We’re so excited to preview the new Banktivity. If you haven’t been following along I recommend you read about our forthcoming “subscription that doesn’t suck” and “services roadmap” as they are both related to our new release.

This is going to be a long post where I cover changes coming to both our Mac, iPhone and iPad products. Please note that the screenshots you see in this post are not final and are likely to change before the final release. Having said that, let’s dive in!

Banktivity for Mac

Apple Silicon and Big Sur

In June 2020 Apple announced they are developing new Macs that no longer use Intel processors. The new hardware will use “Apple Silicon” – or more commonly known as ARM processors. Although we don’t know the final specs of the new processors or what they will even be called, we do know they are based on the SoC (system on a chip) processors that Apple has been shipping in their iPhone and iPad for years.

In order to take full advantage of this new hardware, apps need to be compiled to run natively on Apple Silicon. I’m happy to announce that the new Banktivity will run natively on both Apple Silicon and existing Intel Macs. We already have our hands on a Developer Test Kit from Apple that lets us test our app on the chips.

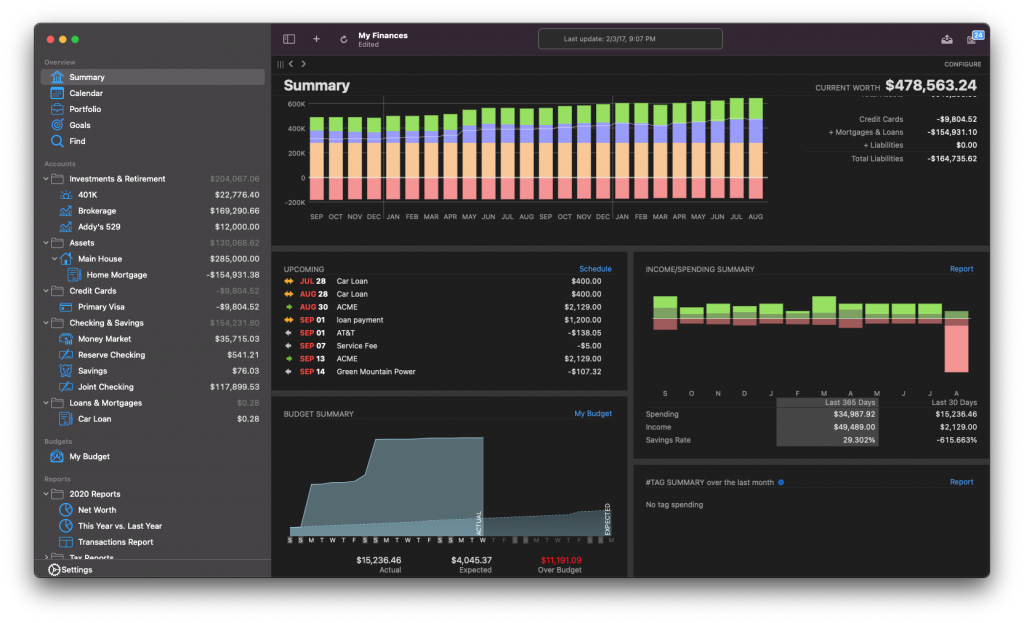

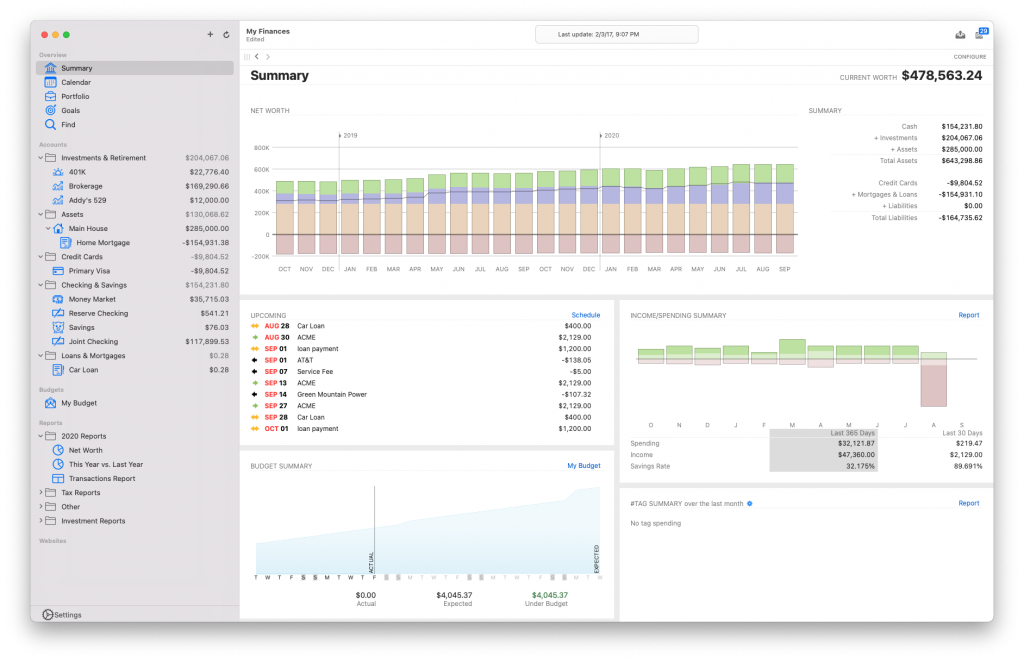

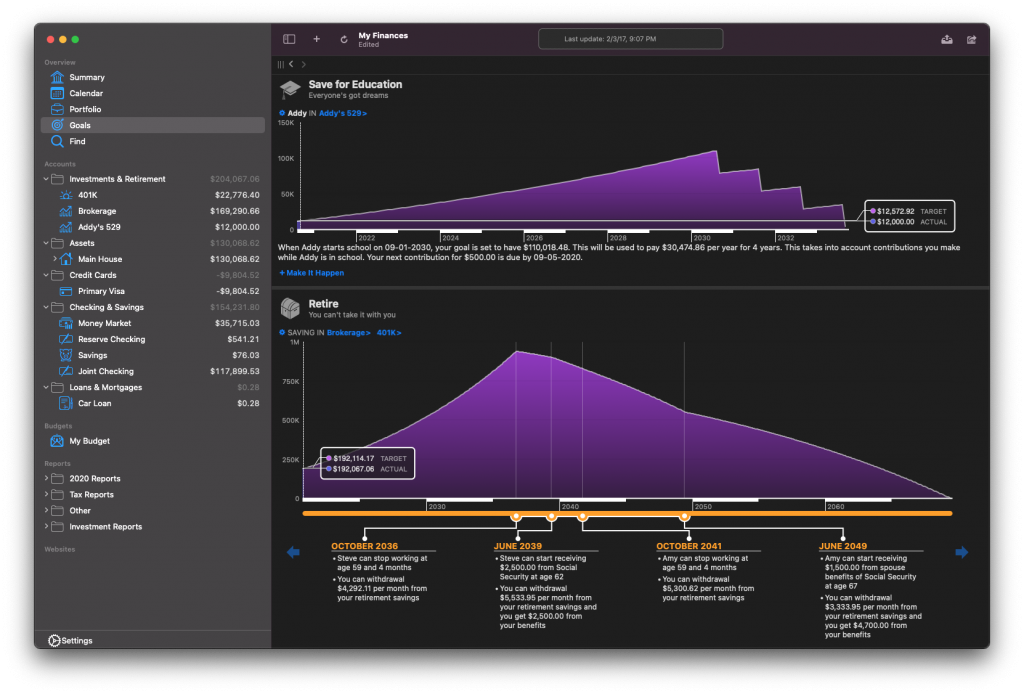

Apple expects to release macOS Big Sur sometime this fall. Big Sur has some of the biggest user interface changes to the Mac operation system in years. Toolbars, sidebars and window chrome (or lack thereof) look really different on Big Sur. The new Banktivity fully adopts this new look and feel.

