We’ve received a lot of great feedback on our original Hidden Gems blog posts, both part 1 and part 2. So in keeping with the spirit of those posts I’ll again be exploring the less touted features of Banktivity 6. But instead of just focusing on new hidden features, I’ll also cover tips and tricks, how-tos and best practices. So whether you’re a penny pincher, wealth builder, loan payer or FIRE (financial independence, retire early) seeker, this post is sure to have something for everyone.

Irregular budgets

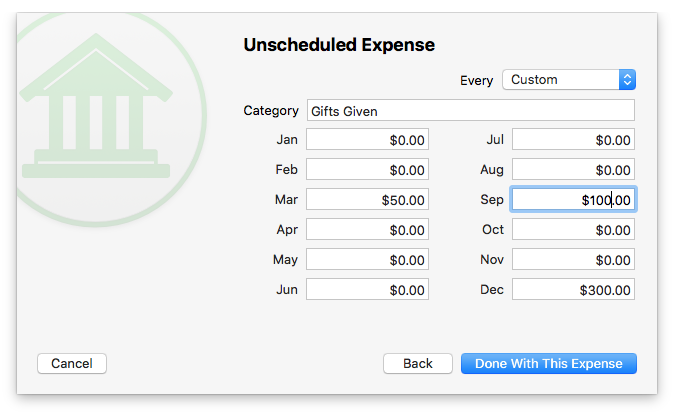

In the past (i.e. before Banktivity 6) budgets had the notion of two different types of expenses: bills and unscheduled expenses. Bills occur at regular intervals for roughly the same amount each month (or week, or whatever interval you want). You know, like a cell phone bill. Unscheduled expenses was for everything else, like your Dining or Groceries budget. This generally worked fine, but what about a category like Gifts? Your gift spending might be high in the months when there are birthdays, an anniversary or in December for the holidays, but then it might be zero for all other months. Prior to Banktivity 6 there just wasn’t an easy way to handle this, but now with irregular budgeting, you can plan for those more idiosyncratic (and still important!) expenses.

To set up an irregular budget you go through the process of setting up an unscheduled expense, but instead of choosing an interval like monthly, choose Custom. Then change the amounts for each month as appropriate.

