We’re so excited to preview the new Banktivity. If you haven’t been following along I recommend you read about our forthcoming “subscription that doesn’t suck” and “services roadmap” as they are both related to our new release.

This is going to be a long post where I cover changes coming to both our Mac, iPhone and iPad products. Please note that the screenshots you see in this post are not final and are likely to change before the final release. Having said that, let’s dive in!

Banktivity for Mac

Apple Silicon and Big Sur

In June 2020 Apple announced they are developing new Macs that no longer use Intel processors. The new hardware will use “Apple Silicon” – or more commonly known as ARM processors. Although we don’t know the final specs of the new processors or what they will even be called, we do know they are based on the SoC (system on a chip) processors that Apple has been shipping in their iPhone and iPad for years.

In order to take full advantage of this new hardware, apps need to be compiled to run natively on Apple Silicon. I’m happy to announce that the new Banktivity will run natively on both Apple Silicon and existing Intel Macs. We already have our hands on a Developer Test Kit from Apple that lets us test our app on the chips.

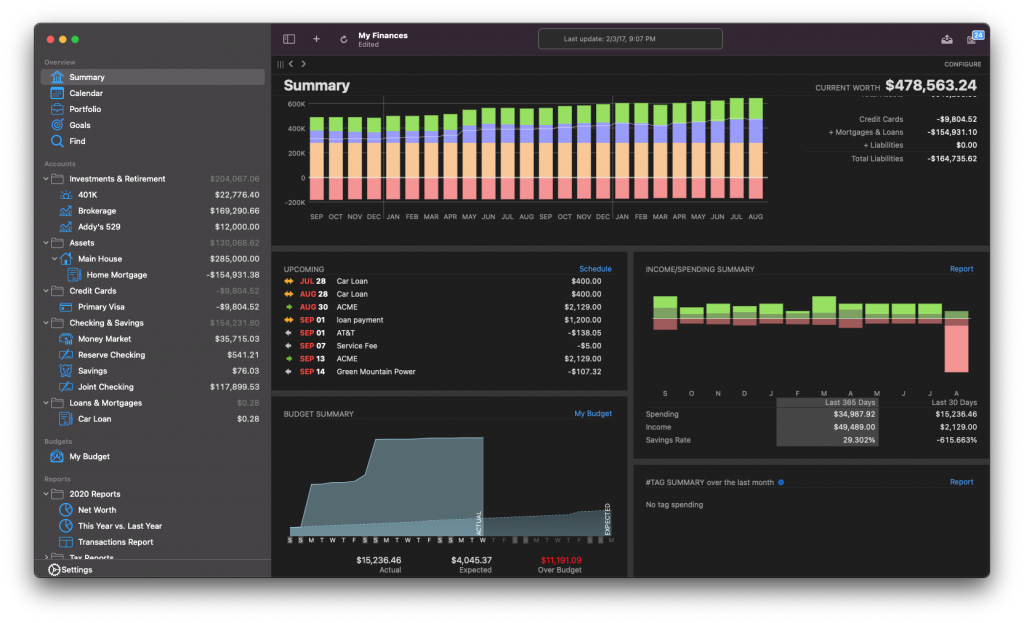

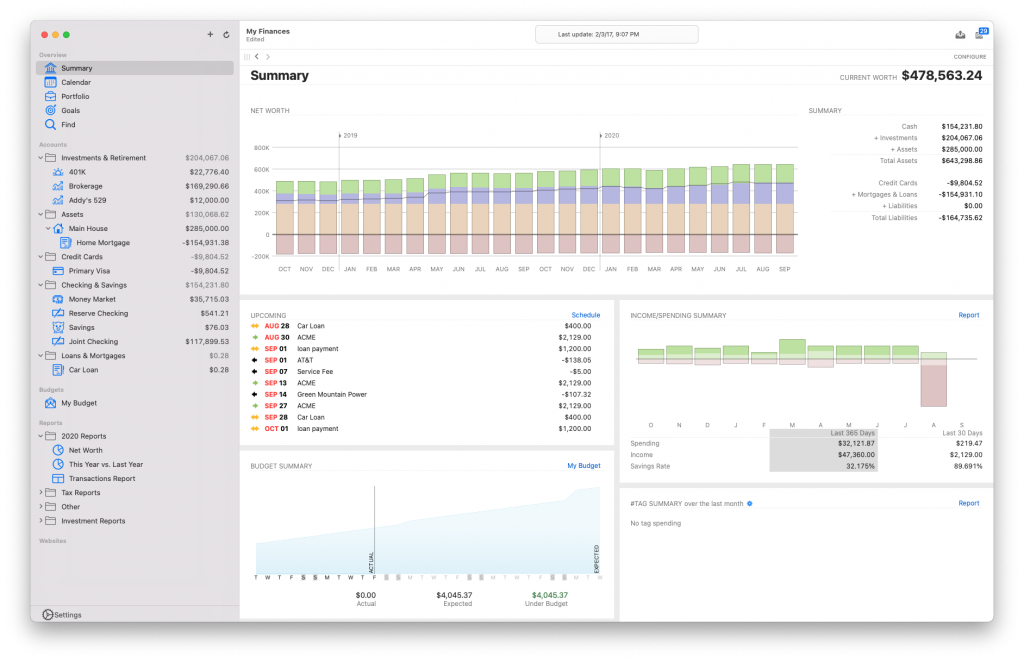

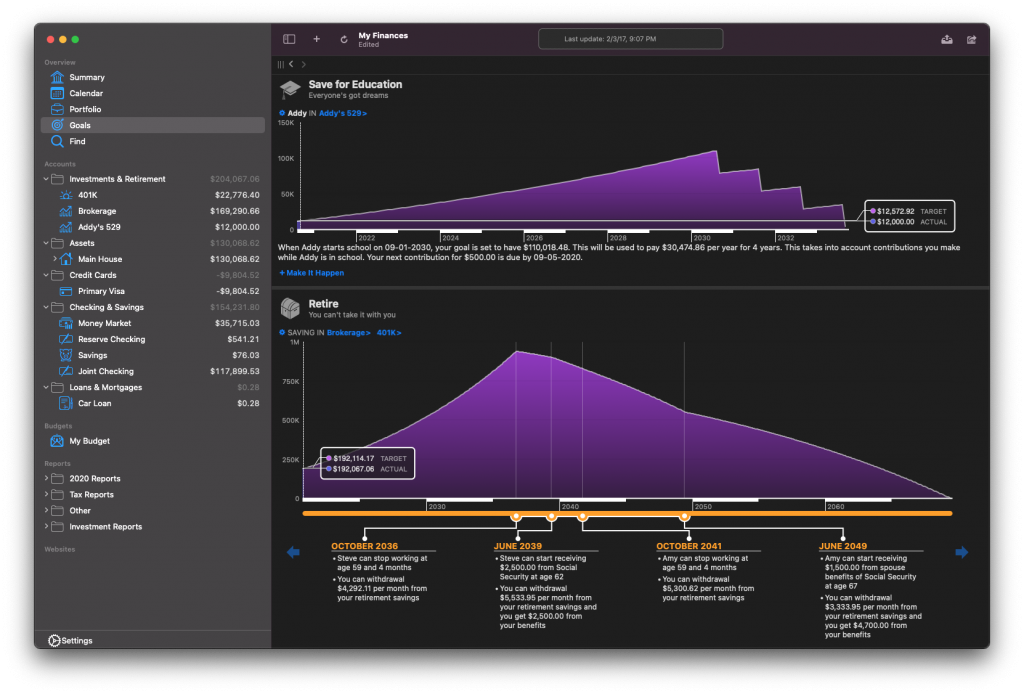