To get a sense of how the new Banktivity looks on Big Sur, check out this screenshot:

Financial goals

Banktivity has always been a great app to see all of your finances in one place, to answer questions about spending, investing and taxes. Banktivity’s budgeting system helps you make sure you have a plan for how you want to spend your money.

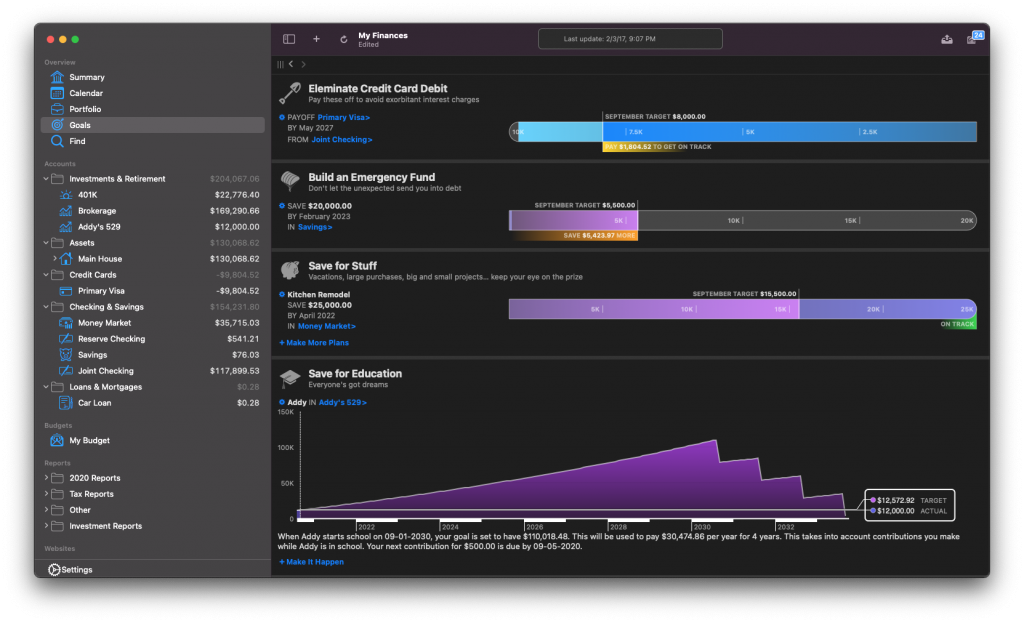

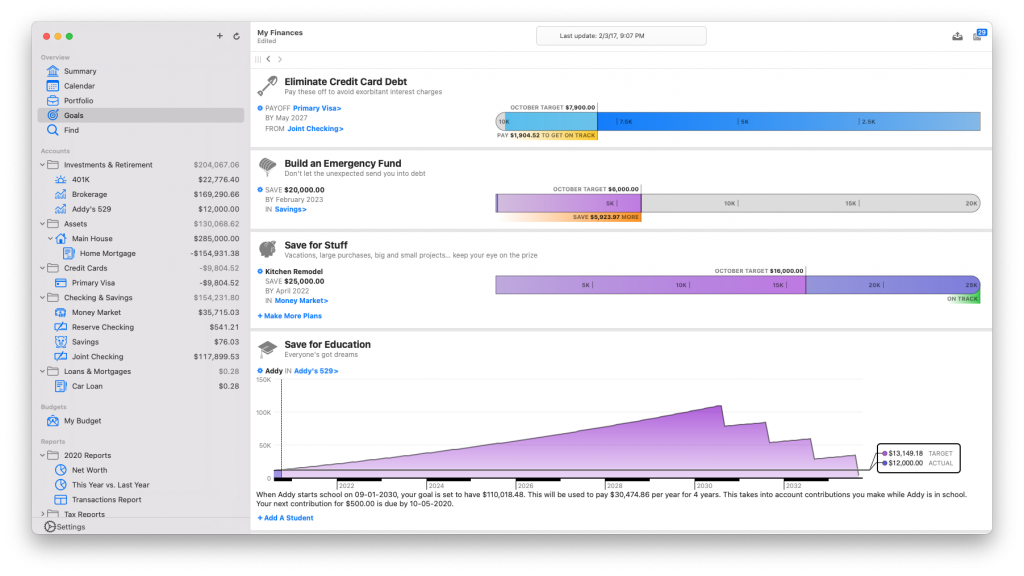

Now we’ve taken it to a new level. I’m proud to announce that our team has added a powerful new suite of features into Banktivity called Goals. Goals help you easily plan for major financial events. Reach the financial milestones that are important for you, no matter where you are on your financial journey. Just starting to take managing finances seriously? You can set a goal of saving up an emergency fund. Experts agree, building an emergency fund should be one of the first things you do when getting on top of your finances. Perhaps you’ve been saving for years and want to plan how to fund your children’s college expenses while also trying to save for a kitchen remodel. Someone else might be trying to understand if they are on track to be able to retire when they want. And who doesn’t have the very worthy goal of paying down credit card debt?

Goals in Banktivity cover all of these financial milestones.

- Build up an Emergency Fund

- Pay down credit card debt

- Save for vacation or other

- Save for education

- Plan for retirement

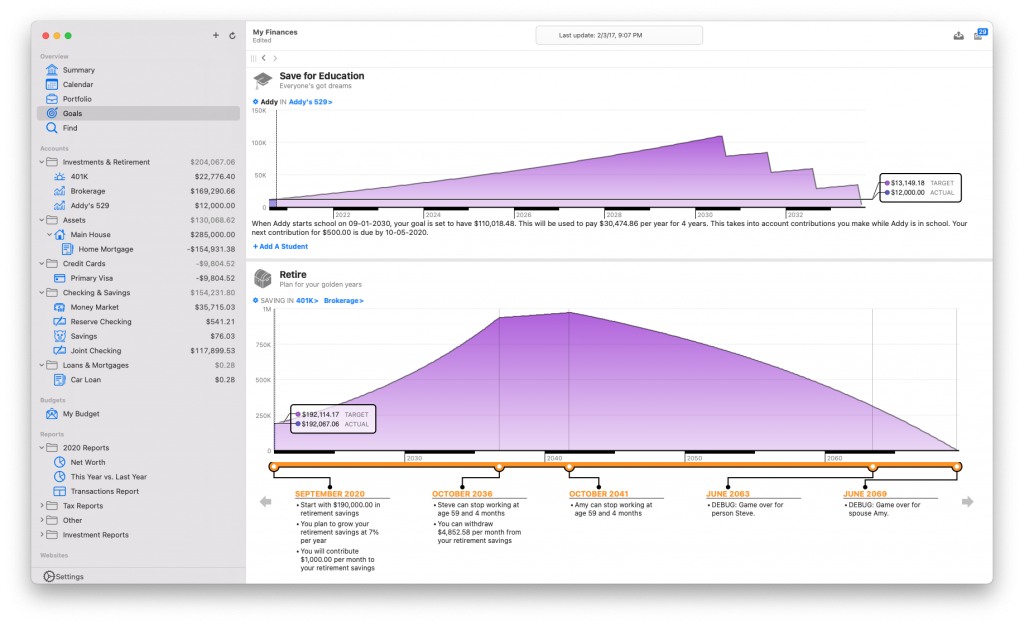

Here is a screenshot showing our new goals page. It’s the place to go to see if you are going to hit your important financial milestones.

Goals not only let you set a stake in the ground, “I want to save this much for my emergency fund by this date.” They also help you track how well you are following your plan to reach that goal. Each goal is just that, and endpoint and a plan to help you stay on track to achieve the goal.