Making the Most of the Built-in Browser

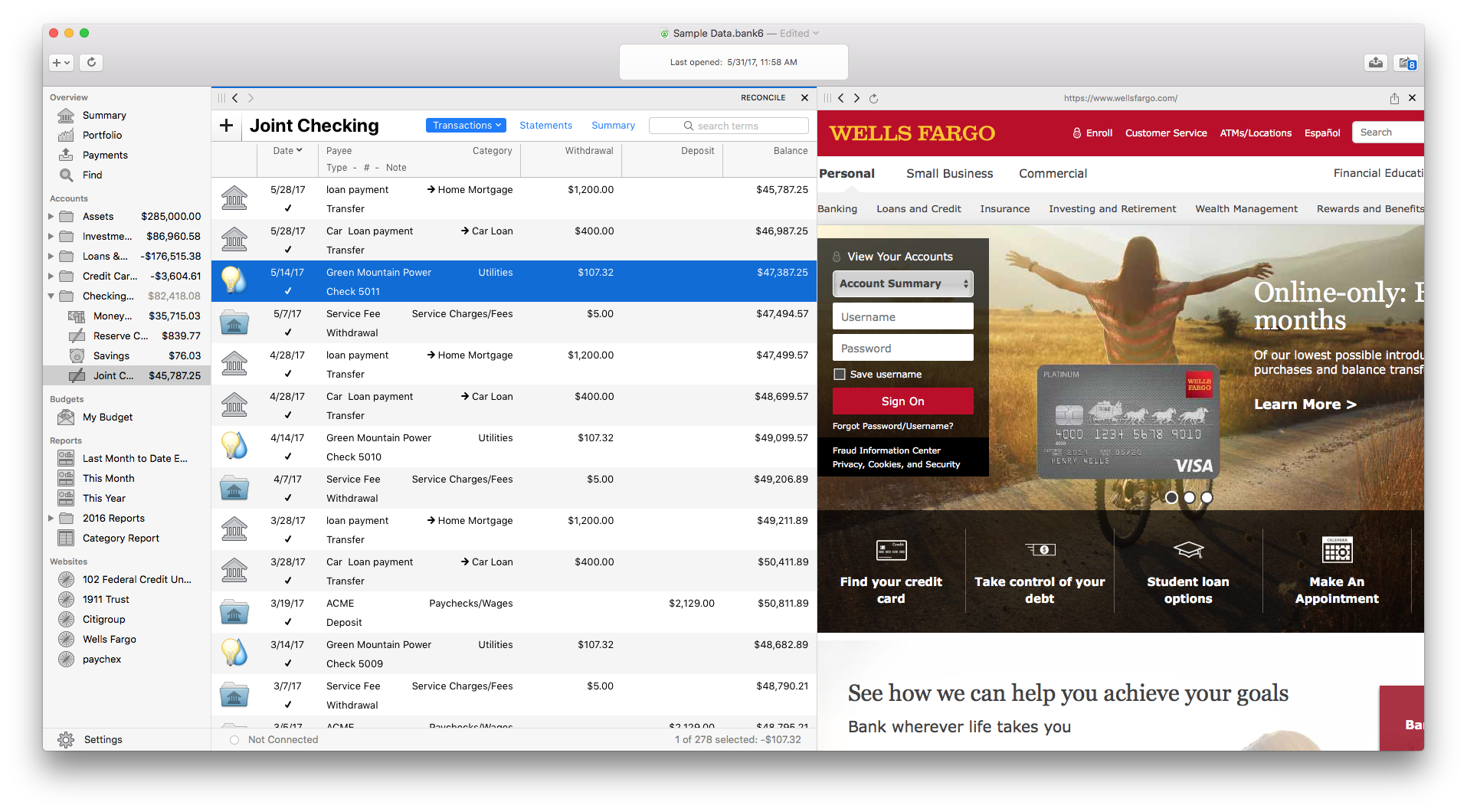

Most of our customers automatically download transactions using our Direct Access service or Direct Download (aka OFX). However, there are some out there, that for various reasons, using the built-in web browser is still the best way to download transactions. Additionally, many people just use the built-in browser if they need to verify an account balance, make a payment to a credit card or do a transfer.

So here is a scenario we’ve heard several customers experience. First, they click on a website in the sidebar, this loads the built-in browser and they log in to their bank’s site. Then they click on their checking account in the sidebar (or report, budget, or something other than the loaded website). Then when they are done in that view, they click back on the website. This brings up a brand new web browser screen and they are asked to log in again. However, if instead of clicking on the web browser in the sidebar a second time, they just click the back button they will be right where they left off on the bank’s website. The forward and backward navigation is new and we really hope our customers embrace it. If you have a hard time remembering the forward and backward navigation, this is a really great trick: put the bank website in its own workspace and put your “working view” in a different workspace.

Putting the website in the right most workspace allows you to easily stay logged in while navigating the rest of the app in the left workspace.

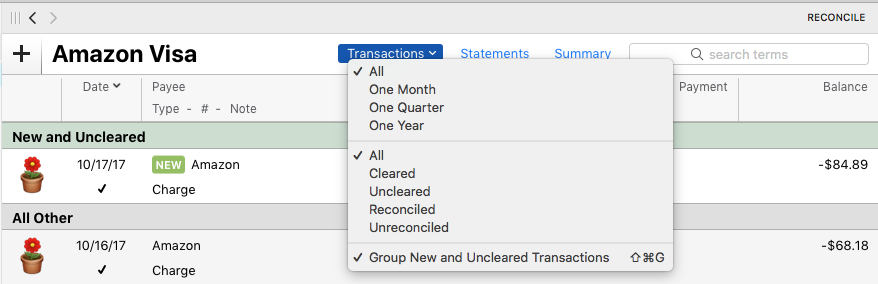

Visual Emphasis on New and Uncleared Transactions

Ok, disclaimer, this feature is in Banktivity 5 but how to access it moved in Banktivity 6. For accounts that have a lot of activity, sometimes you only want to see what is most important: new transactions and all transactions that have not yet cleared with the bank. To see these transactions together, select an account in the sidebar, then click the small downward facing arrow in the Transactions button and select, “Group New and Uncleared Transactions”

Merge Two Transactions via Drag and Drop

Ok, another quick disclaimer, this isn’t actually new in Banktivity 6. But I want to cover it now because if you don’t know this feature exists, you are really missing out. So the use-case goes something like this, you write a check, say for $100. Now, since you are using Banktivity, you of course enter this transaction in the app so you have an accurate take on that account’s true balance. But the person who receives the check, for whatever reason, doesn’t deposit it until a month later. After that month goes by a new transaction appears in Banktivity for $100, but because it is a month after you wrote the check, it isn’t matched to the original transaction you entered. To rectify this, simply drag the new downloaded transaction onto the one that you entered manually and they will be merged together. Case closed.

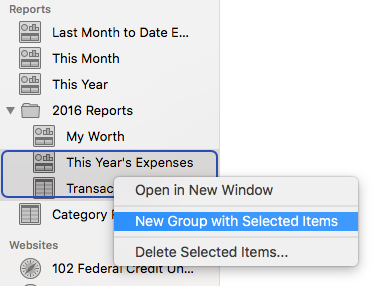

Report Groups

We’ve worked really hard trying to make Banktivity’s reports useful and nice to look at. But until version 6, a customer’s list of reports might grow and grow until the list felt unmanageable. Now you can select multiple reports, right click and choose to put them in a group. Once the group is created, you can drag and drop reports in and out of the group. You can even put groups within groups to organize to your heart’s content.

Right-clicking while multiple reports are selected allows you to put them in a group.

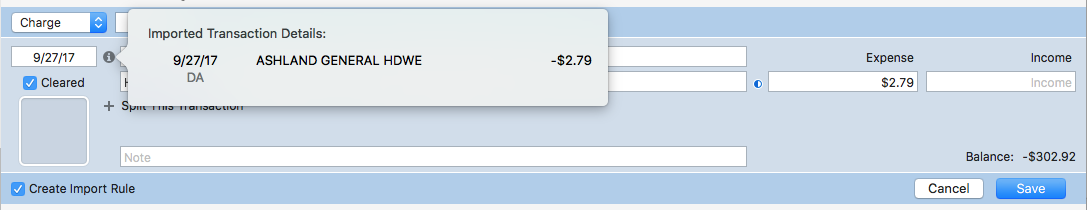

Checking an Online Version of a Transaction

Every once in a while you might have a transaction in Banktivity that you don’t immediately recognize. Further, you might not know if some clever import rules cleaned up the payee and gave it a category you weren’t expecting. Whatever the case, there is a way to see what the original/online version of a downloaded transaction looks like.