Apple expects to release macOS Big Sur sometime this fall. Big Sur has some of the biggest user interface changes to the Mac operation system in years. Toolbars, sidebars and window chrome (or lack thereof) look really different on Big Sur. The new Banktivity fully adopts this new look and feel.

To get a sense of how the new Banktivity looks on Big Sur, check out this screenshot:

Financial goals

Banktivity has always been a great app to see all of your finances in one place, to answer questions about spending, investing and taxes. Banktivity’s budgeting system helps you make sure you have a plan for how you want to spend your money.

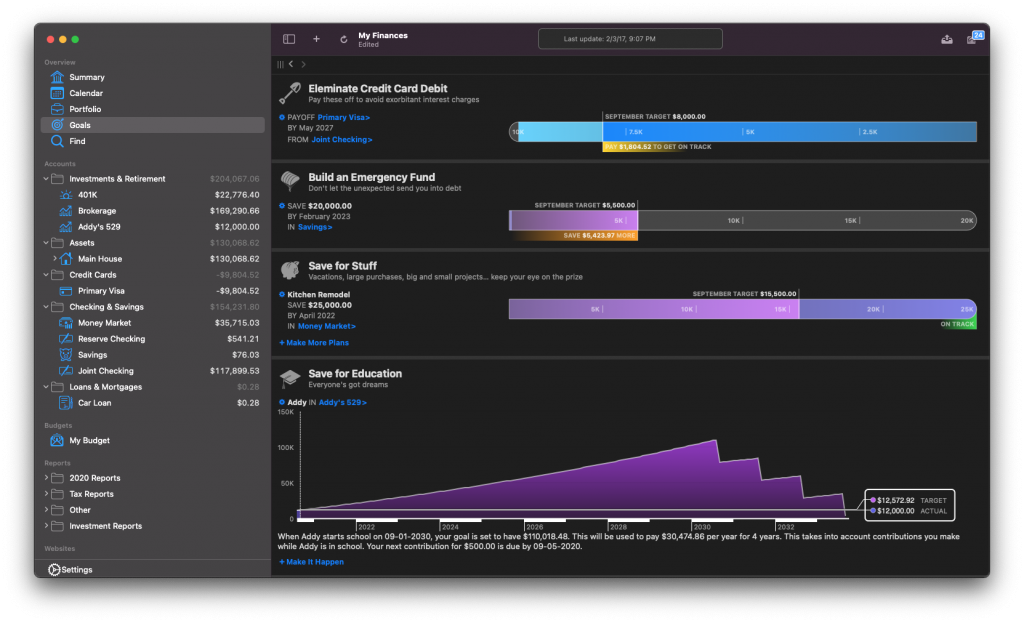

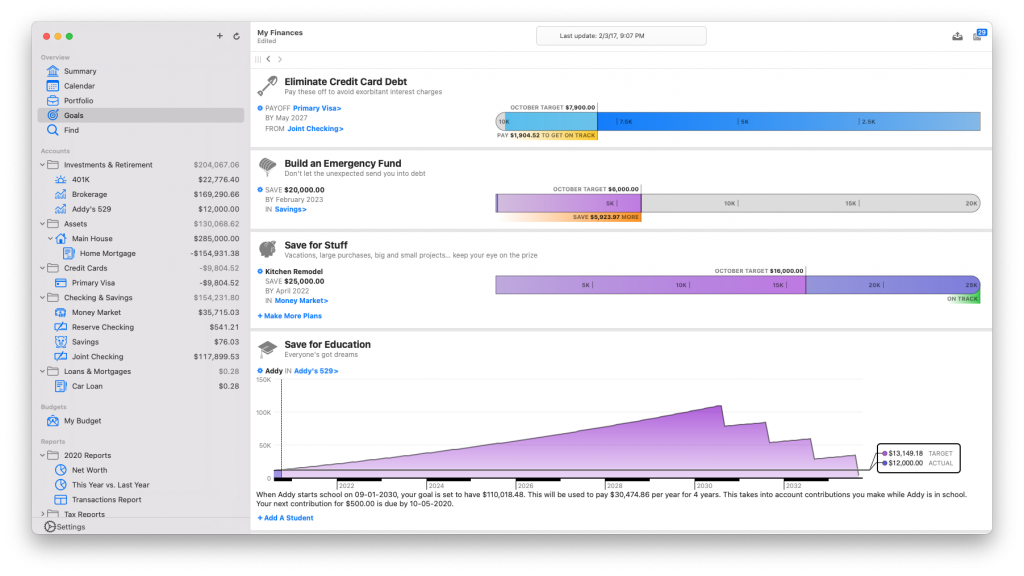

Now we’ve taken it to a new level. I’m proud to announce that our team has added a powerful new suite of features into Banktivity called Goals. Goals help you easily plan for major financial events. Reach the financial milestones that are important for you, no matter where you are on your financial journey. Just starting to take managing finances seriously? You can set a goal of saving up an emergency fund. Experts agree, building an emergency fund should be one of the first things you do when getting on top of your finances. Perhaps you’ve been saving for years and want to plan how to fund your children’s college expenses while also trying to save for a kitchen remodel. Someone else might be trying to understand if they are on track to be able to retire when they want. And who doesn’t have the very worthy goal of paying down credit card debt?

Goals in Banktivity cover all of these financial milestones.

