In this blog post I talk about a new feature we’ve been working on, called “Portfolio,” and I discuss a little about the future development of Banktivity.

Banktivity has supported robust investment tracking and insights since the early days. But one thing that we’ve always wanted to improve is how quickly and easily you can see how your investments are doing. In Banktivity 5 we added a “summary” view to accounts so you can see how your investments in a particular account are doing. This was a good first step, but wouldn’t it be nice to have a way to quickly and easily see how all of your investments are doing across all of your accounts?

Portfolio

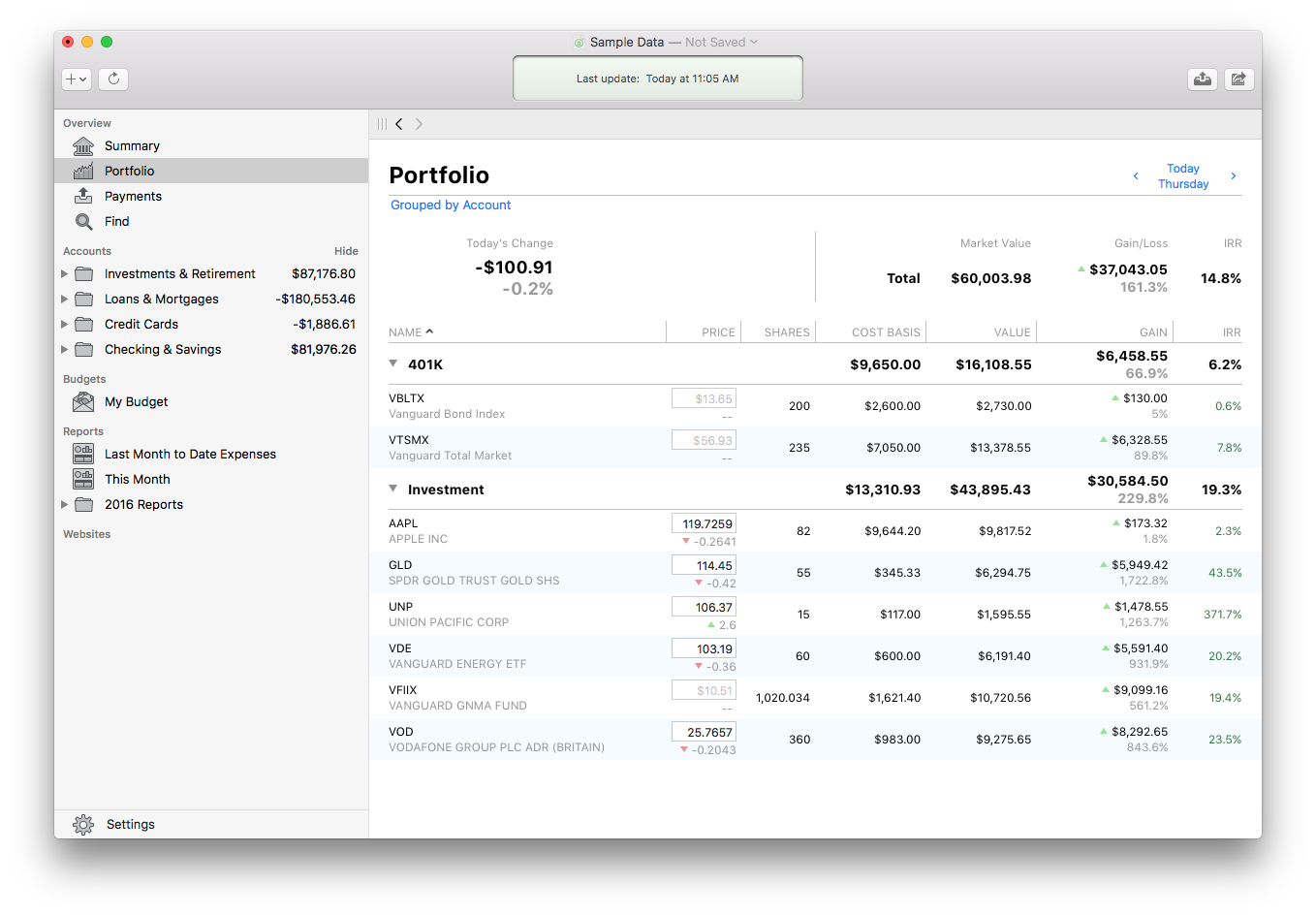

Today I’m introducing you to a new feature called “Portfolio.” Portfolio is a new top-level item that appears in the source list (aka sidebar) so it is always there and always accessible. When you click it, you get a display of all of your securities grouped by either account, security type or security risk.