To see the original imported transaction double-click the transaction to edit it. Then look for the little gray “i” icon. Click it, and you’ll see the original import information, also known as the Imported Transaction Details.

Please note, the little gray “i” button will only appear if the transaction was in fact imported via Direct Access, Direct Download (OFX) or imported from a file.

The List Goes On

There are more goodies throughout the app that I look forward to sharing with you in the future. If you have a favorite tip, trick, best practice or other Banktivity 6 feature you love, let me know about it in the comments.

Until next time.

– Ian

- Building the Future of Banktivity: Organizer Progress Report - October 17, 2025

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

I’m feeling good about not learning anything new with these posts. Also, I don’t think you should call any of these features ‘hidden’ as they’re all in the manual… and you don’t want to *hide* features!! ?

Hehe, good call, “hidden” might not be the best word choice. Maybe, “less obvious” or “less promoted” would be better.

I would consider them as undocumented features, which are always likely when updates introduce new features that have not been documented it the help files or on-line manuals.

They’re documented. In the PDF manual.

Regarding New and Uncleared, I make use of this feature daily in V5 so I launch V5 it into a Smart Account Template of ALL accounts/ALL Uncleared.

With B6 I have to look at every account to get this picture, we need a way in B6 to pull out Uncleared/Unreconciled transactions globally with the either FIND command , Reports Filter or reintroducing Smart Accounts concept.

I agree! I’m looking at Banktivity as a replacement for Quicken, now that they have moved to a subscription only model. My morning routine is to review all uncleared transactions across all accounts while I sip my first coffee. In some ways I use that view almost as a to-do list. It’s important enough to me that I’m seriously thinking whether I can give that up. It’d be like giving up coffee…

You can use a Transaction Report to easily see all uncategorized transactions.

That’s true, but ‘uncategorised’ transactions are not the same as ‘uncleared’ transactions. I have transactions with payees, categories:subcategories, etc. all ready to be ‘cleared’ but I leave them uncleared. In this state they do not show up in reports as they are not ‘uncategorized’.

It should be easy enough to add this little ‘cleared/uncleared only’ checkbox to a report’s setup so allow such filtering, surely?

I do utilise the ‘Group New & Uncleared Transactions’ all the time. It’s a great way to see them all together, particularly when their dates are quite spread out in the ‘normal’ view, but allowing a report to filter based on the ‘cleared/uncleared’ status would be useful in several circumstances.

Thanks for clarifying, I think I was responding too late in the day and say “uncleared” as “uncategorized.”

I have the same workflow as Richard, the uncleared stuff from the catch all Smart Account in B5 is my portal to the day’s Banktivity work. I have delayed moving to B6 for this very reason.

I can live with Paul’s suggestion of a batch report that gives me that info, I can’t consider opening every account to find my Group Uncleared’s.

Likewise, I too could live with a report that allows me to display uncleared transactions, though in an ideal world I’d prefer to see them in a “global” or “smart” register or on the Summary screen. If a report “cleared / uncleared” filter is quick and makes it into an upcoming dot release, you’ve converted this Quicken user. Thanks!

I like that idea Richard, a Global Register under Overview which would pull all the transactions and you could leverage off the existing filter facilities in the register. Sounds like a winner and not much change to the code. Works for me !

Hi: You will find that Banktivity is “adequate” but a distant cousinn of Quicken. It lacks key features such as: very limited account reports, reports in general, inability to change date format, poor or inadequate reconciliation reports, etc. One thing that is great is the support and the fact that it is Mac native. Hopefully improvements will come.

After using Quicken for a number of years, I made the switch to Banktivity and would say that it’s easier and more fully functioned than Quicken in a number of ways – especially when compared to the native Mac version. The reality is that it simply became too complex to manage whenever Quicken or VMWare decided to make a change. My personal financials are probably more complex than most and I find Banktivity is really the only solution that works for me in a native MAC/OSX environment.

Thanks for the browser tip ! a game changer in B6 use ! (but still need the enhancement above)

Ian

I look forward to these “Gems” ( which is an appropriate description )…… Excellant tips.. Now if we can only get the “Present” balance instead of “Projected” balance on the side bar when using scheduled transactions !!!!

Ron

Ditto Ron, it would be ideal for this to be a preference toggle so you have that choice.

I’m not sure I understand this correctly.

My side bar always shows current balances and doesn’t include any *scheduled transactions*… but if I put any future dated transactions into the register, it does show that figure, but this is not the correct way to use ‘scheduled transactions’…

Why are you entering transactions into the register with a future date if they’re meant to be scheduled transactions and you don’t want the ‘future balance’ displayed?

I only add scheduled transactions when they occur, adding them to the transaction register using the ‘Confirm Scheduled Transactions’ drop down list. If I want to see what the future balance will be, I’ll put a future dated transaction in the register… but that’s *not* a ‘scheduled transaction’.

Hi Paul

Maybe I am doing this the wrong way !!!! I like to see what my financial position position looks like in the future so my logic is to input the future transactions to see this.

