Today I’m happy to announce that Banktivity 8.3 is now available for macOS and iOS. While there are several smaller nice features in 8.3 that I will cover later in this blog post, the biggest feature by far, is Direct Access 2 – our next generation bank connectivity system.

Direct Access 2

Please note that for Banktivity 8.3, Direct Access 2 is being released as BETA. I also want to emphasize that if you are happy with your current Direct Access connections you do not need to switch to Direct Access 2 at this time. If you want to try our Direct Access 2 and keep some legacy Direct Access connections around in the same document, don’t worry, that is supported as well. During the beta phase you can only set up new DA2 accounts on Mac, but they can be synced to iOS and will update there.

As we mentioned in an earlier post, Direct Access 2 brings our platform up to a modern set of APIs. We also redesigned it to be extensible, so that we can have multiple backend providers. For Banktivity 8.3 we will be going live with two providers: 1) Yodlee, the same provider we’ve been using for a long time now and 2) Salt Edge, a new partner for us that provides the connections to banks in the United Kingdom and Europe.

Connecting to United Kingdom and European Banks

We are thrilled to now offer a way for our UK and EU customers to connect to their banks. We are rolling out connectivity to UK banks first and will enable support for EU banks soon via a server-side update. Connecting to a bank supported by Salt Edge is a little different than connecting to a bank supported by Yodlee. When connecting to a Salt Edge-backed bank, you’ll be asked to create a Salt Edge profile. Then through that profile, you will grant Banktivity access to download your bank transactions. This is a different flow than connecting to Yodlee because of Open Banking and GDPR requirements. You’ll even have the option to log in to Salt Edge to see a dashboard of all of the accounts you’ve connected and which apps have access to them. However, once your account is set up in Banktivity and connected via Salt Edge, we don’t anticipate you needing to visit the Salt Edge dashboard frequently, if ever.

Better Security

A lot has changed with website security since we first introduced Direct Access over 10 years ago. Our new Direct Access 2 system ties you directly to our backend provider without our servers getting in the middle. We do this by serving up a mini website hosted by Yodlee or Salt Edge and let them handle authentication. We’ve never stored credentials on our server, but now we don’t even need to pass them through our servers.

This direct-to-provider design will also allow for faster fixes when there is an account linking issue. If you have helped us fix these issues in the past you know that they can be frustrating. Although we can’t guarantee it will be painless, we have made significant changes to help improve this process.

Quality of Life Improvements

While bringing support to UK and EU banks is the biggest new feature in Direct Access 2, we would be selling it short if we didn’t cover some of the other smaller enhancements we made.

More consistent indication of what is going on

With the old Direct Access sometimes the app might be in a state where it is waiting to get new transactions, but there were no user interface elements indicating this background process, i.e. no little spinners next to the accounts. We did this on purpose for the old system because that process could take a very long time waiting on Yodlee to get new transactions from a bank’s website. With the new system, we now always show progress spinners when our app is getting new transactions. This should help remove some of the confusion customers experienced wondering why the app didn’t appear to be pulling the very latest transactions.