- Build up an Emergency Fund

- Pay down credit card debt

- Save for vacation or other

- Save for education

- Plan for retirement

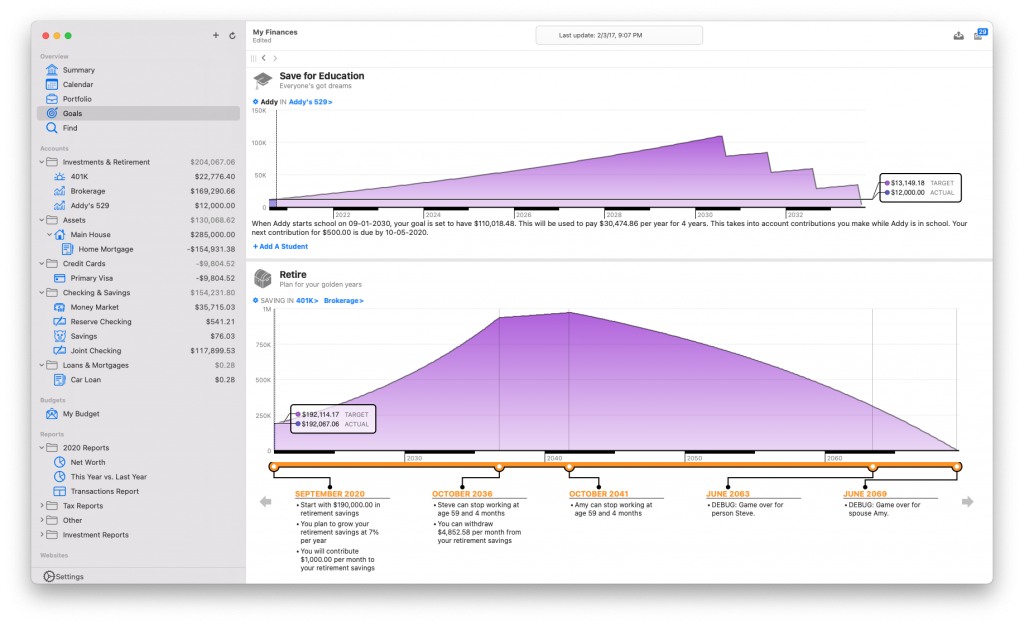

Here is a screenshot showing our new goals page. It’s the place to go to see if you are going to hit your important financial milestones.

Goals not only let you set a stake in the ground, “I want to save this much for my emergency fund by this date.” They also help you track how well you are following your plan to reach that goal. Each goal is just that, and endpoint and a plan to help you stay on track to achieve the goal.

I’m particularly proud of our Plan for Retirement goal. It incorporates a ton of math that you really would never want to try and do by hand. The end result is a plan to help you retire when you want, with enough money to live through your golden years. Of course, if you enter numbers that don’t match your financial reality, it will politely let you know there’s no way you are going to get that retirement you want. We like keepin’ it real here at IGG.

Here is a screenshot of an education goal (top) and the plan for the retirement goal (bottom). The plan for retirement goal calls out the important milestones for your retirement while seeing how your money will stretch over your lifetime. For example, in this screenshot, you can see that Steve can first stop working (at age 59!) and start withdrawing about $4,000 from his retirement accounts. Then the other milestones indicate when he can withdrawal from social security, when his spouse, Amy, can retire and so on.

Our goals also incorporate into other parts of our app. For example, if you set up a goal to save for education and build up an emergency fund, we earmark those funds in the affected accounts. Similarly, if you use envelope budgeting, you can fund the appropriate goals by moving cash to them similar to how you move money between envelopes.

Summary

Our new Banktivity for Mac includes full support for Big Sur including a fresh UI. It will also run natively on Apple Silicon. Our new goals feature lets you plan and hit your financial milestones like never before possible. The goals feature also includes a powerful retirement planner. I don’t know of any other financial app out there that incorporates such powerful goal planning and tracking.

But we didn’t stop there, we’ve also added additional improvements and enhancements through the app, like Touch ID to unlock documents, new statement summaries, a preference to choose what account value is shown in the sidebar and more.

News on Banktivity for iPhone and iPad

First, I want to start with an announcement that has been long overdue: Banktivity for iPhone and iPad is now a single universal binary! Finally! This means we just have one app that works both on iPhone and iPad. Additionally, this means that you get the exact same features regardless of which device you are on. From a development standpoint, we refactored a ton of our code – leaving us able to add features and fix bugs on Banktivity for iOS an iPadOS more quickly.