I’m particularly proud of our Plan for Retirement goal. It incorporates a ton of math that you really would never want to try and do by hand. The end result is a plan to help you retire when you want, with enough money to live through your golden years. Of course, if you enter numbers that don’t match your financial reality, it will politely let you know there’s no way you are going to get that retirement you want. We like keepin’ it real here at IGG.

Here is a screenshot of an education goal (top) and the plan for the retirement goal (bottom). The plan for retirement goal calls out the important milestones for your retirement while seeing how your money will stretch over your lifetime. For example, in this screenshot, you can see that Steve can first stop working (at age 59!) and start withdrawing about $4,000 from his retirement accounts. Then the other milestones indicate when he can withdrawal from social security, when his spouse, Amy, can retire and so on.

Our goals also incorporate into other parts of our app. For example, if you set up a goal to save for education and build up an emergency fund, we earmark those funds in the affected accounts. Similarly, if you use envelope budgeting, you can fund the appropriate goals by moving cash to them similar to how you move money between envelopes.

Summary

Our new Banktivity for Mac includes full support for Big Sur including a fresh UI. It will also run natively on Apple Silicon. Our new goals feature lets you plan and hit your financial milestones like never before possible. The goals feature also includes a powerful retirement planner. I don’t know of any other financial app out there that incorporates such powerful goal planning and tracking.

But we didn’t stop there, we’ve also added additional improvements and enhancements through the app, like Touch ID to unlock documents, new statement summaries, a preference to choose what account value is shown in the sidebar and more.

News on Banktivity for iPhone and iPad

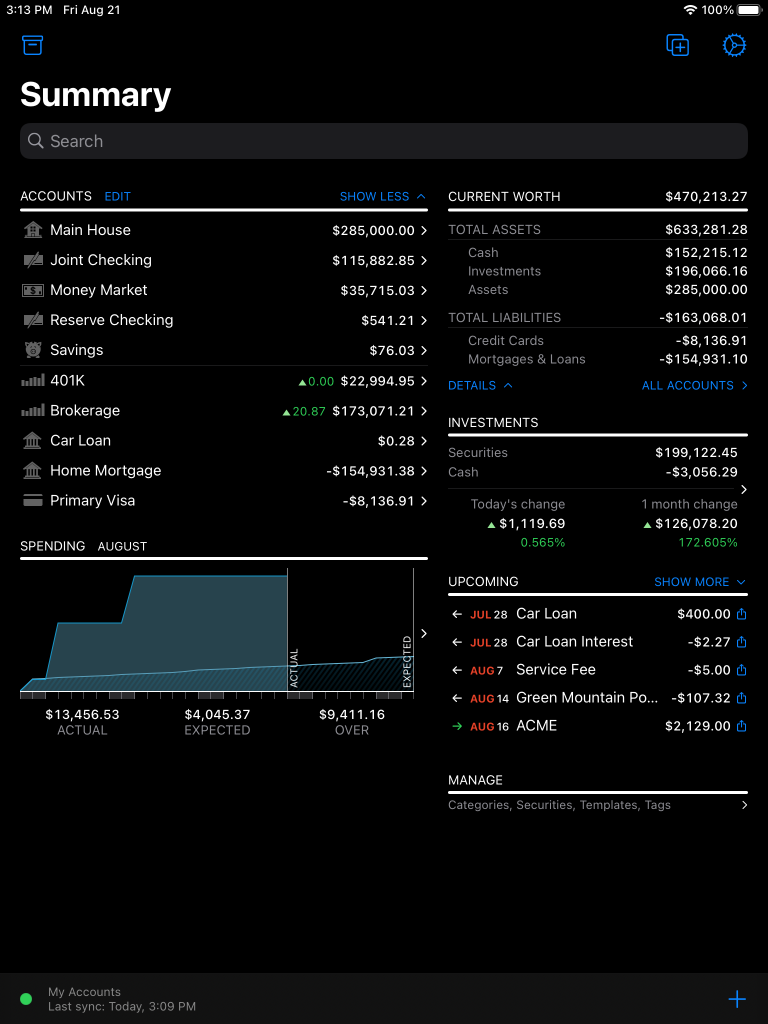

First, I want to start with an announcement that has been long overdue: Banktivity for iPhone and iPad is now a single universal binary! Finally! This means we just have one app that works both on iPhone and iPad. Additionally, this means that you get the exact same features regardless of which device you are on. From a development standpoint, we refactored a ton of our code – leaving us able to add features and fix bugs on Banktivity for iOS an iPadOS more quickly.

Updated UI and Dark Mode

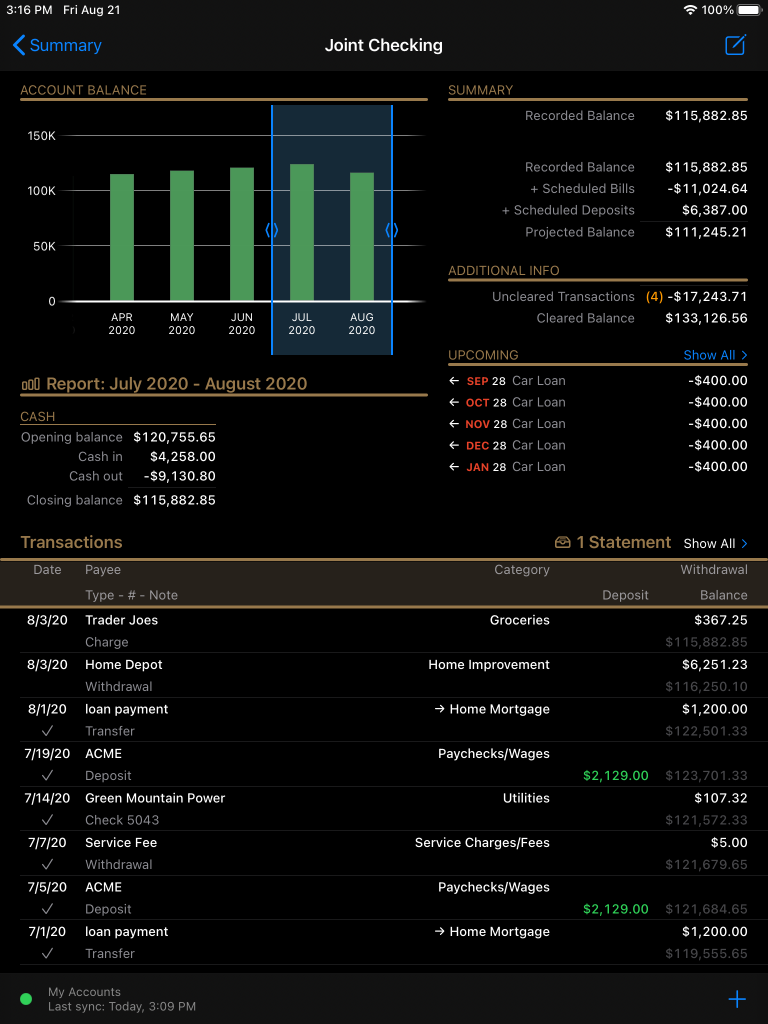

We’ve taken what we liked best about our iPhone app’s more modern UI, combined with what we liked about our iPad version to achieve one new modern UI. We’ve also implemented Dark Mode throughout the app.