Multi-factor authentication and workflow changes

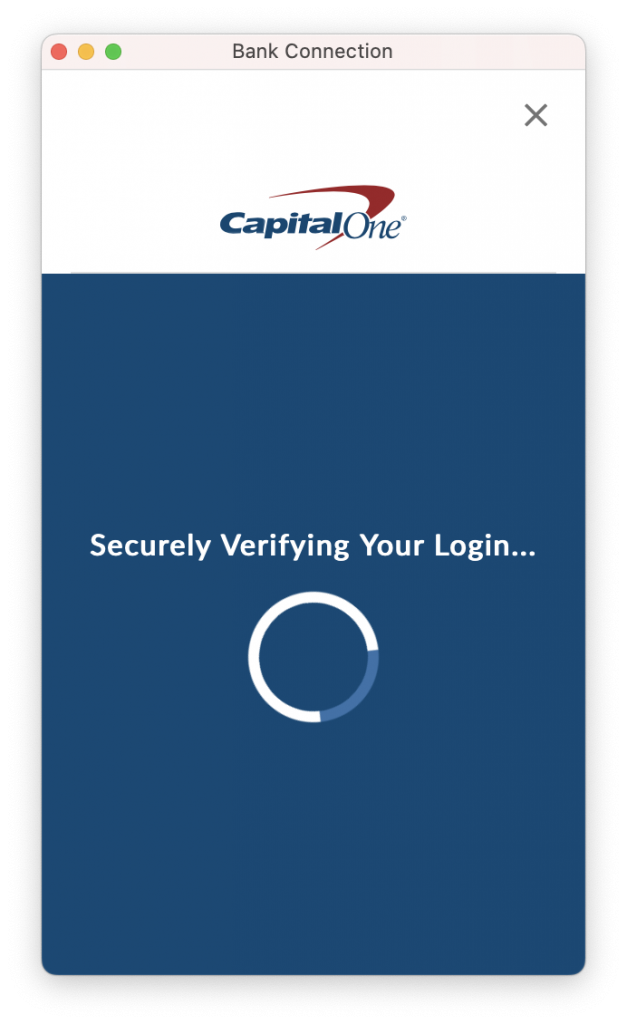

No discussion about data aggregation in this day and age would be complete without talking about multi-factor authentication (MFA). The common manifestation of this in Banktivity is being prompted to enter in a code that is sent to you via a text or email in order to get the latest transactions. While we do not control how often a bank requires this (and some banks still require it with every connection attempt, looking at you Capital One) we do two things to make this process easier. First, if you have the preference turned on to automatically download bank data, we do NOT try to get transactions from MFA-enabled banks. With the old system, it made the preference to automatically get bank transactions unusable because it resulted in an MFA prompt way too often. Now, we only get transactions from MFA-enabled accounts when you click the circular Update Everything toolbar button. Second, when you are prompted for some sort of MFA we display that in a floating window so that your workflow is not interrupted.

One nice thing about this window is that it floats over your other apps so you won’t lose it in the background when your multi-tasking. We think this does a good job of making sure you are informed about any MFA requirements while at the same time providing flexibility depending on your own personal workflow.

Other Improvements

We’ve made a few other nice improvements to Direct Access 2. For example, we don’t auto-populate the note field when it is the same as the payee. (Keep in mind you can always see the original import info by clicking the little “i” in the transaction editor.) We also now fix up pieces of data that might have been missing in an original import. This ultimately can result in better data quality, for example, you will be less likely to end up with a security-based transaction that is actually missing the security it belongs to. Additionally, we improved handling of pending transactions which should prevent some transactions from being deleted out from under you because they were pending.

Direct Access 2 Summary

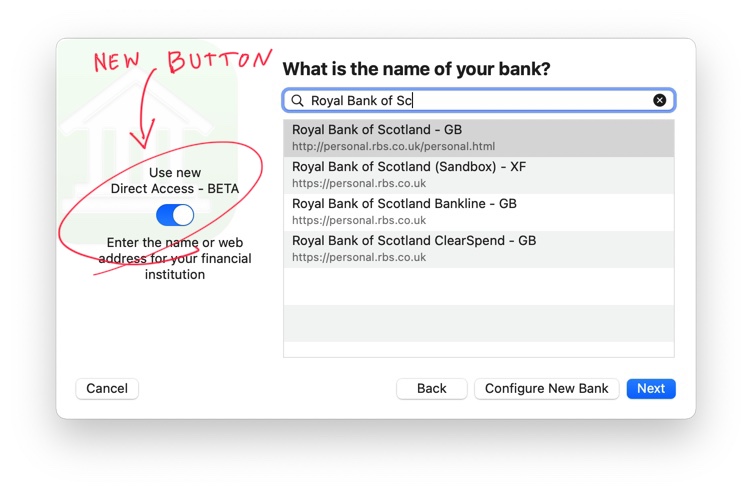

For those that are comfortable beta testing the latest and greatest, Direct Access 2 is available in the app with just a press of a button.