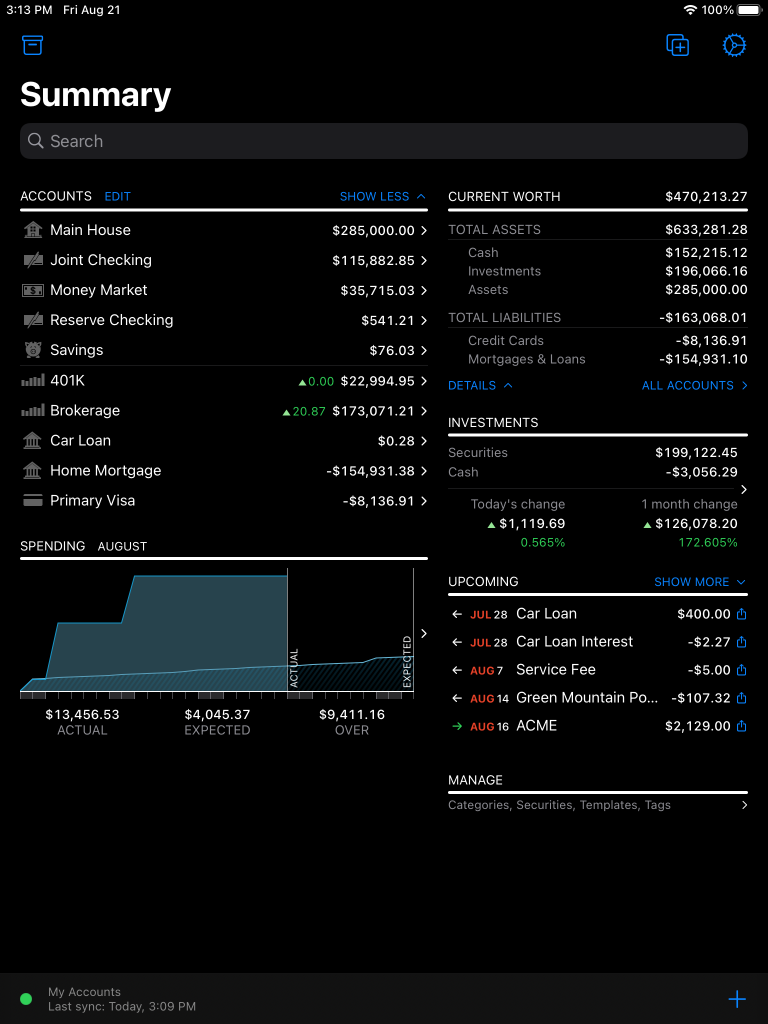

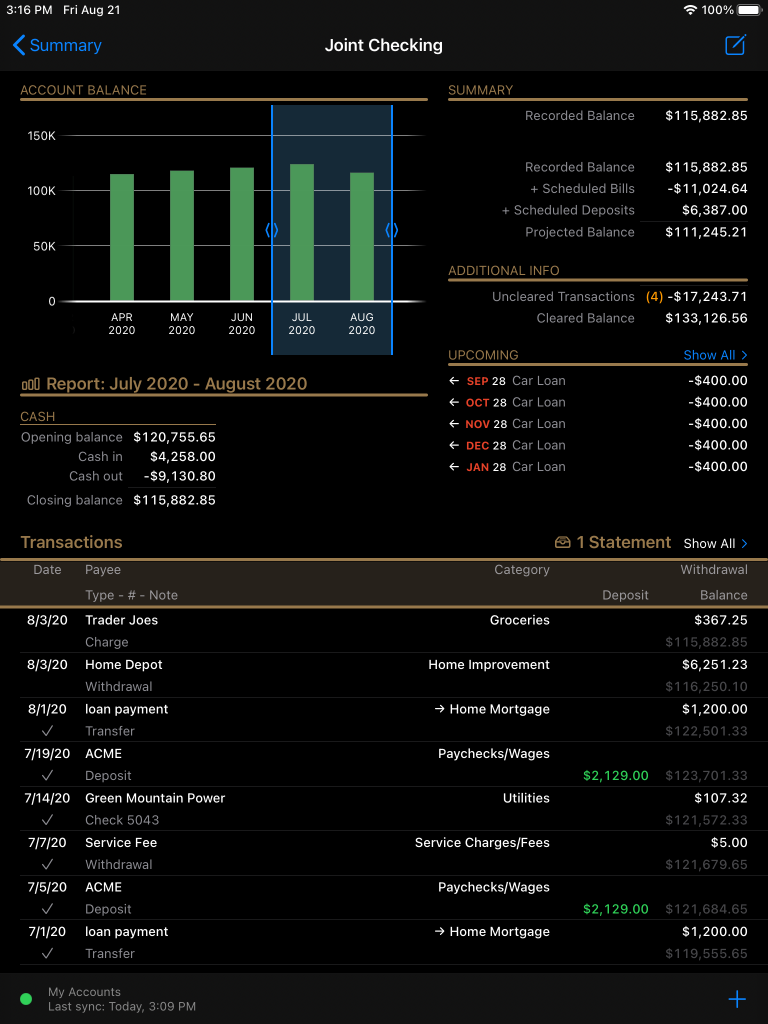

Updated UI and Dark Mode

We’ve taken what we liked best about our iPhone app’s more modern UI, combined with what we liked about our iPad version to achieve one new modern UI. We’ve also implemented Dark Mode throughout the app.

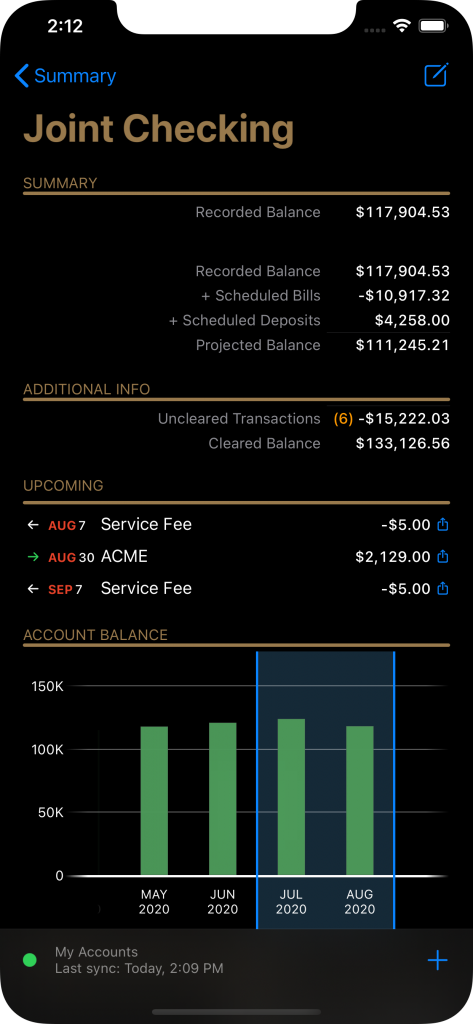

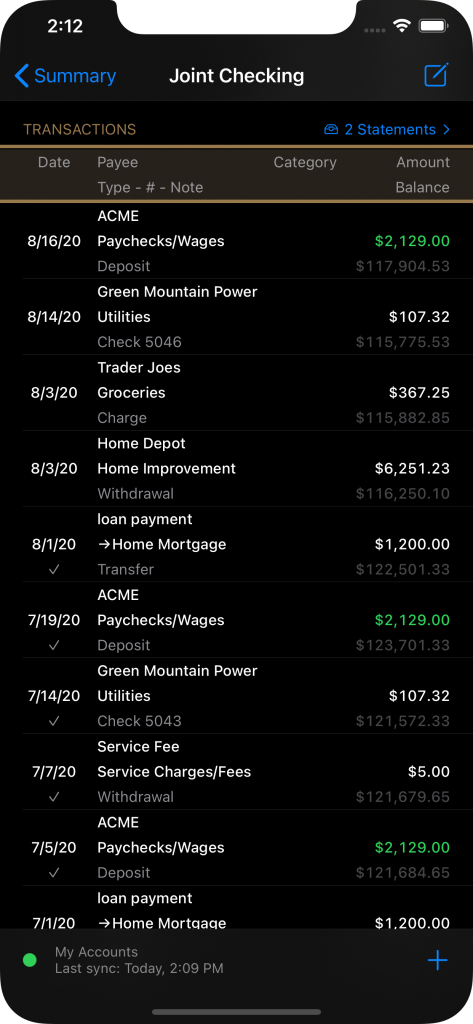

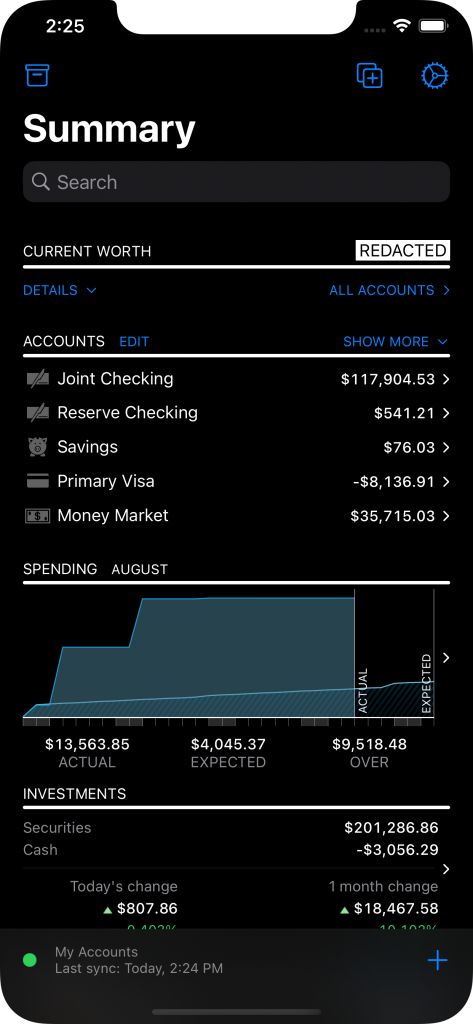

Take a look at some of these screenshots to get a sense of what the new UI looks like in Dark Mode.