As you can see, the Portfolio displays all of the key investment metrics like price, shares, cost basis, value, gain and IRR (internal rate of return). Additionally, if you have a security whose price we can’t automatically update, you can enter the price right on this screen. You can also use the blue forward and back arrows to see how your investments did on a particular day. But what if you are wanting a little more information on your AAPL holding? For example, you might remember selling some of your holding, but you aren’t sure if the proceeds from that sale covered your original purchase. To get at this information, you just click on the AAPL row and a new Security Detail report view slides into place.

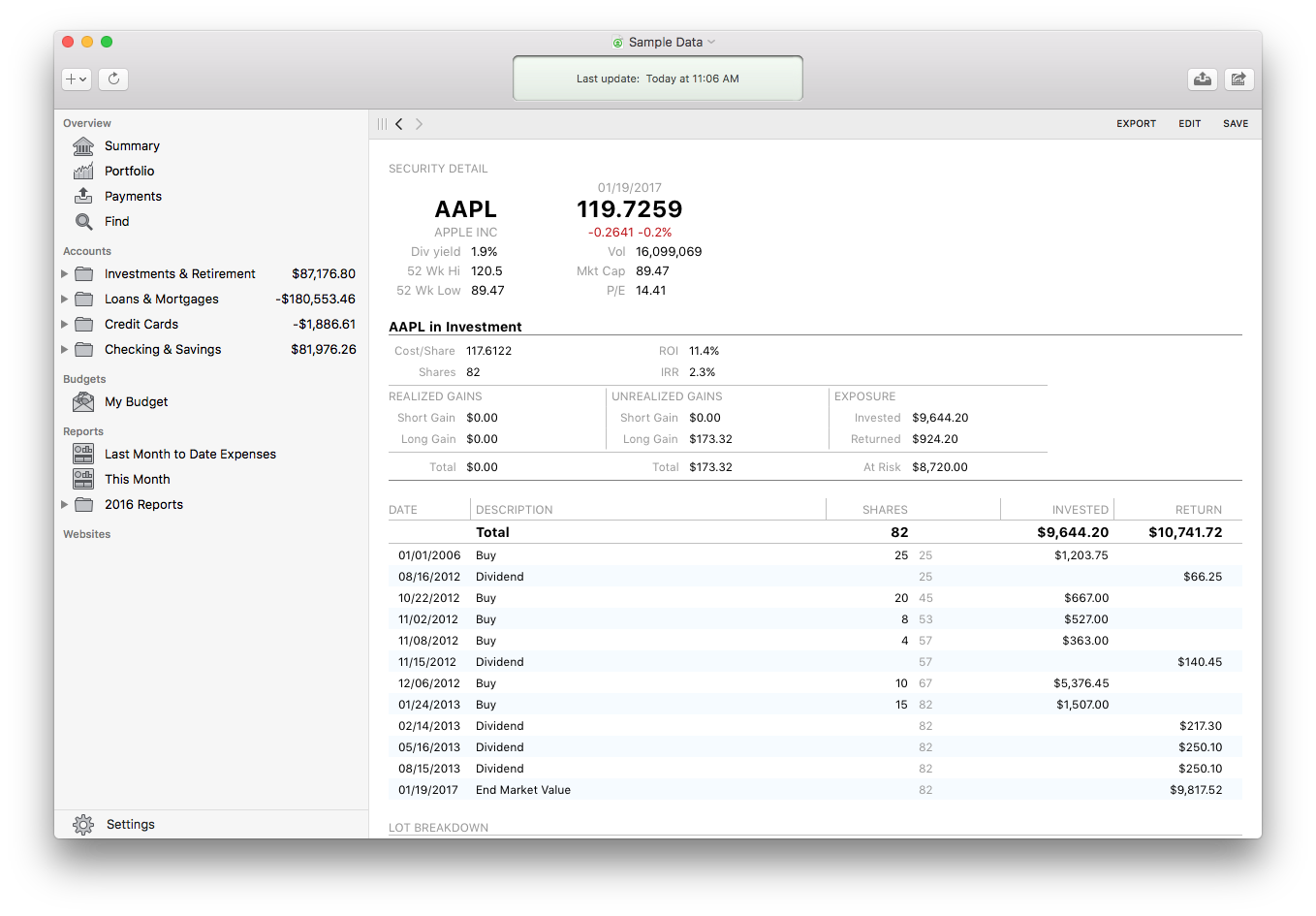

Security Detail

This new report type gives you all of the information you want to know about this particular holding. We show a running list of every transaction for this security and it also includes a lot breakdown so you can see exactly where you stand with each lot. Up at the top, we find that key metric I am interested in for this example: I can see I still have $8,720 at risk.

What’s Next?

I know some of you have been clamoring for an update on when you might be able to get your hands on these new features I’ve been writing about for months now. The good news is, we’ve actually been showing these features to a small group of customers to get their feedback and help us iron out bugs. The bad news is, we aren’t ready for the entire public to jump on these features just yet.

Thanks for reading, and I’m already looking forward to my next blog post which should NOT be months and months out 😉

-Ian

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

- Continuing Investments in Direct Access - February 26, 2024

Do you have a sense of the ETA for the updated version?

The features are looking so great compared the current version

I just would love to have some idea of when

I’ve said it before and I’ll say it again; you’re a financial software developer not a game devoper. When it comes to how people manage their money they like to have some insight. This “it’s done when it’s done” nonsense is very frustrating. You’re not Blizzard. It’s not hard to hammer out a release timeline and tell your professional user base an approximate release date. The only reason for not doing this is to try and dodge some of the responsibility inherent in this kind of work. As it stands and given you’re blog post history it could very well be months before you throw up another short feature tease and months past that before you actually release. Meanwhile loyal, paying customers are left guessing. Also, where are those user forums? It’s 2017, try and work on building a real community!