To try out Direct Access 2, select the account you want to connect in the sidebar, then go to Account > Configure Automatic Download. If the selected account is already connected via Direct Access or OFX, you’ll need to take it offline first before setting up the new connection. You can have a mix of accounts connecting with old Direct Access and some accounts connecting with Direct Access 2 (so don’t worry about trying to convert all of your accounts at once). One additional note, OFX connections are currently only found in legacy Direct Access bank list (we will be moving them over to the new bank list at another time in the future).

Other Features in Banktivity 8.3

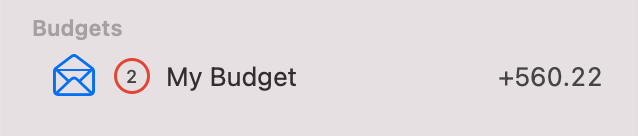

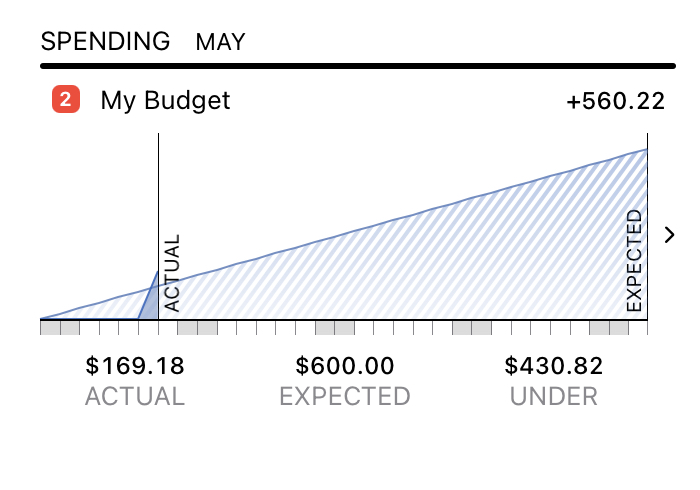

Envelope budget status badge

If you are an envelope budgeter your workflow in Banktivity might go something like this. Launch the app, download transactions from your banks, categorize any of the new transactions as necessary, then check your budget to see if any envelopes are in the red or if you have money to distribute. To help streamline this process, we will now badge your budget in the sidebar with 1) the number of envelopes that need filling and 2) any money you have to distribute.

This new badging has been implemented in both our Mac and iOS apps. In the screenshots below you can see there are two envelopes that are “in the red” and there is 560.22 in income to distribute. The red circle badge and amount to distribute can appear independently from each other depending on the state of the budget.