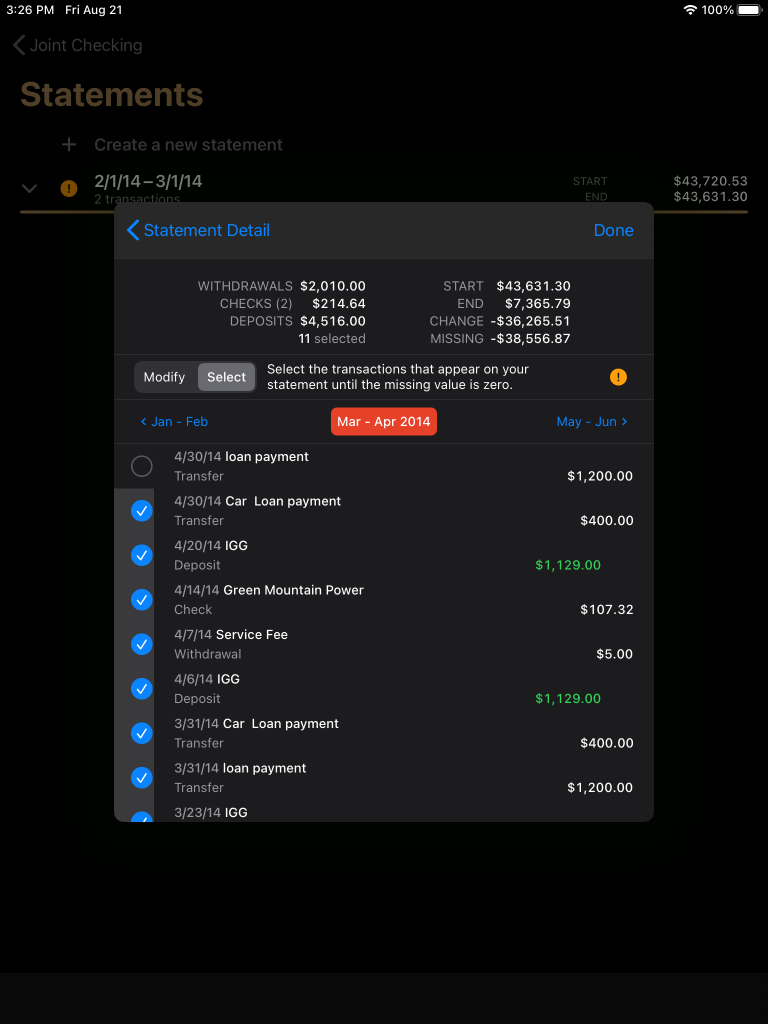

Statement Reconciliation

Customers have wanted to reconcile statements on their iPads and iPhones for a while now. In fact, it has been one of our most requested features. I’m happy to announce that statement reconciliation is coming to Banktivity for iPhone and iPad. So now you can reconcile on any device, iPhone, iPad or Mac and always have the most updated picture of your finances.

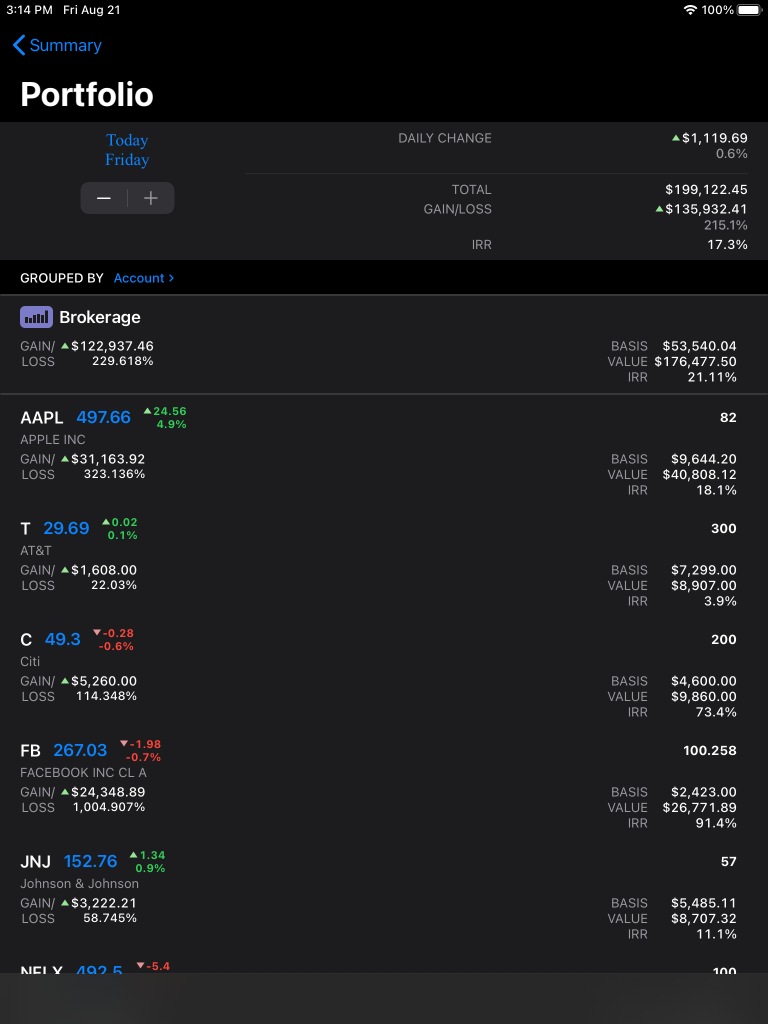

Portfolio

Our previous versions of Banktivity for iPhone and iPad have always had a way to get a little glimpse of how your investments are performing. But we ripped that screen out and built a much more robust portfolio view that is very similar to our Mac portfolio view. For each of your investments you can see gains, shares held, IRR, and more.

The new portfolio view also allows you to edit a security’s price. This has been a highly requested feature and it is particularly helpful for those that hold securities that can’t be updated automatically.

Hide your net worth on iPhone

Swipe to the right to redact your net worth and keep it from whoever is standing next to you!

Banktivity for iPad and iPhone Conclusions

Feature parity across platforms is the direction we are heading in and adding the portfolio view and statement reconciliation is a good first step in getting us there.

We made our first iPhone app over 10 years ago. Back then iPhones were slow and the frameworks that Apple provided to make apps were immature, to say the least. It was a coding triumph to get our app using a SQLite database on the iPhone back in 2009. Now you can get going with a SQLite-backed Core Data-based iPhone or iPad app in minutes.

As iOS devices have matured and evolved so have the expectations of what customers want to do on their phones. While our Mac app has always been the “most powerful” of the Banktivity apps, we realize people want more and more of our Mac-only features on their iPhones and iPads.