I could not agree more with Jonathan. I consider Banktivity one of my most critical applications, but the level of feedback and the rate at which updates are rolled out makes me feel nervous sometimes. The applications itself is good and its potential promising but I am not convinced that you are committed enough to get it there. Every couple of months that I have not seen any movement from your side, I do the rounds trying to find a possible replacement thinking that you might have packed it in.

Do you have plans to support Australia’s franking credits on stock dividends ? I found a way to report on this but I lose sight of its association to the stock (as your sample shows).

We aren’t actively working on supporting those. Can you use the “Dividend” transaction type, but categorize it as something other than Dividend Income to report on it for tax time?

Ian

I figured this out this am. After I posted. Have a lot of data entry to look forward to !! It meets my needs and it will be worth it.

Thanks for your transparency regarding the development pipeline, Ian. It keeps users like myself engaged. I use your macOS app on a daily basis.

5 yrs from now, I could see myself (and many others) going completely iOS across all devices as the platform matures. I look forward to seeing how these features apply to the iPhone and iPad apps as well. Best!

Hi, how do I become a beta tester? I’d really like to be involved in making Banktivity better. I switched over from Quicken some years ago and haven’t looked back, and I think my database would give your updates a good workout, with data going back several years and literally dozens of accounts in multiple currencies, tracking all sorts of financial transactions including investments.

I’d enjoy beta testing or early adopting an updated version of Banktivity, too.

Hi Ian,

Bit out of left field with the regards to the thread topic but I would love to see Banktivity 6 compatible with PilotMoon’s POPCLIP utility, it would make register editing so much easier !

Hi Ian —

One thing that Banktivity (nor any other financial management software for that matter) does is allow you to track annuities. Basically, I have to model the two annuities I own as giant savings accounts with lots of transactions entered as “unrealized gain/loss”. It would be very nice (and groundbreaking) if Banktivity did this.

As an investor I’m excited about the new portfolio features. While Banktivity has always done a nice job of tracking investments in the registers, quite frankly, it’s been lacking in most every other department. I see already I’ll use the portfolio features right away rather than having to generate a rather limited report. I’m also an options trader and while Ian’s post didn’t mention options, I hope we’ll see some improvements along those lines too. In particular, Banktivity doesn’t track options prices, so I hope we’ll see that.