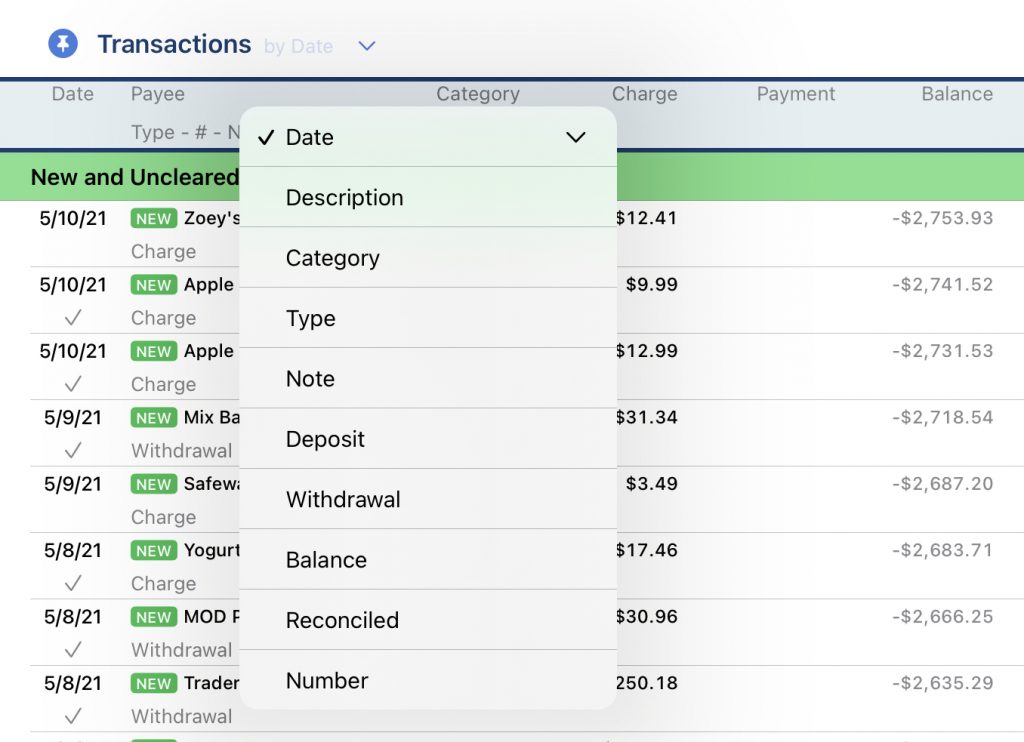

Group new and uncleared, and sort transactions on iOS

We’ve had a handy feature on Mac for a long time that lets you group all of your new and uncleared transactions at the top of the transaction list. This helps you see what is most important quickly and easily. Now with Banktivity 8.3 this feature comes to our iOS app!

We also implemented a new menu (for iOS 14 or higher) to allow you to sort your transactions by date, payee, category and so on – another step toward feature parity.

Some good bugs squashed

We fixed several bugs that have eluded us for a long time. For example, we finally found an issue where a manually entered transaction on iOS would sometimes not sync back to Mac (unless you subsequently edited it). Similarly, we fixed an issue with syncing budgets where you could end up with a “sync error 100”. There was also a long-standing, albeit rare issue on Mac where switching to the Calendar the view could cause a freeze and show the “spinning beach ball of death”.

Conclusions

Banktivity 8.3 represents the third major release since we introduced our subscription service last October. I couldn’t be more thrilled to be delivering one of the most sought-after features: bank connectivity in the UK and Europe. I know that feature has been a long time coming!

- Building the Future of Banktivity: Organizer Progress Report - October 17, 2025

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

Looks like some great improvements. Any timeframe for EU banks in DA2?

My EU bank seems to be working OK through Salt Edge

Thanks – looks good! I’m intrigued by the note in the email – ‘Improved calculations for % change of investments’

What did you change there?

This blog post was really helpful. I had lots of 2FA/MFA questions after only reading the Release Notes on places like the App Store. My questions are all answered now — thanks for a thorough write up of DA2 and how it all works.

+1

Do you now support downloads from USAA?

I use DA with USAA.

Good features. It seems like the Portfolio stock price updates for US market stopped after the move to 8.3.

We had an issue with our quote server, should be fixed now.

Is there any chance you will ever support starting a file from a Quicken Transfer File (QXF) rather than the old Quicken Mac 2007 Transfer File (QMTF)? The old QMTF export from Quicken Mac doesn’t support names/descriptions/memos longer than 30 characters, so a lot of data is truncated when it’s imported into Banktivity and it makes a mess of things. In addition, tags and attachments aren’t imported. The newer QXF export from Quicken Mac would include a lot more of this data. I have a long history in Quicken Mac, and the biggest stumbling block for me to switch to Banktivity is that I lose so much information when importing my Quicken export because of the limitations of the retired QMTF format from Quicken 2007, which is still the only way you support switching from Quicken for Mac.