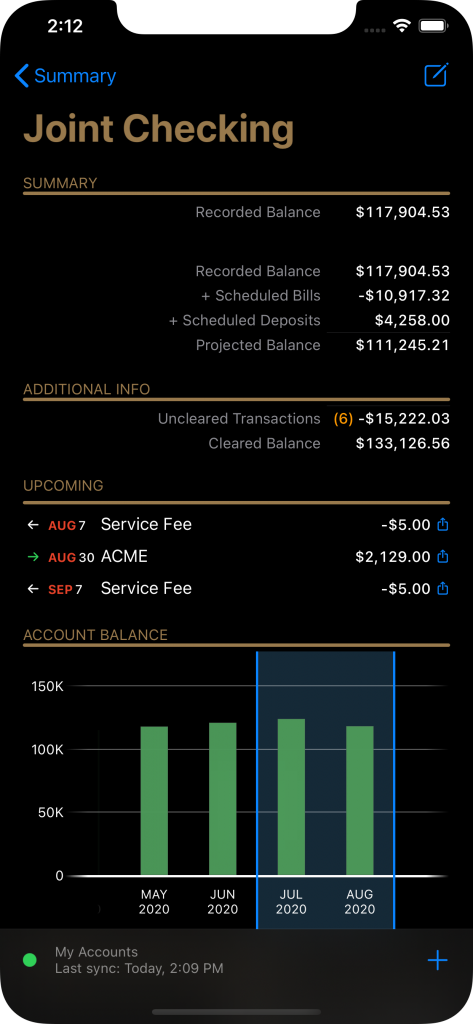

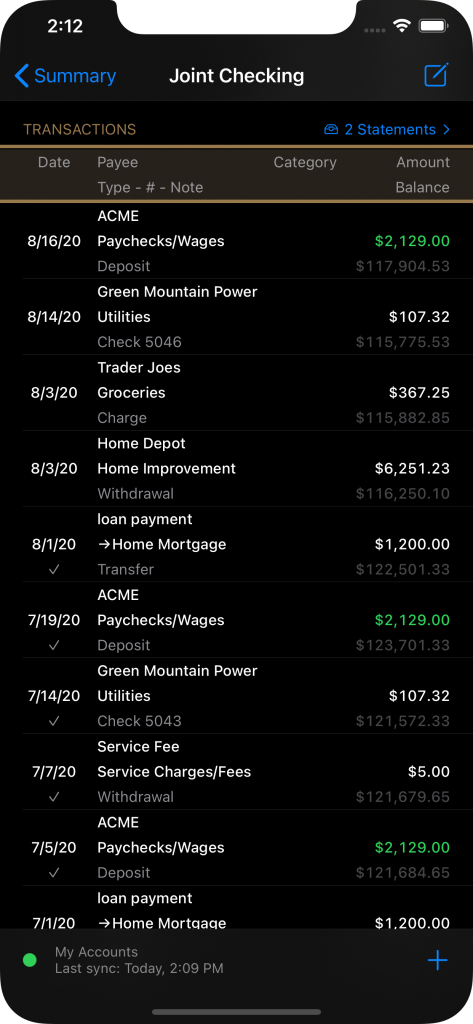

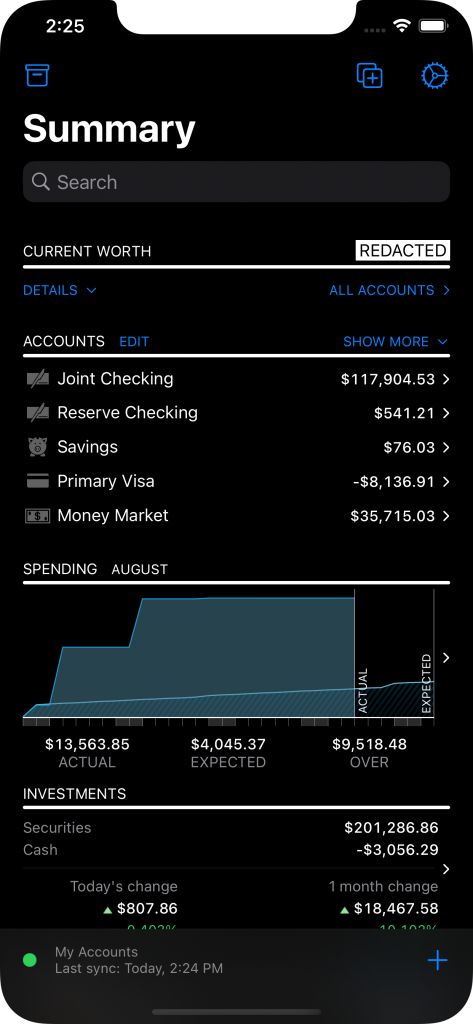

Take a look at some of these screenshots to get a sense of what the new UI looks like in Dark Mode.

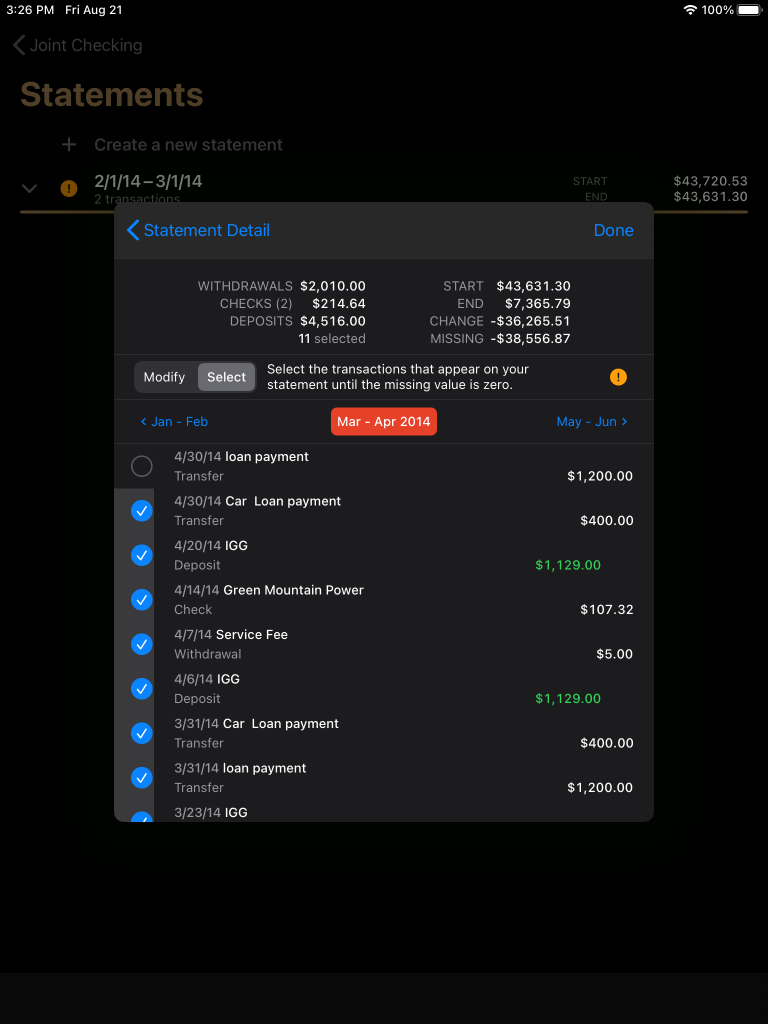

Statement Reconciliation

Customers have wanted to reconcile statements on their iPads and iPhones for a while now. In fact, it has been one of our most requested features. I’m happy to announce that statement reconciliation is coming to Banktivity for iPhone and iPad. So now you can reconcile on any device, iPhone, iPad or Mac and always have the most updated picture of your finances.