Is there a better way to do this ? I have been doing this in Qui******en and it works well. Please advise

Ron

Hmm… I see what you are trying to achieve.

I think you can do this for each account with Banktivity 6 (see p231 of the manual).

Provided you have all the scheduled transactions set (including deposits & withdrawals), you don’t need to have them entered into the register to see the projected balance forecast.

If you select the account in the side bar, then select ‘Summary’ for that account (from the top menu items of ‘Transactions – Statements – Summary’, it shows a nice summary for the account, with current balance and the *projected* balance.

The duration of the projected balance can be set by clicking the little ‘cog’ icon in the corner of the ‘UPCOMING’ section.

Does that help?

Further to this, the ‘SUMMARY’ section in the ‘Summary’ page for an account will display the following:

——————

Cleared Balance

Uncleared Balance

——————

Future Transactions

Today’s Balance <- This shows you the balance TODAY, ignoring future

_______________ dated transactions entered into the register **

Scheduled Bills

Scheduled Deposits

_______________

Projected Balance <- based on the bills/deposits for the set timeframe

** I think this is what you want on the Accounts List on the left, but I think it is much better in this summary format… but that's my preference. ?

Thanks Paul for taking the time and effort to explain this to me……. All though, It would be nice, if we had the option to show “Present” or “Scheduled” on the sidebar…

This (entering future estimated transactions into the register in order to see upcoming/forecasted balances) is my main daily activity in Q*. So far I am happy with the end user experience and responsiveness of Banktivity, but the inability to easily view the the current balance in the menu of accounts on the left is a major shortcoming (in my circumstance, anyway). I am instead forced to drill into the account, remember today’s date, and find the appropriate line in the register. Ability to select the type of balance displayed (current or future) should be an option/preference.

I too would like the option for the sidebar to show EITHER (by choice) Today’s balance or Balance with all entered transactions (currently what happens). My use case is that I get “paid” monthly on the first. Also, on the first of the month I have all credit cards close and am able to pretty much enter/post/pay-online all my outlays for the month in my main working accounts. By the 3rd of the month I can usually see the balances to make sure I don’t have more month left at the end of the money. However, I watch the balances daily and prefer to see in the sidebar the balance visible in the Summary tab.

Me too!

I just figured out this is why my Quicken and Banktivity balances don’t match.

I agree:

I don’t use direct access for transactions and will future date most of my transactions to be confirmed with OFX downloads once or twice a month. The current account balance would be what I am looking for.

Agree with Ron, Mario, Richard, & Michael… (another voice in the cloud…)

I really appreciate the support IGG provides for Banktivity. My former banking software really orphaned its Mac Version.

Is it possible to search for or create a report to find all transactions that have NO TAGS associated with them? In Quicken, many of my transactions were not assigned to any Class, but at the end of each year I reviewed these unclassified transactions to see if there were any that should have been assigned to a Class. Now that I have imported my Quicken file to Banktivity, I would like to search for and find all transactions that have no Tags, so I can review them to find transactions that should have Tags assigned to them.

In the Reports feature, checking NO Tags boxes has the same effect as choosing ALL Tags boxes. Is there currently any way to generate a report of all transactions that have no Tags? If not, perhaps this is a feature that can be added? (…before I need to prepare my 2018 taxes, please.)

Your request is at the heart of what the FIND command should be.

I would like to see a Filters option beyond ‘amount delimiters’ which I don’t find that useful.

Adding all possible filters would make this a very powerful mining tool.

I agree. More fine-grain options for Finding, Filtering and Reporting should be do-able and would enhance Banktivity enormously. I feel these are the only aspects of the application that are currently under-developed.

Great tips! Thanks much!!

When creating a report I would like to see all the transactions for that period sorted by the date, and not by the category. Is this possible.

I will admit I haven’t tried this in 6 but I have had the problem (in 5) where I can’t merge transactions even when everything matches up. If this has been fixed in 6 then thank you and I hope it works for me the next time I need it.

With regard to the webpage tips, I stopped using the build-in web browser as my passwords for financial sites are long random strings, which in the normal browser are automatically filled-in by a 1Password plugin. With the build-in browser I have to copy paste the username and password. This makes it much easier to go the website in normal browser, download the statement and the QIF file, and then import the QIF file. Adding 1Password access to the built-in browser would get me back to using it.

Any progress in developing a tax category report? You are already capturing the “tax category” and it seems as thought it would be an easy report to spew the data back. This is not an earthshaking problem for me but it make B6.0+ even better! I keep discovering features that have made my life SOOOO much easier. Keep up the excellent work!

I would really like to be able to produce a report that shows income by category with a total & expenses by category with a total and a Surplus/Deficit & print this out over a range (e.g. 12 months) by month.

I LIke my Banktivity 6 on Mac OS: but I am wandering when will there be a full Bankitivity on iOS ? Or évent better, when are you expecting having Banktivity on line ?

I don’t understand why Bankitivity 6 is not already available on both platform ? Should I think changing my accounting software ?

“Or even better, when are you expecting having Banktivity on line ?”

Um… hopefully it is *never* going to be a cloud based app. That will be the day I stop using it.

Ditto on that.

I think the Cloud Synch on a mobile device gives you the ‘online’ needs. Sure the IOS versions need to catch up with functionality but I do love the Mac being the ‘have it all’ platform.