I would really like to support QXF, but my understanding is that it is a proprietary format. If I’m wrong about this please let me know as we like customers coming from Quicken!

Everything looks great, although it appears security value/gain/loss updating is no longer functioning. Has there been a change in how this works.

We had an unrelated issue to 8.3 with our quote server. Should be fixed now.

Very buggy – tried all the different options to connect to UK bank. Getting various error messages such as out of date browser (!), “something went wrong, provider with id xxxx not found”, etc…

Thanks for the feedback. It is still beta because we expected some issues like this to crop up. We are already working on 8.3.1. Stay tuned!

Enabled da2 last night and am very pleased with it. Works really well so far. No more manual inputting. Had become a real nuisance. Happy again. Just uk securities to update pricing and I will be fully automated again in banktivity. Keep up the great work.

I was so so so hoping you’d have fixed the bug where ‘Buys’ post as ‘Deposits’ from my 401(k) – but alas even switching to Direct Connect 2 didn’t fix it.

Category Searches in the category panel don’t seem to have changed, It still filters out child categories of the parent you searched. Was that supposed to be addressed?

The 401k issue likely routes back to the data Yodlee is giving us. If you work with one of our support people we can probably get it fixed.

When searching categories in Settings > Categories we know show the full name. For example, if you search for “Fuel”, “Auto:Fuel” appears in gray above any sub-category called “Fuel”.

Until we did this, it was really hard to tell which sub-category belong to which main category.

Hi Ian,

Can you please let me know if there’s any update on the potential availability of New Zealand (i.e. NZX) stock quotes returning. This is a key functionality for me and I’ve really been missing it since it went of line some time ago. 🙁

Best regards,

Barb

Right now we use two different quote providers for stock quotes. Unfortunately, neither one supports the New Zealand stock exchange 🙁

If we can find a provider at a reasonable cost then we can likely integrate them, but right now, I can’t find a provider. I wish I had better news.

🙁 Well, that’s unfortunate. I’ve lost so much of my functionality with this change. I wonder why your existing providers can’t pick up NZ – the NZX as an organisation is quite “consumer friendly” – maybe we could contact them directly to discuss whether they might know a resolution?

When I reached out to our stock quote provider they said the licensing fees for the NZX are too high 🙁

Do you have a list of which UK banks are now supported by Direct Access please?

PS very encouraging to hear of this development at last, and hope it can move on from beta soon…!

Hi Nick

I found this information on the suppliers page

https://www.saltedge.com/products/spectre/countries/gb

Got most of the high street banks and also the likes of Monzo & Starling

Can you please answer the earlier asked by Keith? Do you now support downloads from USAA?

USAA is working with Direct Access. If you are having trouble connecting, please visit our support team, http://www.iggsoftware.com/support

Here’s a link to the UK banks and credit cards supported by Salt Edge.

https://www.saltedge.com/products/spectre/countries/gb

I’ve had no trouble connecting to my UK banks and credit cards. Works great.

I have 2 Barclays Uk accounts one in my name and one in the wife’s on my file. I can connect the wife’s and transactions are imported but not mine!

I don’t understand why that could be. Both set up the same in Salt Edge and transactions visible on the Salt Edge website.

According to the twitter account DA2 for EU banks was enabled. Yet I can’t find a single bank listed on the saltedge website, even tried a number of different EU countries just to check.

Am I missing something?

We are still learning some of the quirks and nuances with working with Salt Edge and we will be exploring if we can get more banks added. If I do a search for “Deutsche” in the DA2 bank list, I see lots of German banks listed.

Hi Ian –

These features look wonderful. However, it broke something because both the new and old DA don’t allow connection to my credit union…very frustrating! 🙁

Coming to support to try and figure out why would be your best option. Thanks!

Fantastic news that SALT Edge will finally be supported!

My Bank (Millennium BCP in Portugal) is supported by SALT edge

https://www.saltedge.com/products/spectre/countries/pt?page=2

But is NOT in the list when I try to search for it. how can we get it added?