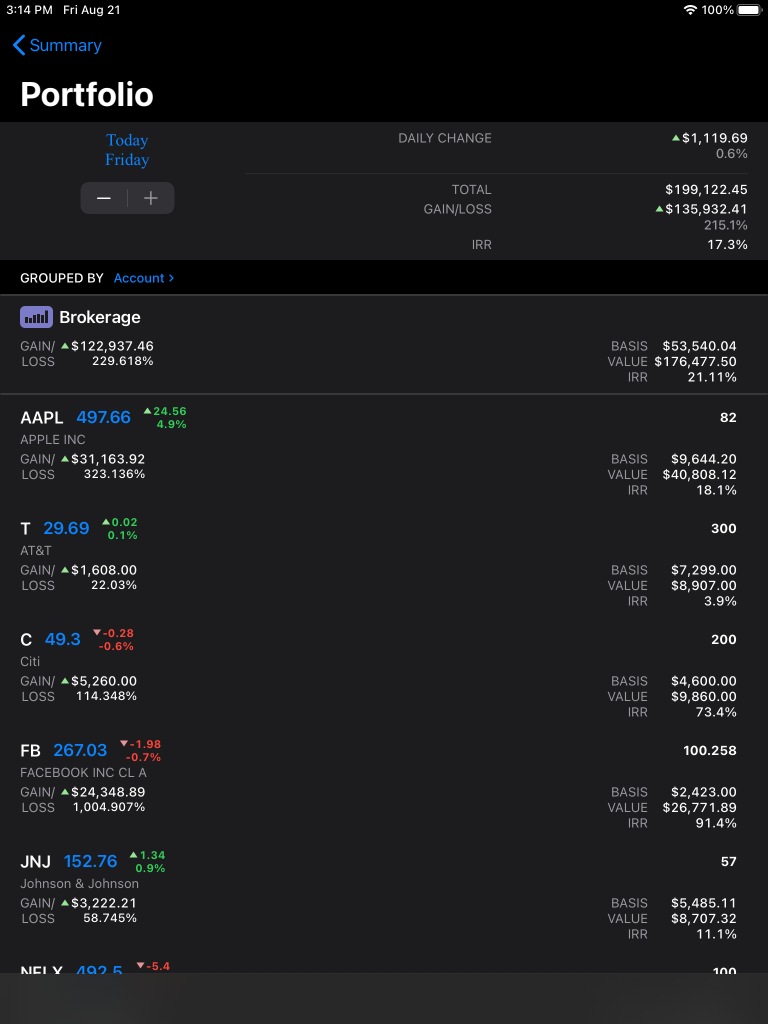

Portfolio

Our previous versions of Banktivity for iPhone and iPad have always had a way to get a little glimpse of how your investments are performing. But we ripped that screen out and built a much more robust portfolio view that is very similar to our Mac portfolio view. For each of your investments you can see gains, shares held, IRR, and more.

The new portfolio view also allows you to edit a security’s price. This has been a highly requested feature and it is particularly helpful for those that hold securities that can’t be updated automatically.

Hide your net worth on iPhone

Swipe to the right to redact your net worth and keep it from whoever is standing next to you!

Banktivity for iPad and iPhone Conclusions

Feature parity across platforms is the direction we are heading in and adding the portfolio view and statement reconciliation is a good first step in getting us there.

We made our first iPhone app over 10 years ago. Back then iPhones were slow and the frameworks that Apple provided to make apps were immature, to say the least. It was a coding triumph to get our app using a SQLite database on the iPhone back in 2009. Now you can get going with a SQLite-backed Core Data-based iPhone or iPad app in minutes.

As iOS devices have matured and evolved so have the expectations of what customers want to do on their phones. While our Mac app has always been the “most powerful” of the Banktivity apps, we realize people want more and more of our Mac-only features on their iPhones and iPads.

We are excited to get these new versions of Banktivity out so people can take total control of their finances, no matter what device they are on. We don’t have a release date yet, but it will be before the end of the year. Under the hood, these take care of a lot of technological debt we’ve built up over the years. Going forward, we are happy to be better poised for more nimble development.

Ian G. Gillespie

President

IGG Software, Inc.

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

- Continuing Investments in Direct Access - February 26, 2024

would love to know if keyboard/trackpad support is coming for iPadOS. i’ve been using Banktivity for years now and it’s become a massive pain point to not have those features baked in with the iPad app.

Would love to know more about the specific functions (the more detail the better) you are trying to do with your iPad trackpad and keyboard.

Well you can’t edit transactions currently without swiping on the screen. You should be able to swipe on the trackpad. You also can’t use tab to navigate to the next field

Verified that swiping works as expected. We have more work to do for better support for tabbing.

Can you repost the first few screen views either NOT in dark mode (for me, it’s hard to read and I don’t use it), or at least larger images? The detail is too small. Thanks.

Please let me second that request from @Bob. In the entire post – every single screenshot is in Dark mode; Mac, iPad and iOS.

Please, can we see at least some shots of what the UI will look like in Light mode?

Will try to do this. Just got a lot on my plate right now.

Thanks for sharing this! This is exciting stuff! Improvements to iPhone and iPad are the most exciting to me as I found the Mac versions very powerful already. I would really like to see reports there as well!

Thank you for the update, I am a little late for Goals since I am retired but I can see uses for those extras and paying down debts. I always found Banktivity very flexible so I am confident I will find uses for this module.

I am probably more excited about the ‘others’ that you mentioned, particularly choosing balance in sidebar (I assume you mean TODAY as opposed to Register). I was hoping to see an ALL TRANSACTIONS register (as was available with Smart Acc’s till V6) which would allow me to filter using the full power of the accounts register; I find the FIND option useful but not adequate to hone in..

I do like the new reconciliation detail , been one of my wish-list items to include START/END and CHANGE in the summary.

Looking forward to launch.

Thanks for the feedback Mario. Have you tried using a “Transaction Report” to see all of your transactions in one place? Our intent with this “report” was to replace the old smart accounts.

My objective with ALL TRANSACTIONS is to utilise the filters available in the register to hone in on a set of transactions that meet a very specific criteria. Smart accounts did that perfectly, I also note that several competing products provide an ALL TRANSACTIONS register view.

Reporting all transactions as a report does not give me the option to find something, I am an 8 year user and I have around 24,000 plus transactions in my file so the report is almost unmanageable when you seek a needle in a haystack. Reporting also has its matching quirks which I have learnt to live with but preclude me from achieving what would be so simple with ALL TRANSACTIONS.

The built in register filters are great, I just need a way to catch everything under a global register that I can manipulate with all its levers. Arguably you could build all those filters into the FIND option but I think ALL TRANSACTIONS in the area where you have SUMMARY etc would be the bomb for me and a simpler solution to code.

Happy with evolution rather than revolution, especially for complex & important software like this.

I’m looking forward to all the small changes as I don’t have much use for the goals. I’m also excited about the behind-the-scenes code tidying & tech debt removal and what it means for new features going forward.

One thing I’d like to see (and it may be here) is to be able to split the panes vertically… or at least have an account view which has a summary & graph at the top, and a transaction register below. It would be a good use of screen real-estate. I’m really hoping that you can sort out the ASX stock price issue too!

One issue I have with dark mode on iOS/ipadOS is that black with white text is actually harder to read than dark grey text on a black background (or white text on dark grey). This is a problem with lots of apps, including Apple’s!

In iBank 5 manually entered security prices synced perfectly to iPhone and iPad meaning net worth stated in sync across all three devices. For some reason this was trashed and has never been put right. Will the new software work in this respect? I have no desire to enter prices 3 times on different devices.

I’ll spend some time digging into this to make sure it behaves as expected with the new versions, especially since you can now enter prices on iOS!

Ian, take my money now! Just a couple of questions:

1. You avoided mentioning when we might get our hands on v8?!? and

2. Has data entry for eg credit card transactions changed in the iPad version? I enter all my charges manually as I’m in UK and don’t find the current form very friendly.

Good job!

Mike

Hi Michael, thanks for the feedback. We expect the new version to launch this fall. As for transaction entry, can you elaborate on why it isn’t very friendly? The more specific the better. Thanks!

There is a lot of good stuff in there – but what I really need in B8 is some sort of cash-flow forecast. The “Forecast report” in B7 is not useful to me because it does not integrate budgeted expenses. Could you either add an option to include budgeted expense into ‘Forecast Report” or alternatively optionally include budgeted income in the graphics in Budget view so that the graphs represent total cash over the selected budget period rather than just spending?