We are excited to get these new versions of Banktivity out so people can take total control of their finances, no matter what device they are on. We don’t have a release date yet, but it will be before the end of the year. Under the hood, these take care of a lot of technological debt we’ve built up over the years. Going forward, we are happy to be better poised for more nimble development.

Ian G. Gillespie

President

IGG Software, Inc.

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

- Continuing Investments in Direct Access - February 26, 2024

I was happy to check out the beta and deploy it across my Mac, iPhone and iPad. I’ve been using Banktivity for years, and have been mostly happy with it.

I was beyond disappointed that you are extending one of the worst features of the iPad app. The default ‘report’ that tries to highlight the latest month, except when it won’t. so every time I look at the register I now have to modifiy the bars on the monthly part of the screen befoer I can look at the current month. I’ve reported this as an issue multiple times every time there is a new revision and was beyond annoyed to see it’s spread.

The use case is if I enter a future transaction in the following month. Say a one time purchase pre-order for something. Now, every time I open the app and go to checking it then moves to that future month instead of the current month. So I then have to find that part, drag the calendar back to the current month to look at the current month. This setting resets every time you leave and re-enter that checking screen, adn there are no settings/adjustments to turn that off. I just want to see the current month + anything else later already entered.

Also, I still can’t unmatch/rematch a downloaded transaction when it does a bad match.

Scheduled transactions are very cumbersome on the mac, and hard to use. Why we don’t have similar behavior between all three now is frustrating. On the iPad it’s best to enter the recurring transactions, as I can match if it already downloaded or many things, but creating while easier to do on the mac is much harder to find (under settings?) and entering them can only enter, no matching of an existing transaction.

These are annoying stupid things that should be addressed.

Hi Tom, thanks for the feedback I appreciate. Your use case for why our default selection on the report on iPad is very helpful. I have a developer looking at this.

I too want better match, un-match and rematch on iOS – it just didn’t make the cut for the initial launch. I hope we will be able to check these issues off the list as our app marches forward.

+1

I too have this issue with the selected view jumping to the future (on iPad) if future dated transactions are present. It should really default to ‘current month’ and any future months that contain transactions. I reported it as a ‘bug’ during the beta.

1. Has the issue of totals/subtotals in reports been resolved when expanding a category. If a category has $500 total and you expand the category to see the subcategories, the category heading goes to $0 which makes no sense. There is no way to see a subtotal when subcategories are expanded.

2. For Canadians – have you implemented Average cost in calculating investment capital gains?

Just two of the many features/fixes that have been requested way back when. and ditto to Tom ‘s

Hi, thanks for the comments. For question #1, this is by design. Some customers categorize transactions at the “parent” level. So say you have Auto, Auto:Fuel and Auto:Service. When the category is collapsed, we sum up everything. When it is expanded, we show the amount in all three categories because some customers might have an amount in just “Auto”.

For number 2, we haven’t implemented this yet, but it is on our list.

Same as Jonathan, calculating investment capital gains based on average cost is so important for Canadian clients for taxation. Presently, I do need to calculate the realized gains on an Excel spreadsheet which obviously, make no sense when enjoying managing my investments for years through Banktivity Aps. Please do so to accommodate your Canadian clients

In the iPhone app, how do you view more than just the most recent 7 or 8 transactions in an account?

You can select the bars in the bar chart to change the range.

Hello Ian. Although Banktivity 8 is a good upgrade overall, the inability to have the iPhone/iPad show “Transactions View” as a default like the Mac is the one major flaw I have found. The bar sliders work sometimes, but often end up freezing the app requiring a restart. I often open an account wanting to scroll back through transactions (especially for accounts that do not have a lot of activity). I do the same on my Mac, but at least there I can set the default view to “Transactions” so it is simple. I submitted this as a request but am posting this here hoping other users will also submit it or at least add their support to my request.

The app shouldn’t be freezing! I tried testing this some and I wasn’t able to get it to repeat. If you are still seeing this issue on 8.0.3 please let us know!

Thanks for the feedback on having “Transactions View” as opposed to the bar graph, which drives which transactions you see.

Please note, you can select multiple bars at once and the app should remember this selection between launches of the app.

It is definitely working better (i.e. not freezing) in 8.0.3. And you are right about being able to select multiple bars (I just dragged the left slider as far as possible held it there) and as you noted, the app does remember that period for transactions. Would still prefer the option for Transactions view without the graph removed, but this is a very viable workaround.

Great update and thanks for answering my question in The New Banktivity, now available blog as well.

Oops, I meant to say “with” the graph removed, not “without”.

How soon will a Banktivity 8 manual be available?

Thanks for the feedback! This isn’t our highest priority right now.

Wish it were. Would be helpful to both you and us…I assume many questions could and would be answered with a refreshed manual.

I am a brand new user and it is very difficult to find definitions/how to’s for something as basic as reconciliation.

I am a 20+ year Quicken user and want to transition away from having a virtual machine to run windows on my Mac.

I know it’s a long learning curve,,,

Hello Rick. I used Quicken since 1994, but switched to a Mac in 2017. I found the virtual machine options to run Quicken were basically unusable, and Quicken for Mac sadly lacking, and so installed Banktivity – and never regretted it. Admittedly, while the importing of 23 years of Quicken transactions worked mostly, it got confused on some more complex transactions (multi currency transfers, and option trades for example). However! The multi-currency in Banktivity is much better (meaning it works like it is supposed to) and the app itself works well. The manuals, however, could be much better – and I don’t agree with some of the accounting assumptions (ie when duplicating a budget the actual budget amounts aren’t duplicated unless entered as scheduled transaction. Support personnel don’t understand accounting so I got no sympathy there. But please hang in – I’m very comfortable with how well it works once I got used to it.

Will Banktivity 7.4 continue to function after the release of the new Mac OS?

We haven’t tested v7 on Big Sur and we don’t plan to update v7 to address any issues that might arise in Big Sur. However, the new Banktivity will be fully supported on Big Sur.

Will Banktivity 8 run on catalina.

YES! And it is ready for Big Sur!

I am on seven and have updated to the next version since 3 or 4, I forget which, but this version worries me. I don’t use Direct Access and I don’t download anything, but I do track my investments by manually putting in the transactions. I don’t need iPad or iPhone version since I’m retired. I am worried that the stock prices will no longer update if I stay on seven. I have some questions: (1) how long will seven be supported? (2) where is the data stored:your Cloud Servers or my MAC? Thank you

Hi James, thanks for being a long time customer. We don’t have a date set for when v7 stock prices will stop working.

All of your data is still stored on your device – that hasn’t changed with the new version. (If you use Cloud Sync, then an encrypted copy of your data stays on our servers.)