With all the new features in 6, I think I will stick to banktiviey 5. I just use ibank for basic bookkeeping. I do not do budgets; I do not see value in separating transactions into various groups – the registers with all transactions is easier to manage; Also, it has been my experience that once a program starts adding many features, it just becomes confusing going through the learning curve all over again

The separation of txns (new and uncleared) is optional and has been there in B5 (icon between list and Reconcile in register) .

What I do miss is the Smart Account concept, specifically the ability to have a catch all txns register that I can use the register filters across all txns. This is a big function gap , new Find command and Reporting has not adequately replaced this.

Ian -you mentioned the use of ‘Custom’ for unscheduled transactions. I use this feature quite a bit when setting up my budget. In a webinar I attended several months back I asked you about when this might then reflect in the app as well for budgeting. You mentioned it was on the developers list. Any chance that is getting closer to reality? Able to budget and keep up on the Mac pretty easy. On the fly with the app, not so much. Please make this a must to complete.

Unfortunately these tips are not good as the budget does not total correctly. I have logged this problem and have been told it is a known issue, but there is no date for rectification

We have a budget calculation fixed for the next release.

I wish B6 had printing options like B5 does. There’s no adjusting margins, orientation, or scaling by %. I was told by support that “We do have feature request to have more print options. I will add votes to those on your behalf.” But there is no timeline.

I appreciate these emails; they are good reminders of functions even when we already know them. Since we seem to be creating a “wish list” here, i would like to add my request that when we start a transaction with “deposit” it will only go into the “deposit” column and likewise for other types of transactions. I really don’t understand why that wasn’t put into 6. Thank you.

I’ve been using YNAB4 for several years, but am now looking for a replacement and Banktivity 6 seems to be the best option. I’ve also grown fond of envelope budgeting, but I’m not finding a way in Banktivity to earmark funds already in savings accounts for things like funds for emergency cash, future car purchase, or other big things that may not occur in the near future. Is there a way of doing that planning I might have missed? The budgeting capabilities seem constrained to just monthly income.

Create a custom categories within the savings account for the items for which you’re saving. For deposits, you could use the split feature to separate a single deposit into the categories.

I have just updated to Banktivity 6 from i-bank 4. I-bank 4 had a feature that I used all the time. There was a line that showed “Remaining Cash to Spend”. Is it possible to have that added to an update of Banktivity?

I have been using Mac based financial software from original Managing your Money on my Mac 512k, Quicken 2007 forward to iBank to now B6. Budgeting for me using B6 is difficult. The budget expenses screen only shows 5 expenses. I have over 100 budget lines. You cannot search and organize these expenses. You change one and then the position in the list can change, you go back to the expense screen after adjusting one and the list take you back to the top. Not the last line you were working. A more spreadsheet type screen would work for better me. If I could change the different expense lines at the same time, it would save me time and aggravation.

In the Banktivity 6 upgrade can you now show My Budget report for a half and three-quarters of a year or is it still only for one month or one quarter at a time. I like to be able to track my expenses against my budget as the year goes on. Unless this feature has been added then Banktivity 5 works great for me.

Yes, at the top right corner of the Budget Report is a drop down box which allows you to select the budget view for:

– Current Week

– Current Month

– Current Quarter

– Current (Financial) Year

…and to the right of this are two arrows. Clicking the left one will go back a period, clicking the right one will go forward.

Sorry, misread your post.

There is no ‘half year’ option, but you could create something similar using a forecast report surely?

I do this to see what future balances will be. It only takes its data from scheduled transactions and not the budget. Would be nice if it did.

Version 6 is much harder to see what’s what on the screen. Future, cleared and uncleared transaction all look about the same. In Version 5 one could easily see the differences by use of color. Much harder to find transactions. When looking at individual securities the graph of prices is very difficult to see for those securities which require manually input of prices (most of mine do). I thought the graph was blank but finally saw tiny little specs that were the price data. Looked about the same is tiny little dirt specs on my screen. Fix this the feature is not usable the way it is. Over all the look of the transaction screen is like looking back at software of 15 years ago under a DOS operating system. We all have color screens – use color. Also, to add a note to a transaction under Version 5 you just added it. Now you have to double click on the transaction and then edit it. This might be better but it’s going to take some getting used to.

When downloading accounts from my bank, only the last 5 months are downloaded. How do I get all of 2017 to date downloaded?

I have a hunch this depends on the bank. Some banks seem to present the last year’s worth of transactions to Direct Access, some only the last month.

Ian,

I thought I’d left this question about irregular budgets before, but I can’t find my post anywhere. This is the feature I’ve been waiting for since about 2008, so I’m thrilled to be using it. I’ve documented cases where the reporting doesn’t add up all of the expenditures, and the amount spent is wrong. The current version still does not include any categories in the total spent if nothing was budgeted for that period.

I’ve been a long time and heavy user of B5 and spent last week evaluating B6.2.4. I won’t spend any time on the improvements (of which there are plenty) but will instead focus on differences to B5, in hopes that current users can determine for themselves whether the upgrade is worth it or not. Before providing my input, I read through the 3 blogs covering B6 as well as all the comments and for the most part, none of the points below were discussed so I think I’ve avoided doubling up on comments. As a result of my testing, I was disappointed to realize that I couldn’t upgrade to B6 as quite a few of the items below are deal breakers for me and my workflow.