Thanks!

It’s there on 8.3.1 and it works!

I have DA2 working also with my EU banks. However, I am really confused by the transaction view when “group new and cleared transactions” is selected. Prior to DA, this neatly put all cleared (tick) transactions below the line, and all uncleared (circle) transactions above the line. I could see at a glance my cleared balance by looking at the top line of cleared transactions. When I checked my bank account on line I could just manually tick the circles of cleared transactions, and they would drop below the line.

Now this view is completely useless to me as transactions that are “matched” stay above the line, even though they are cleared (tick). This makes the transaction view an unreadable, illogical jumble to me. Is this deliberate behaviour? If so please can you add another view that simply groups all uncleared (circle) transactions, and ignores whether they are matched or not?

The idea of the New and Uncleared section is to make it easy to look at the transactions that you likely want to review. To see all uncleared, click the little downward arrow next to the Transactions button and choose “Uncleared”.

Yes I know that option but then I can’t see recently cleared transactions! I would like to see all cleared (ie ticked) transactions below the line, all uncleared (circle) above e the line. I then have a clear view of cleared balance, and what might be clearing soon and how that will impact balance.

At the moment, having “matched” transactions above the line mixed up with uncleared transactions makes it difficult to read how the account will be impacted over the next few days.

And might it be possible with DA2 to allow Matched and New transactions to be cleared manually, instead of having to wait 24 hours for them to clear? It would be more “Apple” if the transactions worked like notifications instead of having to wait 24 hours. It gets really confusing if you have a lot of transactions coming in, trying to stay on top of what is really new and what is still there from yesterday…

Can I endorse this request – I would like Matched notifications to be removed immediately when I clear the transaction.

I quite like having the Matched transactions in the ‘New & Uncleared’ section so please don’t change it.

Just change your view to ‘uncleared’ transactions only and they’ll disappear…

I am confused now – EU banks? Supported by Salt Edge?

I can see my banks in Finland and Denmark are supported, but can only see some Germany banks with Banktivity 8.3

Please confirm: All EU banks which are supported by Salt Edge are coming DA2 sooner ( or later) ?

We had an issue with our bank list, but that should be resolved now. Can you please try again.

Is the latest 8.3.1 release still Beta for DA2? I had some problems with DA2 in 3.1 so stopped using it until it goes into standard support.

Yes. It clearly states BETA when you connect an account so expect issues. When it’s no longer a beta service I’m sure it will be very obvious to the user when Banktivity updates. 8.3.1 contains improved logging for DA2 – you’ll now see files like ‘Yodlee…’ in the logs.

If you have issues make sure you submit a support ticket with details. I’ve been doing that and tech support has been very helpful. Apart from minor quirks, I think DA2 is going to be excellent and much more robust than DA.

I’d like to have the login window be seen by password managers like 1Password (or even iCloud Keychain), but I’m sure that’s on the developers’ wish list.

Appreciate the efforts to get DA2 working for UK Banks. Working well with a number of different institutions so far via Salt Edge and the additional security of Open Banking is great.

Made me a happy customer again and happy to upgrade from version 7.

If you can add support for UK fund prices that would make me even happier.

I will upgrade to Banktivity 8 when it supports at least German and Spanish stock quotes.

Will we have these quotes available soon?

Regards

Ian – can you explain with DA2 the best way of handling scheduled transactions. Say I have a scheduled transaction due on 9 June. Normally, I would enter this through the scheduled transaction window on the day and then clear it when I logon to my bank. How does DA2 deal with a scheduled transaction downloaded on the day, 9 June, but not yet in the account register on Banktivity. Is DA2 smart enough to recognise and process the scheduled transaction and process it as part of the ‘matching’ process?.