Hi I’ve got version 7 which I paid for – I live in Australia and recently some of my shares no longer update their prices and looking online this is a common problem. If I upgrade to version 8 is this problem fixed – if not it’s Banktivity is not really suitable for the Australian market anymore – I appreciate we must be small compared to your US customers but it would be good to be honest with potential Australian customers before they buy your software

Thanks for the feedback Carl. We will be implementing end of day closing prices back to Australian users in v8. We expect this to be done before the end of the year.

I am using v8 on my Mac, iPhone and iPad, for both my personal and business accounts. While there are always improvements that can be made, my main purpose here is to thank you for delivering a superb app that takes care of almost all my needs. I like the consistency of presentation between the different devices, and the user interface is clean and appealing to me. The automatic transaction updates for my (Canadian) bank accounts and credit cards are working well. I will be recommending this software to anyone interested in managing their bank accounts and investment portfolios.

Thanks Dave!

I’m a long time Banktivity user, even after using MS Money and Quicken before Banktivity. I never liked that I had to purchase new versions of Banktivity, and for multiple devices. But I tolerated that, because I really like the Banktivity apps and cloud sync’ing. So still good value. Because of the features I use, it looks like I have to go with the gold plan for $99. That’s a lot! But I understand that I can downgrade to the bronze subscription next year to save money but still keep the gold feature-set. I appreciate that, but until now, I have been telling my friends and colleagues about how great Banktivity is. But now at this price point, I can no longer recommend it.

I’d like to suggest that to boost/maintain some good will with customers, that for existing customers who move to the subscription model by the end of 2020, that you give us 2 years for the price of one. I believe this would help you meet your goal of moving customers to subscriptions, but also gives us, your customers, a bit of a break. I gather from reading other blog comments that the subscription model is not popular with everyone. I hope you’ll consider this. Cheers!

Will Banktivity 8 support download of Australian stock prices. IE ASX. Banktivity 7 and previous versions did for years but that stopped working earlier in 2019

End of day ASX prices will becoming soon. We expect them before the end of the year.

Thanks for an amazing set of Apps. Looking forward to upgrade this weekend.

Do you have any plans for Shortcuts support in iOS/iPadOS versions of Banktivity?

Thanks for the kind words! We have considered some shortcuts, but in full-disclosure we are working on some other features right now. What type of shortcuts would you like to have?

I have been a ibank/banktivity user for a while and upgraded to v8 and am very impressed

the iOS and iPadOs and macOS apps integrate really nicely and especially the iOS and iPadOS versions are now much easier to use (can actually update stock purchases now)

Also searching for categories is now so much easier.

I have not yet setup a new budget for 2021 which I will be doing in December and hopefully this now works better to (used to be a real pain if you changed a bill, £40 per month instead of £50 often resulted in past budgets being updated as well and not just looking ahead from the date of change) and the long list of scheduled bills could not be ordered so you had to go thru each one to find the correct scheduled bill

hopefully will also be able to include tags in budgets from now on

have subscribed to the highest tier of support because of multicurrency and although it is a bit more than I like to pay I hope it means product improvements will keep on coming.

also looking forward to having openbanking standards implemented at some point as manually entering transactions from banks and credit cards is a bit tedious but have gotten used to it

The goals section is not something I use as retirement only seems to be useful for US based users, perhaps you could also do something about using UK house price data, zoopla.co.uk for instance provide this data

Anyway am really pleased with this new version

thank you

I live in New Zealand and have been using I Bank and later Banktivity for a long time. Please let me know the cost to upgrade to Banktivity 8 from Banktivity 7?

Thank you.

Hi Sarath, thanks for writing. It depends on the features you need as there are a few different price points. You can go hear to learn more, http://www.banktivity.com/pricing

For Brazil end of day prices (and historical!) , what is the Symbols for Brazilian stock? For exemple, Ambev when yahoo Finance was used by Banktivity his symbol was http://ABEV3.SA. Yahoo used to add .SA at the end of the symbol.

I’ve tried both.SA and -SA and it does not work.

The iOS versions need a search bar to be able to find and filter transactions. The only way I have found to look for a specific payee is to just scroll through looking in various accounts.

Hi Ken, like many iOS apps, just pull the screen down a little and you’ll see a search field.

Great product. We have been using since iBank days… Appreciate all the work your team puts into Banktivity! We use MAC-OS, IPAD-OS, and IPHONE-OS….

There are a few items I would like to put forward….

1. Are you working on adding TAGS to SCHEDULED Transaction Templates? Towards the end of the month I POST all scheduled transactions for the next month. Then, I go back and add the TAGS to them. It would be helpful to already have the TAGS already part of the TEMPLATE for the SCHEDULED Transaction.

2. Some of my Scheduled Transactions have variable amounts from month to month, like utility bills. It would also be helpful for the scheduled transaction to reflect the previous month amount. Right now, I use an average that reflects the YEARLY Budget divided by 12 to get a monthly amount. However, some bills have big differences from month to month, depending on the season.

3. On my IPAD I was trying to post a Scheduled Transaction that was for the end of the next month. All I could “see” were Scheduled Transactions that were occurring prior to the 8th of the next month. My work-around was to post the transaction from the “+” button. Since I post all my scheduled transactions a month in advance it would be helpful to do this on my IPAD. My other work-around is to use my MACBOOK (when not traveling) which does not have the limitation that is on the IPAD.

These are items that would be helpful.

Thank you,

Steve Maggiora

Well, I have a bit of a gripe about how you’ve divided up the tier levels. It makes sense that foreign currency issues would be relegated to an upper tier, since I would guess that they would be useless to the vast majority of U.S. users. But check printing? That is a current feature of V7, and a feature becoming less and less necessary. I would think that it would at least be available at the silver level, if not bronze. I typically print 2 checks a month. Not enough to justify paying an extra $30/yr. As it is, the annual cost of using Banktivity is going from $49.99 for 12-months of Direct Access, to $69.99 for 12-month Silver level. Please consider putting check printing features into one of the lower tiers. Other than that, I think you have a pretty decent program!

5 DRAFTS

Hello,

I’m a 67y/o recent retired person who has used personal financial software since the mid 80’s (every version of MYM until it faded, and then every version of Quicken, first for PC and then for Mac). Finally, fed up with Quicken’s long unfixed problems, I switched to iBank and then Banktivity and have been quite pleased with how Direct Access has changed account download into a much more reliable process. I think Direct Access is Banktivity’s strongest feature by far, and this seems to continue into version 8.

After upgrading to v8 and transferring my Direct Access subscription to the new version, it’s hard not to observe the 40% or greater increase in annual cost to use the software that most users will have to accept since investment account download has been excluded from the bronze level. Plus, the 40% is on top of the recent 11% increase for Direct Access before the new version came out. The only one of the new “Goals” modules that I’ve tried is the one for retirement planning, but that one seems not to allow for people who have just retired, and it gives out incorrect social security information. As the developer must realize, most or all Banktivity customers have ready and free access to a wide variety of financial planning offerings through the well-established banking and investment firms we all use, and those tools are likely to be more robust and tried-and-true with the bugs already worked out. Far more useful to many Banktivity users would have been improvements to basic tools such as the report generator. Currently the report generator is reliable but it’s capabilities are limited — in my experience it is mainly useful as a filter to select data for export to a spreadsheet programs that is capable of generating a more useful report.