1. Register->

a. As noted by others, “cleaner” isn’t always better. While some aspects of it we could get used to with time (i.e. lack of colors on future transactions), the lack of lines across rows and columns creates a sense of everything being dumped into the register and you have to work harder to separate / distinguish.

b. This one was a shocker to me but you can no longer use the delete button on your keyboard (or any keyboard combination I was able to find) to delete a transaction. There isn’t even a “-” button like B5 had but instead, you have to mouse over to Edit on the menu bar and then select “Delete.”

c. Along the same lines, there’s’ no longer an “Undo” option either! It’s amazing how many times that has come in handy and when you no longer have it, it will absolutely cause you extra time cleaning up an unintended edit.

(1) I haven’t been able to find a way to undo an improperly merged transaction when done by the user in error. I’ve also not found a way to break apart a system matched transaction between two unrelated transactions that only happened to share the same date and amount. Since this is a specific issue with my data, I won’t get into more details but there does appear to be a new matching code called “X-Type” which I need to research further on its functionality.

d. The Investment register, no longer shows the Commission amount of your investment transactions in its natural state (i.e. without editing a specific transaction). The problem is with some investment accounts which don’t accurately handle rounding between downloaded fractional shares (3 or 4 decimal points) and dollars (2 decimal points) and leave a few cents in the commission field. It’s an error that has to be manually fixed (and isn’t caused by Banktivity) but in B5 you could easily identify the relevant transactions with this error because you could see the few cents in the commission field. In B6, you have to click through the edit functionality of each transaction to get the same information making it unnecessarily more time consuming.

(1) To add further “insult to the injury,” when you do find these nuance transactions that need to be cleaned up, every time you go to change the price of the share by extending the accuracy to several decimal points (the correct fix in my scenario above and the only way to eliminate the commission amount without changing the share count), you get a warning prompt about changing a reconciled amount. I get the use of that prompt but why not have that pop up after we hit “Save” on the transaction, indicating that we’re done with ALL our changes not in the middle of them. In my example, after I extend the dollar price to the right decimal points, I clear out the pennies showing up in the commission field and there’s no longer a change to the total transaction amount therefore that prompt won’t be needed if it had only waited until all my changes were completed before showing up.

e. Not sure if this is a Banktivity issue or a TRowePrice one but when exchanging dollars / shares from one fund to another, the Transfer Out transaction is shown as a “Sell” type with negative shares. By having negative shares on a “Sell” type, it causes the opposite effect (think of a double-negative) and in essence creates a buy transaction since it reduces the register’s cash balance for the value of the transaction. So this has to be fixed manually (and of course, in doing so, you get the maddening pleasure of clicking through the warning prompt I mentioned earlier).

2. Scheduled Transactions->

a. When you’re at the “Payees, Schedules & Rules” section you can no longer start typing a name as a navigation shortcut. I have hundreds of transactions and if I want to correct a payee showing up multiple times by deleting the extra instances, you have to painfully use the scroll bar to get to it.

b. When you do find your transaction under “All Payees”, there’s no indication whether a transaction is scheduled or not. In B5, the equivalent area of “All Templates” would have a calendar date present if it was scheduled. That way, you wouldn’t inadvertently delete (i.e. clean-up) a scheduled transaction which would then affect your budget.

c. A minor point that Ian and team could easily address is that in the Summary view (and maybe other places as well but that’s where I found it), when selecting one of the Upcoming Transactions, it takes you to the Scheduled Transactions but you’re looking at the top of the list of ALL scheduled transactions. So it appears that the actual transaction isn’t selected but in reality it is, it’s just not in focus. If you hit the up or down arrows, it will take you to the expected transaction,

3. Navigation->

a. When selecting the Accounts bar on the left, you used to be able to navigate with your up / down arrows. This is no longer the case in B6

b. If you group accounts into folders, in B5 you used to be able to select the folder and get a view of all transactions in the accounts under that folder. This was especially useful if you wanted to see all your unreconciled or open transactions for example for that particular group. In B6, you no longer have that functionality and instead, when selecting a folder, you get the exact same view as you would by expanding the folder. So not only did we lose functionality but what it was replaced with is redundant.

c. You can no longer actively manage accounts but have them excluded from your Overview totals. To exclude them, you have to hide them so they are no longer present on your account list. If you are managing accounts for someone else (say for a parent or child) and are downloading their transactions and monitoring their accounts but don’t want those accounts in your totals you’re out of luck. Even if you want to monitor an employer’s credit card account (for which you submit expense reports and the employer pays direct) to make sure you’ve accounted for all charges and there is no fraudulent activity, you can’t do it without it also affecting your overview balances.

(1) The workaround here would be to save your file with a new name to capture the accounts you don’t want to affect your total Overview. Word of caution: be sure to turn off online sync because even though you have renamed your file, it will still over-ride your cloud document.

4. Budget->

a. To be fair, this was an issue with B5 as well so I’m sure there’s logic behind it but it’s still frustrating nonetheless: I’m a heavy user of the Budget (vs the Timeline report) to manage actuals and budgets as well as to see Full Year totals, especially for future periods. In B5, you have Income and Expenses (shown as rows) for Budgeted and Actual (shown as columns) but not the net of the two. Why would that simple yet critical calculation not be shown right there? It’s as simple as adding the two numbers together. Well, in B6 you now do have a total but the rows and columns have switched (Income and Expenses are the “columns” whereas Actual and Budget are the “rows”) so you’re actually getting a view of the Remaining amount of budget left to spend (or earn). I get the functionality of that, especially in the Budget, but why not give us a toggle switch to also give us Net Income budgeted and actuals so that we can easily see how we did right there vs having to run a separate P&L report?

