the past actual numbers and future budgeted numbers. Having the forecast in mind would help us improve the budget reasonably.

2.3 I found that the envelop budgeting is not very robust and would lose data during syncing with IOS. I tried twice re-entering historical budget transfer among envelops and now I stop using it until it gets more robust.

Thanks again for the great product! Hope it get better and better.

Thanks for the feedback. Just wanted to comment on Google’s stock quotes. Last time I checked, their license prevented us from using it.

I have been using Banktivity for 8+ years so it was interesting to revisit the past on this app as well as hear about the future. The number of bugs and missing features in the earlier years was quite frustrating, but slowly, most of my major pain points have been eliminated making this a great piece of software. As for the future:

– Improving the reporting would be top of my list. Your plans there sound great.

– One feature request I would like to see is more customization around is securities. It is rather frustrating to be forced into the set security types and risk types defined by Banktivity. I would prefer that I could define my own similar to how I can define my own income and expense categories.

– Likewise, I wish I could customize and define my own account types. Many of your users aren’t based in the US, so to be forced to select from account types such as 401k isn’t useful. Even in the US, there are many types of accounts beyond the choices iBank allows.

– Lastly, my biggest source of frustration is the incorrect historical reporting across accounts with different currencies. To be clear, foreign exchange transactions are handled fine within Banktivity. It is the reporting function that isn’t handled correctly. When looking at historical trends, account values are translated at current f/x rates, not the historical f/x rates. This really distorts all of reports with historical trending or analysis as I have accounts in US$, C$, GBP and EUR.

Fullly support the last point highlighted. iBank manages really well multiple currencies (many other tools do not).

But I also have acounts in multiple currencies and using the latest FX instead of historical rates forces me to track my net worth in XLS… Not very efficient in my mind.

Would be great to have more options to fix the rate (i.e. last day of the month or average of the month)

Thanks for the great work anyway team IGG, really love the iBank suite!

I’ve spent a considerable part of my career designing and building reports for large financial institutions – it’s a hard thing to get right, but there are some basics that really can’t be ignored.

Let’s start with the easiest one, but the one that never gets addressed. Pie charts… Pie charts are quite simply the worst way you can display multiple data points possible. So unless you’re contrasting one data point Vs the whole, there is no sensible reason to use a pie chart at all.

In the one screen shot you showed, there was a pie chart loud and proud, and even worse, it looks as though you’ve tried to combine income and expense into a single view. The only Finance application I know that actually uses a bar chart to show category spending, is MoneyWiz. Other apps tend to only use bar charts for trending, but it’s actually a lot easier to contrast other things too with a bar chart, than a pie chart. I do like your income/expense comparison 2015 to 2016 on the right.

The other feature that’s almost always lacking in these apps is the ability to omit recurring payroll expenses from headline reports. Telling me month and month, year after year, that Federal and State tax are 23.6% of my expenditure is a waste of pixels. Even worse if it’s an almost equal slice of a pie chart along with mortgage interest, pushing every other category into meaninglessly smaller slices. The most important thing about any report is providing information the consumer can act upon (many BI professionals never quite get this). So if the majority of space is consumed telling me things I have no control over, they it’s wasted. Being able to create net spending reports based upon discretionary categories should be a priority for any financial application developer, but I don’t know any that do it well. The app should be able to create a budget that ignores all fixed payments, as well as the income that consumes, and allow a focused area only on spending I can control month to month (or whatever time period), because that is where I will make or break my financial planning.

Great feedback Mark. I did want to let you know that in the current version you can omit specific categories from reports and budgets.

Ian… I could be mistaken but I think Mark was talking about things such as the overview page when he says headline reports. Either way…. I think it’s a vey good idea.

Ah, good point. Yes, a feature like that for the Overview makes a lot of sense.

Yes exactly this – it’s the reports that are not customizable.

Even so, I had to create some strange category hierarchies to budget ‘net’ income – Something like this: Salary->Salary:Tax->Salary:Tax:Fed Tax etc. Then my income/expense report will show the net income on the right (which is all I have to spend) and my next spend on the left. I do LOVE the way you allow the interest to be posted to the loan account rather than the payment account… that is a much better way to budget and allows me to focus on the total payment, but still be able to slice and dice and see the interest if I wish.

Two final things… one feature. It would be great when typing in the category if it searched the category hierarchy, so I don’t always have to remember the parent. So if ‘digital content’ is under Personal->Entertainment->Digital Content, it will come up as I type “Dig…” rather than have to type “Personal…” which might have 15 options.

The other thing is I should have said in my first post how much I love your software… it’s easy to be nitpicky, and I was, but I’ve bought every version since iBank 2 and subscribe to the downloads and bill pay. I’m very glad you’re updating your users with these posts. Keep it up!

I’m a UK user and the most problematic thing for us is the price of securities from Yahoo. I know the main problem is with Yahoo. On some stocks and funds, today’s prices are quoted in pence, but historical prices (including yesterday’s if today’s price isn’t there yet) are quoted in Pounds Sterling. I can’t think why Yahoo do this. Unless I update Banktivity every day (which often isn’t possible), the missing days will be filled with historical prices which can be out by a factor of 100. I then have to correct these manually – a real chore.

Moneydance gets around this problem, by having a checkbox which you can untick to prevent historical prices being downloaded. This would be a godsend in Banktivity. Moreover, in Banktivity, the Closing price of a security may be in Pounds Sterling, yet the opening or high / low price may be in pence! That one, I don’t understand.