I am hoping to see quite a number of the “ pain points” resolved as they are not mentioned here. Just two examples:

1) Allocating (searching for) a category to a transaction without having to type in the category group name

2) Allocating a tag to a scheduled transaction

Hi, thanks for the comments!

We implemented your request #1. Unfortunately, #2 didn’t make the cut for this initial release.

That’s a real pity for #2. Personally, tags are completely useless if not automatically added to scheduled transactions… and the (limited) search options makes it then difficult to have “smart” reports. Too bad!

Re #2 I agree – that is so disappointing and I am surprised that full functionality of tabs didn’t make the cut. I find tags to be very helpful, but to have to go in and add them manually to scheduled transactions means, in addition to being a big hassle, that I miss some and don’t discover them until I notice a gap in a report. I am only the IGG website today only because I decided there must be a way to include tags in scheduled transactions and I would search for the answer. Oh well …

Yeah, this didn’t make the cut, but it doesn’t mean it won’t come in a future update!

Hi Ian, great work here. Can I clarify 1) please – does that mean you can enter a category on a transaction by entering any part of the parent>category “path” string? The more you enter, the more accurate the options presented are?

That is correct.

Legend! Thanks 🙂

I’d like to echo Paul and Antoine. I switched from another program to Banktivity around the release of version 6, largely because of the addition of support for transaction tagging in that release. Tags were a big part of how I organized and tracked expenses in the previous app, so it was a critical feature for any replacement.

Three years and two major versions later, tagging remains a very incomplete feature. As Antoine said, not having the ability to add tags to scheduled transactions is a major usability issue. It leads to situations where data is less reliable than if tags didn’t exist at all, since it requires manually adjusting every scheduled transaction that gets posted. If you forget to do that, or forget a tag, it’s very hard to track down the inconsistency. I’m at the point where I just hope my data is correct, which is not a great way to be in a financial app.

For how long this feature has only partially existing, I’m honestly starting to get worried that in version 9 or 10 it will simply disappear and I’ll lose a lot of valuable data. Three years to add an input field that already exists in one part of the app to another part of the app is a long time.

It’d be great to know that finishing version 1 of tagging is still on the todo list.

I think it makes sense to add tags to scheduled transactions. There are some details to work out, but this is something we want to add.

Sounds great Ian! A couple of years ago I switched hardware from windows pc to mac. In the process I migrated from Quicken to Banktivity (didn’t like quicken for Mac). Two of the functions that I missed from my Quicken days was a retirement planner and debt reduction planner. I’m excited to see we are going to get at least a version of it in Banktivity. Can I ask when we can expect it to be released.

Thanks for this post Ian. Goals looks really interesting, especially the retirement planner which I admit is a feature of Quicken on Windows that I’ve always liked (even if the interface is a bit 1990’s) so I can’t wait to try it out in Banktivity.

I know you probably didn’t cover all the enhancements here, so perhaps other new features are included but weren’t mentioned, so I am hopeful this isn’t the only change.

I do have to say I am disappointed by the iPhone and iPad apps being made the same. My hope was that the iPad app would be much closer to, or even identical to the Mac app. Having a bigger version of the iPhone app doesn’t appeal to me, and although it will be essentially free I probably won’t use it. Given iPads are getting larger, faster and utiliizing more ‘laptop’ interfaces like keyboard/trackpad/mouse it surprises me that you didn’t think of making the Mac version available on iPad. With the silicon being basically the same this would have been possible, and also open up a new market for you.

Hi Mark, I just wanted to comment on iPad vs Mac. Apple has made a way to bring iPad apps to Mac (technology is called Catalyst) without too much trouble, but not the other way. We can’t just make the Mac app work on iPad — there is a ton of work there to move the user interfaces and user experience over. To be clear, we do want to bring more features over from the Mac to iPad (and iPhone) and this initial release is a step in that direction. Obviously, there is still more work to do!

Thanks for the direct response, and yes I am probably under-estimating how much work that would be. I like that Apple is making iPad distinct and not just a larger iPhone; even back when they released the original Mini they made a point of that at the keynote (unlike on Android where tablet apps are just larger phone apps). That’s why it seems disappointing here. I think an iPad app capable of standing on its own (without a Mac) could be a hit!

Hi Ian,

Great news on how the transitions and advances will proceed. My wish has always been to be able to do all operations on an iPad in the same way we can on a Mac. I have a MacBook Pro 13inch which I can’t wait to ditch in favour of an iPad Pro. At present the only thing stopping me is Banktivity. Look forward to progress as things move forward. Not expecting miracles, just steady progress and information when you can provide it.

Please don’t forget the tutorials as things change. I still can not use all the features of current v.7 not having an accountant who will use Banktivity and give advice.

Regards Neil

Hi, Ian. Wow!! This really looks GREAT!! You and your team have really outdone themselves on the iOS versions, and have developed what I’ve wanted for the iPad and iPhone version for years – a fully functioning app that isn’t just a snapshot of the Mac OS version of Banktivity.

The Mac version also looks excellent, and I’m glad to see that it appears to have expanded the use of color in an otherwise monochrome background. More information about goals would be helpful, especially around retirement. For instance, will we be able to incorporate expected income from pensions, Social Security, Canada Pension, etc. into the planner?

Can you expand on what you’re doing with investments? I’ve always liked Banktivity’s robust support for paying down debt, etc., but have also wished that it would provide more investment support. I’m approaching retirement, don’t have any debts to worry about, but am concerned about my investments, their performance and diversification. Some additional support for this area would be helpful.

Finally, and also very important, will the new release support adding physical precious metals (gold, silver, etc.) as an asset class? I ask because of their relative attractiveness in the face of monetary debasement by Central Banksters, and the fact that Basel-III now allows banks to carry gold on their balance sheets as a Tier-1 asset. This means that more pension funds are also increasing their investment allocation to PMs (e.g., Ohio State Police/Firefighters Pension Fund approved a 5.0% allocation to PMs; Texas pension funds also have sizable stakes), and I’d like to be able to track it. Updating price is also important, as ETFs such as GLD and SLV are only “paper gold”, and don’t reflect the physical gold/silver price. The ability to track these in Banktivity would be a very welcome addition to its functionality.

Overall, great job and a big thank you to you and your team for making a very good product an excellent product.

Ian – thanks for the update. What I hope is that the basics of B8 for Mac are maintained or improved. Reporting, cash flow forecast etc. Along the same lines, please take the time to robustly test the end-to-end application and synchronising across the Mac and iOS platforms. I would rather wait a few weeks longer for a thoroughly tested application that I can have full confidence in. In the past, my confidence in the iOS apps has been undermined because of very obvious failures to synchronise data across the platforms. Even today, the only way I can show a consistent investment value across the platforms is to force the local replicas to be replaced by a server copy I know to be accurate.

Thanks Ian for the preview of B8. I’m nearing retirement, so the retirement planner is one area of interest. As noted above, perhaps you could expand on any improvements to investments. For example, will B8 include diversification tools, such as % holding of your overall portfolio or the ability to group & report securities by sector, such as financial, energy, utility etc. In the past, improvements such as Portfolio View or Calendar were immediately worth the upgrade, and improvements to investments, such as these two examples would be well worth upgrading to B8 gold tier on day one of its release..

These are beautiful screenshots and yay for that. Yay for refactoring old code.

I really hope you’ll be addressing the one major problem I have with Bankitivity — cognitive overload and external note-taking required to use it. I want my financial application to make it easier for me to spot abnormal things in my banking, not harder.

Example: I open up Banktivity and it says I have 7 new transactions in personal banking. Have I seen these? Are they all matches to expectations/schedule transactions or are they unexpected? So I review them all.