My apologies if any of these issues have been addressed or covered somewhere else and I missed them.

“you can no longer use the delete button on your keyboard ” I may not be interpreting this correctly but THAT is the way you delete a transaction, ie click on the txn in the register and hit DELETE on the keyboard.

I agree with your sentiments, it is annoying to lose functions (eg smart accounts, quicklook of attachments, find and sort options in several components) whilst others like the look of the register one can adapt. I am positive about the new register.

I have faith with “IGG” that all problems will be addressed at some point in time ( hopefully ). I am sure that everyone has their favourite feature and when that feature is no longer available, due to upgrades, I would also be disappointed.

But what are the alternatives ? Lets give them some time to see what they can do….

Ron – you’re absolutely right! There are no better alternatives than Banktivity out there for the Mac. I hope my post wasn’t interpreted as negative on IGG or Banktivity. I merely intended to point out differences between B5 and B6 so people can make an informed decision based on their own use of the program. For new Banktivity users, the “missing” functionality isn’t really missing since they wouldn’t have had it before. For Banktivity 5 users, it comes down to personal preferences and workflows and I wanted to point out some of the areas that I thought might be relevant to them as they were to me.

Banktivity was one of the main catalysts that pushed me to get a new iMac as my 2009 one couldn’t run Sierra and B6 is only available to Sierra and above. So I was pretty excited to upgrade to B6 once I got my new iMac (and still hope to sometime in the future), I just can’t disrupt my workflow quite as much as the total changes would require me to. Maybe others might be in a similar boat but in either case, Banktivity 5 or 6 remains the best option out there for people that want to track and improve their total financial picture.

Mario – after your comment I went back to confirm that I didn’t make a mistake regarding the “delete” functionality. So what I was missing was that in B5, the delete function was executed by pressing “command + delete” and in B6 it’s now just “delete.” A little easier perhaps (once users learn the new key combo) but note that with the lack of the “undo” functionality, an accidental or hasty single-button delete action can’t be undone.

And by the way, when we talk about the “delete” button, it’s the one next to the “plus” sign as the one next to the “end” button (on the extended keyboards) doesn’t do anything (didn’t in B5 either).

Thank you for taking the time and providing the clarification!

I have appreciated the irregular budgeting and reporting in Banktivity 6 more than you can imagine (even though it doesn’t add correctly yet).

As I prepare my 2018 budget, I’m wondering what tools are available to make it easier to add. Is there an option to duplicate and rename the 2017 budget that I’m overlooking? Or is there a way to export the 2017 budget, make changes in Excel, and then re-import it (with the irregular monthly amounts)?

Also, there’s a subset of my budget that I want to track separately from the entire budget. Is there a way to create a budget report that only uses some of the categories that I’ve defined in the full budget? Or will I have to duplicate the entire 2018 budget and then just delete the expenses that don’t get tracked in this report?

Team,

I just want to view a summary of my Budget, i.e. what my budget is. I don’t want to see envelopes etc. Just a summary of my income and expenses in a table or some other format. I can’t figure out how to do that.

I would like to change the default from Withdrawal to POS when I add a transaction

I would like to do that too. Did anyone ever tell you how to change the default?

Any idea of the upcoming transactions on the summary page will be updated? It isn’t in sync with scheduled transactions. In fact on the summary page.. I still have transactions that show due in November! But I have already entered those in scheduled transactions.

Troy,

I believe there is an issue with the product in that regards and I am very careful as to how I manage Scheduled Txns in B6. I have found that Upcoming Transactions and Scheduled Transactions work separately to some extent (this is an opinion not a fact).

I have found that if you delete a Scheduled Transaction that was in the Upcoming Transactions this ‘orphaning’ that you mention occurs. If a Transaction makes it to the Upcoming i suggest you post it and then delete the transaction and then delete the scheduled transaction.

I agree the product should clean these up but avoidance is the better cure. The only way I have found to resolve your issue was to restore, post as I suggested, and forward recover your data. Painful I know but only way you will get rid of this until they do some form of clean up and synch.

Banktivity is a great app – I’ve been using it for 6 years now and have transactions dating back 21 years imported from MS Money – that’s 44MB of data and access is still lightning fast. But there are still some things I’d love to see: a search field on the Payee, Schedules and Rules page; better graphs for securities prices; a way of deleting a securities prices over a range of dates when, as all too often, the Yahoo feed screws up.

Ditto Graeme, a search in the Payee, Schedules and Rules is essential (please raise a request so it gets up voted for consideration). The biggest chore of working with this version.

Regarding B6. This comment is about hand posting prices for bonds in the Settings>Securities Section. Prices for bonds are not available from any service supported by Banktivity 6.3. So each month I must hand post prices taken from my brokerage monthly statements. These statements are month end, the last day of the month. some times the date falls on week ends. B6 does not allow posting on week ends or days the market is closed. Thus I create a price that is not the same as the statement. My suggestion is to allow posting on any date as in previous versions. Also eliminate the question ” ADD PRICE” when posting a new price. Just one more key stroke that is not necessary.