Like many others, I’m anxious to get ahold of the new version. While I’m an IOS user too, I do 99% of my finance and investing on the Mac, so I’m thankful that so much loving attention is being focused on the Mac version of Banktivity.

Looks like some math errors in your screen shot. e.g. showing AAPL long term unrealized gain of just $173 ?? Seems wrong. ROI also seems wrong.

Ha, good eye! The math is accurately reporting on the underlying transactions. The problem is the underlying transactions were just hand entered based on some fairly non-realistic numbers.

iBank/Bankactivity needs more close attention to such details. The current reports continue to have errors that eluded attention for some time. Will Bankactivity6 fix the several years outstanding problems with foreign currency accounts ?

It does not appear you are including the cash balance in the portfolio view of the accounts. This could be the result of a quick example for the blog. I would think displaying the cash balance is very important as I would envision using the portfolio to reconcile my account to the monthly statement I receive from my broker.

I realize that I would reconcile the cash balance in the register, but the typical brokerage account provides a total including securities and cash. But securities tend to have Stocks, Bonds and Mutual Funds with separate subtotals and no grand total for investments. Therefore, I believe it would be best to have cash included in the totals for the account in the portfolio.

Ian, in your past few blog posts you’ve introduced us to a lot of new functionality for Banktivity. I presume that this is targeted primarily at the MacOS version, but could you comment on how much of this will appear in the iOS versions for iPad and iPhone? Thanks.

Anyway to show the gain/loss from previous day by security?

In the new Portfolio view you can step “back in time” day by day. As you go backward/forward, the Portfolio view recalculates based on the date you are currently viewing.

Very nice. This in particular caught my eye: “it also includes a lot breakdown so you can see exactly where you stand with each lot.”

So, will we also be able to choose specific lots when selling securities, or are we still limited to FIFO? Thanks.

We really wanted to add lot selection, but it was cut near the end. 🙁

6.1? The sooner the better.

I am financial planner and am looking to recommend your product to clients. I have two questions:

1. You do not mention security measures or protections. Is there built in encryption for file and data transfers and if not what encryption software do you recommend be used to avoid any conflicts with yours?

2. Does your Portfolio software have automatic downloading of market data from the various markets, issuers of mutual funds, ETFs, etc

1. Our cloud sync system is completely encrypted such that, IGG doesn’t even have a way to decrypt the data. The customer holds the key. As for the local file, we offer a password protection, but it is NOT encrypted. We recommend File Vault for that.

2. We download quotes for securities using Yahoo.

For file-level security, what I do is to keep all of my finance-related files (the Banktivity file, as well as statements, PDF’ed receipts, all of that, in an encrypted disk image. You need a password to unlock and mount the disk image, and once it’s open, it appears like any other disk to the operating system.

Create the disk image, put your Banktivity file and all other accounting files there, and done.

Note that while you can’t use Time Machine to back up the disk image, it’s easy to back it up manually. Just drag it in Finder to any destination.

See https://support.apple.com/kb/PH22247?locale=en_US&viewlocale=en_US for more information.

I have just installed Banktivity 6 and have an immediate problem with currencies. My base currency is the Swiss franc but when I indicate this it changes all the currencies on the Portfolio screen. I do not want to see my Schwab account converted to Swiss francs. This never happened in version 5.

Hey,

Do you have any plan for automated link with managed portfolios such as Nutmeg? would be great to see the gain/loss in those in our Banktivity Portfolio.

I am disappointed that Banktivity 6. does not include a facility for dealing with reinvested dividends where no additional units/shares are acquired (quite common in the UK). This means that the ongoing cost of an investment is understated by the amount of retained income. Separate details have to be kept elsewhere so that correct costs are used to calculate Capital Gains/Losses on disposal. Any advice?

Just installed 5.6.10. Does not fix inability to download quotes. The new Overview does NOT have a Portfolio section!

How do I add or delete securities and share numbers, purchase price, etc to the various accounts (IRA, spousal IRA, Trust, etc.)?

Do you think you can come to our live chat? They should be able to help you. The short answer is, you’ll want to have transactions for each of your buys, sells, etc. in each of your accounts.