Now when I open it up tonight, it also says 7 transactions. Are they the same ones I already reviewed? Did say 2 of those pass the 24 hour cutoff and there are 5 the same and 2 new ones? Banktivity doesn’t tell me this. I have to manually review those 7 again. (cue external note taking)

What about if I opened it to check one account and didn’t have time to check others. When I open it again, all those new flags are gone. Nothing tells me I didn’t review those transactions, nor even what account they were in.

“Added in the last 24 hours” is not a useful tag. It usually contains tons of things I expected and are normal. So it provides no value. But worst of all, if I open the app but don’t have tine to check every account then those flags disappear. Fraudulent or wrong transactions can slip through without me being aware.

Please provide a feature where unexpected/non-matching transactions retain a tag until reviewed. This will assist with cognitive overload, not push us into putting stickies on our desktop to keep track of our accounts.

Ian,

Have Scheduled Transactions received any upgrades , eg auto posting option , more scheduling criteria, improved reminding of overdue, due etc.

Also hoping the Securities screen has been updated, particularly the graphing section.

I am looking for some changes/fixes here as well. In particular, when using scheduled transactions and envelope budgeting, it is very difficult to make changes to the scheduled transaction (change amount, stop or delete a schedule) without impacting previous months budgets.

+1 !

Thanks for the update. Really looking forward! Should we expect a full featured iPad experience? For instance, the ability to view / edit reports on the iPad the same way we do in the Mac version would be greatly appreciated!

iPad/iPhone get some new features like statement reconcile and dark mode. Reports aren’t there (yet).

Love to know if the new iPad/iPhone app allows merge 2 transactions. On the Mac platform, it’s being done via drag and drop the transaction.

This isn’t in there, but it is an obvious missing feature we will hopefully add not too long after launch.

Ian,

1- Excellent that we will be able to manually update prices on IOS but this improvement will be worthless in case such prices do not synchronise to the Mac and other devices. Today is a pain to have to update the server once a week to keep all devices up to date for a few days or hours

2- I still keep running Quicken on the side just because their Investments reports are easier to analyse. I know that I can get the same information on Banktivity but I have to keep changing reports and drilling down. Hope new version 8 will have a summary with Gains, ROI, IRR by YTD, 1 year, 3 years etc on a single page. Makes analysis quite easier and helps takes decisions faster.

Looking forward to the new version

Regards

Frank

Why note an iPad version just like macOS version?

The iPad is full capable to run it. Think about, it would be a game changer on iPad finance apps.

If it was as easy as flipping a switch we would have done it already 🙂 As I said before, we are working toward more feature parity.

Looks like the new reconciliation feature on the iPad version of Banktivity will be a winner. Can you tell me what the subscription level will need to be to access this feature? Thanks for adding this long-desired feature.

This feature is available in all tiers.

So happy for this update. I’m hoping the bug in the iPhone version was fixed where multilevel categories in the budget don’t total correctly?

Thanks for sharing this, interesting update to come.

One question about Goals: will they be focused on “US-only” customers (especially the Retirement plan)? I fear it is.

I’m a long-time user of Banktivity (and iBank). Your new subscription will be considerably more expensive than the upgrades I’ve bought as soon as they’re released. It’s not a bad deal though if I take into account the Direct Access feature. I haven’t used this since I had a free trial in 2015. Since then I’ve changed banks, 401K plans, credit cards, just about everything. Is it possible to try Direct Access with Banktivity 7 for a month to see how it works with my current finances? If it works well, I’m sure I’ll take the $100 subscription. If not, I’ll probably stick with version 7.

What happens if you have subscribed to a yearly direct access plan and now want to migrate this this new version. When will it be released.

You will be able to move/convert your Direct Access time from v7 to the new subscription system.

This looks great! I have tried for quite a while to move completely over to my iPad due to travel. The one thing that keeps me going back to my Mac is finances. This update looks like it will finally allow me to break free from that and actually – leave it home when I travel.

Seriously looking forward to this Version.

Can you confirm in version 8 you solve the problems with respecting CAD system preferences using comma as separator because it’s not easy to use version 7 with this problems.

Would like to hear the answer to this. And will investment capital gains be able to be calculated the Canadian way (average cost)? Has that come yet?

No, this isn’t supported yet…

It’s mean we can’t use numeric keypad to enter the numbers……

Please take time to add this request 1082971+1J6QY@tickets.livechatinc.com by use using comma as separator. We are a lot of french Canadian that use your software. When I buy the first version it’s was available in french….. But at least can we use our numeric keypad to enter our transactions….

I have a suggestion to make the envelope budgeting more intuitive and useful. Currently the graph only shows expenditure. This might be useful for people who have a fixed monthly pay check, so they can see how expenditure is tracking against their known income for the period. . But is not useful for people like me who have multiple and variable income streams. I would like to have an option for the graph to show total envelope over the selected time period (ie include income and invert the graph). This would enable me to project cash flow over a year and see when I might be getting low on cash if I don’t make my budgeted income in a month. I think a lot of new users might also find the envelope budget feature easier to understand if the graph shows total envelope, rather than expenditure.

Also, it would be good if you could make it possible to make budgets in non-base currencies. At the moment, it is possible to select a different currency when setting up a budget – but this does nothing – the budget is always shown in base currency!

The reporting aspect is not that much intuitive if compared to software like YNAB and others, can we improve the UX of that part as right now it feels very rigid and dont seem to be organized well. For starter, when highlighting on specific element in graph, can we show abit summary information there?

Hi Eduardo, what sort of summary information are you looking for? Right now you should be able to hover over parts of the graph and get a floating little window with additional info. Or of course, clicking drills you in to get more info too.

For me, when hovering over a column in the investment reports, I get “Market Value, Security Liability, Cash, Cash Liability” – but why o why no “TOTAL”???

Hi Gordon, can you tell me which screen specifically you are seeing the total missing from?

PLEASE PLEASE tell us that 8 will have the ability to print/view YTD reports. Its a basic accounting need when reviewing comparative performances.

Hi Jim, unfortunately this hasn’t made it into the version. Can you please expand on why the “this year” report option is falling short. Thanks!

Hi Ian, one other thought.. have you implemented ability to either add URLs to transactions (preferably clickable from any register/report), or recognise urls in the text of note, memos etc ( again one click to open)? Did suggest this many moons ago, would be really useful to link out to other datasets. …even better if we could call on some ML to auto match transactions to a separate repository of data (e.g. email receipts, ocrd receipts etc)… maybe at some point?! Thanks to you and the team for all the work.

Ian,

I’m in the camp of folks not really needing the “goals” feature. I’ve already retired, have an emergency fund, don’t need additional education. Possibly might use for saving for a special trip but that’s all. When might we expect to hear about the other features of the coming update? I’m curious to know if any of the many user requests have been implemented in the update. In particular the ability to view or export from the “memo” field, and the ability to import security prices via a spreadsheet import.

Thanks.

I agree. It would be great to have a location to submit ideas and track their progress. No leaving the customers hanging if something is ever going to happen.

Ian, could you create an idea board like this?

https://big.ideas.aha.io/

We’ve been discussing doing something like this. Our first goal is get v8 out. I was thinking something where people could submit a feature request and/or vote on what they would like to see. We would then try to work on implementing the number one requested feature. However, sometimes these types of approaches give me pause because even though this blog is read by lots of customers, there are far more that never read it. So I want to be careful we don’t implement features entirely based on the most vocal customers, even if they are a small majority. Anyway, good communication is good for everyone so I’ll see what we can do.

Can we edit/tailor the retirement goal to work for UK milestones (e.g. Personal pension access at one age and State provided pension at another age?)

I hope with the new version that the share download for the Australian Share Market ASX will be included as presently there is no download and it is a pain!