Thank you for your attention,

Jim Otto

Is two factor authentication ever going to be implemented? If not, why not? Theft ID has hit me too many times to leave my accounts without the proper protection.

I’ve been using Banktivity for some time and always look forward to the new versions, as they invariably bring useful improvements. I’m disappointed with the loss of the autoreconcile feature in version 6, however. This is a dealbreaker for me, and I will be continuing to use version 5 until that feature is incorporated again.

Any way to see the transaction category/transfer during reconciliation?

Right now I am double-clicking every transaction to check that they have been correctly categorized during reconciliation!

After years of using iBank/Banktivity for person (non professional) use, I have decided that the easiest way for me to do my yearly taxes (small business + personal) is to do it with a yearly ledger. The very large files that come with continuing multiyear entries makes it a pain to do any kind of searching, and Banktivity will not return to where you were if you do a search, so you have to scroll through all the years to get back to zero.

Now I have finished with the 2017 tax year, filled in all the entries, created all the reports, etc.

So – here is my question: I don’t want to have to create all the accounts and reports from scratch next year. I want to simply clear all entries in the 2017 file (after renaming it), and start afresh. I don’t see a way to clear more than one entry at a time (select all doesn’t seem to work). Is there any way to do this?

So, this time I download statements and annual csv for a one year period, overlapping Jan to get all of Dec. That means I had to recreate all the different accounts and reports I use, totalling 6 different things.

I am using B5. Think I will wait on using B6. I don’t like the lack of lines – too hard on the eyes. Looks like a Johnny Ives downgrade.

Sorry for the jumbled paragraphs above. There is no way to edit.

OK, stumbled on a method to clear all entries. You have to go to the reports, Select All, and delete from there. You cannot do it from the accounts themselves.

When printing a check how do I get rid of the $. My checks already have one.

Having problem with an Asset account. I’ve created an account for personal items (owned for a long time) and input their value as a deposit. Unfortunately the value as a deposit shows up as uncategorized income. How can I prevent this?

Two issues I have with Banktivity, advice or help please.

1: when reconciling, for the more complex accounts, I usually I need to start fresh. With Quicken this meant clicking, “clear checked boxes” with Banktivity I need to individually clear every check blue box. There must be a better way!

2. This is so annoying, when putting in catagories, pressing return twice, sometimes moves the transaction deep into the opened account, unseen, and now nothing works. I have to scroll, find the transaction in which that the return button failed to save, and then save with a click, not a return. Not always do I remember the issue, which makes things very frustrating. Why not a single return button save? Igg, this is really annoying!

Thanks for writing. For #1, the best thing to do is select the transactions you want to change and then right-click and choose to reconcile or unreconcile. As for #2, if you could give detailed steps on how to reproduce this that would help. I’m not seeing that behavior 🙁

Workspaces don’t work. I can drag and get the blue border, but it doesn’t come up with the second box no matter where or how close to the edge I move it. Yes I watched the video, but it doesn’t do that on High Sierra.

Love the new features for iPhone. Well thought out.

How about adding a feature to look for duplicate entered transaction. Both my wife and I use B6 on our phones when shopping and sometimes transactions get duplicated. Thanks

It would be useful to be able to export the [custom] budget I’ve created to a CSV file.

It would be even better to see the bug I reported last September (where budget totals aren’t added correctly) be fixed.

And I’m still hopeful that a future version will give us the ability to duplicate budgets and give us some reporting options for budgets (such as reporting subsets of the full budget).

Would be great if web site had a “tips” section for people to post helpful information. I suggest that might have to be moderated to ensure advise is not poor. That said, people could benefit from others’ skills. Some folks are not social media fans, or at least very selective about it.

Example… I would guess many users without accounting backgrounds lose spending optics on their cash spending because they only record the ATM withdrawal. A tip – create a “Cash” or “Wallet” account and trasfer ATM withdrawals to that instead. You then draw down against that account by posting cash transactions against categories like usual. Even guestimates on spending there provided more accurate spending reports than losing sight of where that cash is going.

I await all the… “Hey, nobody uses cash any more!” comments! 🙂

THanks, great idea,

Hello new to Banktivity but having trouble with the reports, for example I am trying to look into my finances YTD and even though I have selected to report on “this year” from the “edit” button on my report it’s pulling information from the last 12 months and therefor not yielding the information I am looking for. Any idea how to get the date range to come through to the report? Thanks!!

Is IGG Software available for Windows .Please do reply for the same.

Greetings, I’m a new Banktivity user, migrating from Moneydance. While I’m happy with the software overall, I find that its simplicity can, at times, cause some significant frustration.

I’m almost embarrassed to admit it, but my current headache is trying to find a way to “un-match” downloaded transactions!!! For all the fanfare regarding B7’s “complex algorithm” used for matching, it’s almost guaranteed that one or more unrelated transactions are erroneously merged.

I can certainly forgive the mis-match, but I’m completely dumbfounded that there seems to be no way to prevent this other than disabling transaction matching completely (which I do not wish to do). Even more frustrating is that once a mis-match is made, the only recourse I’m left with is to edit the merged entry, then re-create the unrelated transaction again from scratch. This is certainly not a sustainable method… surely I’m missing something(?)…..