Hi Peter,

There isn’t too much of a difference between DA1 and DA2 when it comes to matching manually entered transactions (or transactions entered via the Confirm Scheduled Transactions window). I think your work flow of posting from the Confirm Sch. Transactions window, then download transactions from DA2. In most cases it should match, if it doesn’t, you can always drag and drop the downloaded transactions onto the manually entered one to merge them.

Are you planning to implement in the syncing process for the iPad or iPhone versions to include the transaction field where I am dropping my PDFs of receipts ?

Your tech support was working with me on an amortization problem. However after I provided the required file they have ghosted me. They no longer respond to the question of when they will have an answer. Very frustrating

Looking in to why it seem this issue slipped through the cracks…

any update?

Service seems to be slipping. Your tech staff just decided my problem was solved. Never looked into what was going wrong

And no reply ever?

I know that this is probably only of interest to a few of your customers, but is there any chance that the Singapore stock exchange will ever be added? I was hopeful that it would come when you added Hong Kong, as they are similar / competing exchanges, but alas……

Please could you allow us to create budgets in non-base currencies?

For those of us who use multiple currencies, the envelope budgeting is unusable because it keeps getting out of balance as exchange rates change. As a workaround, I tried to set up budgets dedicated to each currency that I use. But that doesn’t work either because even if I select a different currency at setup of the budget, and use entirely accounts in that currency, the budget is created in the base currency…

To add to the confusion, the amount available to distribute that shows in the sidebar never has a currency symbol so I am never sure whether that is in base currency or the currency I selected at set up…

Fantastic news to see UK account supported again!

Could you please update https://www.iggsoftware.com/support/articles/ibank-5/a-message-to-our-uk-users-regarding-direct-access/ with a link to this anouncement?

I had been checking that page regularly and missed the good news.

Thanks for the nudge. We updated it.

I endured the process of having to get a new Mac; I also had to get an upgraded Banktivity. Fine. Everything transferred OK to the new version. But now I find I can no longer print checks without a subscription!! The unmitigated gall !! I do not need all the fancy hookup to my bank. I do not need to track a nonexistent portfolio, I just use Banktivity (since the collapse of Quicken for Mac) to do my checking accounts. Turning off an existing feature is a slap in the face!

Hi Richard, you can buy the gold tier once, then after a year, choose to not resubscribe. The check printing feature will be unlocked and will continue to work along with all of the other non-connected service features.

I would love to see some new improvements/enhancements to the Budget screen. Currently, there is no way to see all 12 months of the budget on one screen. It would be great to visualize the budget for the entire year with each column represented by each month in the year – similar to what Quicken has done.

I’ve been using Bankivity for half a dozen years. I’m using version 7 and will stick with it. I started to upgrade to Version 8 just to support the developer even though I don’t need all the features such as investment portfolio (my broker does that) or goal-setting, auto accountdownload. I ONLY want to have MANUAL downloads. Version 8 apparently requires access to my passwords to install. (I think it is all my passwords.) Providing passwords to a third party for auto download or otherwise is an infringememt of at least my bank and a couple of my credit cards. I don’t use an ponline password manager; I’m not about to grant password access to a third party program.

Fix it so avoid those issues and I’ll probably cnsider again forking out some $ just for continued support for the program, even though it works as is ok for me now.

Hi, I appreciate you giving Banktivity 8 a try and supporting us. I want to be clear, Banktivity 8 does NOT ask for any passwords, unless you entered them in Banktivity 7. Even then, the only passwords it will ask to use during the upgrade process are:

1. Your Banktivity ID password so that the app can authenticate with our server

2. Any OFX passwords you used in previous versions of Banktivity

The only password you absolutely need to put into Banktivity 8 is your Banktivity ID password so the app can authenticate you. I hope this helps clear up any confusion!

Thanks, Ian, for the clarification. I’ll try installing Version 8 again

I’m in Canada and will only be using Canadian Currency. Do I need the Gold version or will Silver work for me?

Hi,

Silver should be just fine in this case.

Your auto match is rotten. Can we turn that off yet?