I agree that reliable and live stock prices is a must if I am going to subscribe. I would be an immediate gold subscriber if there are live and reliable prices – but will stick with B7 if data feed for European markets is no better than it is now (ie yesterdays’ prices for a fairly patchy selection of stocks). All the major stock exchanges have their own APIs which provide complete and very reliable data. I have no idea what these subscriptions cost and whether it would be economical for IGG to subscribe – but really for me this a killer feature. Even when there was free Yahoo API, this was not really good enough for a subscription model as the data is so poor.

Agree with the suggestion above to make the envelope budgeting feature easier to understand. Took me ages (maybe I’m old and thick) to understand that as the envelopes go down, the graph goes up. Just didn’t understand what the graph was trying to tell me. If the graph just showed the total in all envelopes – and goes down as I spend and up when I earn – then all is immediately clear!

Hi there, great to see the evolution and although I cringe a bit at thinking about the subscription model, I agree it’s a sensible way forward and the pricing is defensible.

Two specific questions I would have:

1. Is there downward compatibility with Mac OS Catalina (Big Sur is the first version now not to run on my Mac)?

2. Do you have a roadmap or plan to accommodate international/European connectivity? I understand it’s likely more complicated and might not represent too big a share of your customers. A middle way might be to upgrade the csv import (remembering column allocations, etc) – any plans in this direction?

Hi, the version works on Catalina, but it looks best in Big Sur. Here is our roadmap for better EU support: https://www.iggsoftware.com/blog/2020/08/services-roadmap/

Hi Ian, any news on integration with Open Banking in the Uk?

What I hope to see in the future for B8 is a better forecast report. I have a 6 month `’on`’ six month “off” expat job so earn most of my annual income while I am away from home – then the bulk of my spending is when I am “off” and at home. I can make a reasonably accurate forecast of my annual income and my annual expenditure – but because one is a “cosine wave” and the other is a “sine wave” it is very difficult to see using the existing “envelope budgeting” feature where my finances will be at the end of any given month. I would really like to have some sort of cash projection so I can see where my net cash will be in the future. – especially where I will be at the end of my time “off” at home. The “forecast report” does not do the job because it only takes into account scheduled income and expenses and not the day to day budgeted minor expenses. Some sort of cash flow forecast would be very welcome!

I’m one of your many UK customers who have for some time been unable to download transaction data from our bank(s). You seem to be doggedly radio-silent on answering any questions asking if this will be sorted out in version 8 (or version 7 even). Can you please clarify the situation?

Our most update info about supporting UK direct downloading is here: https://www.iggsoftware.com/blog/2020/08/services-roadmap/

Are we still going to have to pay full subscription price with the lack of direct banking in the Uk?

Thank you Ian, that’s very good news. Apologies for the fact that I had missed that posting.

I will be happy to pay for subscription if Singapore stock exchange SGX and London stock exchange LSE are both supported. It is a hassle to input the stock prices manually when there are more than a handful of them.

Hi, you should be able to get end of day quotes from London Stock Exchange now. The suffix for the symbols needs to be -LN.

IEX’s EOD quotes are as interesting as yesterday’s newspaper. If you want to get my subscription you have to offer near-live prices for LSE, Euronext – especially as you prominently display “day change” on all your apps!

Do people REALLY use *Banktivity* to track minute by minute share prices and if so, why would you?!? Surely that’s better served with either your stock portfolio website or a dedicated tracking app?

Banktivity is about the bigger picture to me.

I’d be fine with EOD for the ASX as I track real-time changes elsewhere – Banktivity is not meant for that – and when I buy/sell, I simply enter the price at the time in Banktivity. No big deal.

I would be content with the ability to logon to my broker acc at end of day , download a csv and let the built in browser post the EOD prices to my stocks. Anything but typing 40 odd prices daily.

IGG needs to find a programatic solution to this before V8 launch.

Ian, I’m glad that you and many of the people who have commented here are excited about Banktivity 8, but after reading about the new features, I’m afraid I have a contrarian view. It seems the new version mainly adds the “goals” features you discuss above plus a lot of added functionality for the iPhone and iPad. While I have both devices, I have no desire to use them for Banktivity—I’d rather use it on my iMac. Moreover, the current version of Banktivity basically fills all my needs—I don’t need to save for any goals and simply want to track my investments, expenses, etc. So I don’t really see anything of great value for me in the upcoming version. As such, I may want to stick with V7. You say in this blog that I can do that, but when I bought V7, I thought I was buying the right to use all of its features (such as downloading quotes) and access to support if something went wrong. Now it seems that if I don’t opt to pay for features I don’t need, I can’t entirely keep what I already paid for. But maybe I’m missing something…

curious if there are any plans to add a benchmarking feature in at some point would be nice to be able to compare investing performance versus the s&p or dow or whatever.

Will it be possible in Banktivity 8 to obtain a comparative report for a given period with the same period of the previous year?

For example: 01/01/2020 – 03/31/2020 with 01/01/2019 – 03/31/2019.

Also, I think that comparative reports should show the difference between one period and another, and even the percentage.

Thank you.

This is possible in Banktivity 7! Once you have your report set up, click “Edit” in the upper right and you can add a comparison period.

Hello Ian

What you say amazes me. At the time, I asked for help from technical support, and on August 22, 2019 they answered me this: “The custom date range setting in reports will not allow you to do what you want, sorry.

I have created a Feature Request to do what you have described, and added a vote on your behalf.

You will need to setup two reports (one for each year) and then view them side-by-side in Workspaces.”

The option “Compare to Custom period” does not work well, because it modifies the dates in an incomprehensible way.

Thank you.

Ugh! I saw the email today and was hoping it was an announcement for the new version. 🙁

Can’t wait!

Thanks for the update. Waiting for the new release! I do hope that the IRR bug (which I had reported to your tech support several releases back) where the IRR is shown as blank whenever the IRR is >= 1000% (I know this is may be rare but definitely not improbable – stock going up by 3 % in a day for e..g).

Looking forward to this release, i was afraid that perhaps you would not continue with Banktivity and I would have to switch to an inferior product

Banktivity is near perfect for me although as i am based in the UK had to give up Direct Access as it would not work and am currently manually updating various accounts which is a bit of a pain so am really looking forward to this new release

Not sure which tier I will go for, I do need multiple currencies and investment data but am a light user so decisions decisions decisions 🙂

Any charge of getting rid of the big graphic for selecting date range. I hated it on the iPad up so much of the screen. Now you want to torture me with it on the iPhone! I just want to put in a start date and end date and see the list of transactions between.

I’m excited for version 8! There’s a lot of stuff in there that I’m going to be taking advantage of.

I currently have a subscription with Banktivity 7, and would prefer not to overlap subs on the Beta. Will the full release be out by then, or the subscriptions merged in the background?

The subscriptions in Banktivity 8 are an entirely new beast, so it is best to think of it as two different systems. Once you setup your initial subscription in the new system, you can migrate your old v7 Direct Access subscription to the new system. You can do this one time and only in one direction. So you could NOT, for example, migrate the time to the new subscription, then migrate it back again to the old system. The public beta of the new Banktivity is now available, http://www.banktivity.com.

Perhaps I missed it, but have you come up with a solution to dealing with the Direct Access subscriptions? My B7 notes that the subscription expires on 4/26/21. Will those of us who shift to B8 receive some sort or credit toward whichever version we select?

Yeah, please see my other comment:

Just had a look at the Beta and very underwhelming. I can’t understand why you have spent so much time developing goals tool and retirement tool when you have not even addressed more basic and easier to implement tools such as CASHFLOW! The Forecast tool is hopeless because it does not take into account budgeted expenses, and the budget planner graph does not take into account income. There is simply no way in Banktivity to see where my cash will be beyond the end of the current month…