There are other free services in the UK, such as FT.com, which you could get prices from. When Microsoft Money (MM) shut down their servers, an ex-MM programmer wrote an add on for us Brits which updated all the security prices in MM from the Financial Times. It is still working and there is no charge. Another supplier of security prices in the UK would be the ideal situation for us. (I wouldn’t even mind paying for a reliable service which Yahoo certainly isn’t).

Don

I have posed this question long ago to IGG support (never answered) back when the update to iBank was done to make it compatible with iPads. At that time the types of transactions in the Mac version of the program retained 8 types of transactions and the iPhone/iPad went to only 4 resulting in a loss of information if one enters a transaction on the mobile devices. Will this ever be corrected and the Mac and Mobile versions match?

+1 for that, this is a real pain as I like to use POS for over the counter transactions and I need to edit all my data entered via the iPhone app. The earlier version of Ibank for iPhone supported all the Mac Txns types but this was dropped. Also would love to see custom txn types.

Ian – How about an answer. Will the transaction types ever be made to match on the mobile and Mac versions? Withdrawal on the mobile just does not cut it.

It makes sense for the transaction types to match across iOS and Mac OS, this is the direction we are headed in.

+1 for more robust reporting. I would particularly highlight the ability to export more than 6 months worth of data at a time in Month by Month Income/Expense reports. This appears due to the fact you can only fit 6 months worth of data on a 8.5×11 page, but this is an archaic limitation give I export the data to Excel, where I have an unlimited number of rows.

The one thing I really am trying to do is get my life organized. I like iBank and just started Banktivity5 and saw I could add scheduled transactions to my Mac reminders. Unfortunately, it puts them where I cannot put them on my calendar along with other reminders or caldav information. This is a deal breaker and I will check out Mint Bills instead.

You can turn this off by selecting Scheduled Transactions in the sidebar and then uncheck “Add to Reminders”

I turned this off because it only put the reminders on my Mac and reminding just on my iMac is really not helpful when away on a trip. It would be helpful if Bankivity would use notifications on iOS and OS X and it would eliminate having to copy them to reminders for notifications.

A new user, from PC and Quicken here who has dumped his PC for a mac. You have a nice program, but get a one button backup feature PLEASE.

Big Omission. Big big big.

As a Mac user, backups are something I don’t need to worry about on an app level basis for one reason: Time Machine

On top of Time Machine, if you use Banktivity’s Cloud Syncing service, your data is backed up in a way, particularly if you synchronise multiple devices.

But importantly, use Time Machine and a decent external drive. Easy peasy.

I owned iBank previously and just upgraded to Banktivity. In some ways i’m very pleased and in others not so much.

My largest frustration is Currencies, Banktivity seems to not handle currencies very well at all. For example the main currency where I live has 3 decimal places, Banktivity shows 3 however only calculates 2 resulting in large errors that have to be adjusted out each and every month. If you enter multiple transactions with 3 decimal places each and every transaction is immediately rounded to two digits, it doesn’t even hold the 3 digits behind the scenes.

Also many investment accounts allow you to hold multiple currency stock in the same account. For example, in my Canadian account I have Canadian and American stocks. In my US account I have US, CDN, GBP, Euro stocks all in the same account. Banktivity requires me to setup a seperate account for each currency, which means I have to make fake transactions between accounts everytime I purchase a stock.

Lastly for some reason when entering these multiple currency stocks banktivity continuously gives me the error

“The amounts don’t match

[IGGLineItem

setTransactionAmount:exchangeRate:amount:]……..”

all the time and the entire program crashes loosing anything I have done. So now anytime I enter a currency transaction I save the file first. Frustrating!

That all being said I do like the program and fine the online chat helpful, unfortunately they can’t provide me anything on when these bugs/features will be fixed.

I’ve been using iBank/Bankitivity for about 8 years and love it! I just saw this blog and am so excited to see some of the improvements you are planning! A big help with the reports would be to allow us to have a “toggle all” check box on the Account Selection screen. I have many accounts and when I run reports I typically only pick a few of the accounts for a report. I have to uncheck all the boxes except for one or two! Thanks for all you guys are doing! Keep up the good work!

I wanted to bounce the idea of moving Banktivity to a compulsory subscription based model that would inject funding to support enhancements , fixes and ANNUAL new releases.

This is the most important tool in my computer and I would support such model if it accelerated the evolution of the product. This tool is money to me and I am sure that anyone using this it has a good reason to go to the trouble.

I understand your desire to keep IGG Software afloat and ensure the continued maintenance and development of Banktivity. I would like that, too. That’s why I had no problem paying for an upgrade from version 4 to 5. Having said that, I hate, hate, hate the subscription model for software! I much prefer to purchase my software upfront and pay for upgrades when I am ready or able to do so. I would be very, very disappointed if Banktivity became subscription-based software (such as Office 365 or TextExpander, for instance).

Fair comment Rob. I yearn to see a release each year. So many things the product could include and/or do better (so many great ideas in this thread). The major release cycle is every 2 years with some minor enhancement/fix. I think we all want more, like you I would gladly pay for the upgrade and those that are happy with the status quo can park themselves there.

My one simple request is that if you select several transactions, the total amount of the selected transactions appears at the bottom of the window. It would make life easier just to get a quick total without having to run a full report.