It’s also annoying that after a 51% price increase we have to deal with new bugs and a user interface with a dumbed-down appearance. Version 7 had more refined and useful transaction icons, but those are now gone and have been replaced with colorless childlike line drawings reminiscent of a DOS-era program. Account icons are colored but are now now line drawings, and — worst of all — the very likable stack of fat little nest egg icons from version 7 has been replaced by a depressing stack of sunsets! The developer might as well have gone ahead and drawn little sad frowny faces in the suns.

Nevertheless, Banktivity’s Direct Access functionality trumps all the frustrations, even with the aggressive price increase. Seeing EVERY ACCOUNT download successfully is a very happy sight indeed. So I’m still on board, with or without a better report generator, but I’ll still offer my list of requests / suggestions:

Bugs & requested fixes:

1. MOST IMPORTANT NEW BUG: It no longer works to type a colon “:” to speed the process of entering categories with subcategories into transactions. Typing a colon now puts the cursor after the second letter of the category rather than at the end, resulting in typing the subcategory on top of the parent category rather than after the colon. Correction of this error of course takes more time.

2. Please consider restoring the very nice account and transaction icons you had in version 7.

3. The little “>” characters to the left of account folders that are supposed to expand and collapse the folder often do not work.

4. Please provide a more capable report generator. Exporting to a spreadsheet works, but of course one can no longer tweak the data selection or make corrections to data or categorizations, etc., after export. One has to go back to Banktivity, make the corrections, and then export again. A stellar report generator, combined with Direct Access, seems highly likely to put Banktivity clearly out front, even with its high price.

5. Long overdue is the option for some basic background color choices. It’s hard to understand why that still has not been done.

Best regards

R. Ford

Another vote for being disappointed with the new icons.

I’ve resorted to creating my own after seeing the new ones and it feels like a bit of wasted time on my part, but that’s how strongly I feel about them. Maybe it would be nice to include the Bank 7 icons as well and it would cost you guys almost nothing to include them.

Other than paying Apple or paying you, is there any difference between the App Store version of Banktivity and the download from your site? I’ve been a long time user and love it. I have v7 right now, but I’m going to upgrade to 8 and I wanted to know if there was any compelling reason to consider the AppStore vs your site. Thanks

The two apps are functionally equivalent. If you buy from us, we keep more of the money. If you buy from Apple they take a bigger cut.

I switched to Banktivity in 2015 when Quicken for Mac was essentially gutted. Banktivity is comparable to the old Quicken (which was PERFECT until they dumbed it down) in many ways. I have two big complaints.

My first complaint is exporting transactions, which I can only do from given reports, and then they’re organized in the weirdest way, grouped by accounts so it’s very hard to find the transaction I am looking for, which is generally info I need for my tax returns. The last update I installed, Banktivity 7, made this worse than Banktivity 6. Why can’t I export a segment of a register, showing all transactions, placing it into a spreadsheet, where it would be useful? Why can’t I search all of Banktivity looking for a given transaction, instead of account by account? So much I would like to analyze is inaccessible because exports and searches are very cumbersome and limited to only a few sorts of reports, not robust as pre-2009 Quicken was.

My second complaint is scheduled transactions. These are sort of hidden and easy to forget about. If I schedule a transaction, I would like the option to have the scheduled transaction AUTOMATICALLY post on the date it’s entered, or preferably a few days before. AT LEAST, I WANT TO BE REMINDED. For me, these are bank autodrafts that I don’t handle, and I want them to be deducted from my Banktivity account before they are deducted from my bank account, so that I know how much money I have in the account when paying bills. I’ve tried posting reminders; they don’t pop up, either. Sooner or later, I will bounce a check due to this glitch. I’m an accountant, by the way, who uses Banktivity to handle my checking and credit card accounts, so these critiques are from an accounting viewpoint. I won’t be buying additional Banktivity products unless you fix these two problems.

I hope someone is reading this. And the “budgeting” feature, about which you seem very focused, is something I don’t even use. It seems useless to me, because what I hope to happen is a guess, whereas what has happened is useful. I want a record from which I can do my own extrapolations. Please.

Thanks for the feedback. I want to point out a couple of features in case you missed them. You can select any number of transactions in an account and choose File > Export Selected Transactions. Also, select “Find” in the sidebar to search across ALL of your accounts.

As for the scheduled transactions, I will be sure to note that you’d like to see the ability for transactions to automatically post.

Yes! Please allow automatic (scheduled) posting of scheduled transactions. Isn’t that basically the definition? We are scheduling them so that they will post and we won’t have to remember to post them. Ideally, as Karen says, we can provide a timeline for the posting. ie “Post to ledger x days , weeks, months in advance.” etc.

Also echoing Karen – all my scheduled transaction have reminders but I’ve yet to see any reminder appear. If they do show, where/when do they show?

Autoposting scheduled transactions is something Quicken has done for ever, and an often requested feature (look around the boards). I am always amazed when a new version comes out that it has not again been implemented.

Hi Ian, Nice to know you live right here in Portland, like us…Banktivity has worked out well for us since I switched a few years ago to your product. The one thing that confounds me, and has me again on the verge of switching, is your budgeting system. It seems it is designed for much younger people that are not good at planning, which I am. We need a way to create a budget and then track it monthly or quarterly to see if we are staying reasonable on track. I don’t need or use envelopes. How about a seminar sometime for retired folks who just need to do what we do?.

I have been a customer since 2007, first with iBank and then with the various iterations of Banktivity. I am very happy with it. However, there are some things that I do not rent, such as music, food or software. I might be interested in purchasing Banktivity 8 as I do MS Office. Under the present scheme you have lost a customer.

Thanks for the comments. Please keep in mind you can subscribe for on year, then unsubscribe and that app will keep working and you get updates free. Only our connected services require and active subscription. You can see more here, http://www.banktivity.com/upgrading.php

How does one “un-redact” your net worth on the iPad? I mistakenly did something (swiped right, maybe?) and now net worth is “REDACTED”. How can I get it back? Thanks.

I appreciate Bantivitiy. Switched from Quicken quite awhile ago and I’m very happy I did. Thanks!

Just swipe it over.

Can you please confirm that Banktivity (both 7, which I have now, and 8, probable imminent upgrade) will run on new iMac 24” (M1), OS Big Sur? Thanks. RS

Hi, they should both run on it, but Banktivity 8 will run “natively” on the M1 chip (i.e. it will be faster)

Rather disappointing… used to be able to connect to Bank and download transactions but latest upgrade just hangs all the time. End result is you can’t quit programme.

If you come to support they should be able to help you out.