I’m writing today with an update on what we’ve been working on since our last blog post a couple of months ago. Before I discuss where we are on our roadmap I want to highlight some of the improvements we’ve already shipped with Banktivity 8.7.5 (the most up-to-date version at the time of this writing).

Shipped and delivered

Before we moved to subscription, some of these improvements probably would have been “held back” so we could tout about them in the next paid version and make a better argument for why customers should upgrade. We fixed a lot of bugs and made improvements to our old payment model, but now, with our flexible subscription, we can iterate more freely.

Search result improvements

A few customers lamented about how we should really show hidden accounts in our search results. When the team read about this, it was like, “yeah, of course, why haven’t we done this all along?” So I’m happy to say that feature was rolled out in version 8.7.5.

Envelope budget improvements

Long-time readers probably know that I’m an avid envelope budgeter. Several years ago we added the “target” amount to your envelopes, but we didn’t show it for all categories. The idea at the time was we only wanted to show it for categories with irregular schedules, like an insurance bill due every 6 months. We recently revisited this based on some customer feedback and we now show target amounts for every category that doesn’t have a basic, monthly budgeted amount. The idea is, if you have any category in which you might need to sock away some extra cash now for a future obligation, we should show that in your budget.

Direct Access 2 improvements

We continue to put time and energy into improving Direct Access 2. Our legacy Direct Access implementation is not being actively developed as it is using antiquated technology that our backend provider is phasing out. The future is with Direct Access 2 and we want to continue to make it better. Banktivity 8.7.5 has several improvements in handling investment transactions. In particular, it does a better job of interpreting what a transaction should be, based on the data our backend provider gives us which is sometimes not totally clear. We also fixed an issue where we incorrectly ignored some transactions altogether when the transaction type was unrecognized.

Roadmap progress

For the rest of this post I talk about how we are doing sticking to the roadmap we laid out in the last blog post. Additionally, I talk about some great (and long overdue!) improvements we’ve been making to scheduled transactions. So without further ado, here is where we stand on some of our biggest forthcoming features.

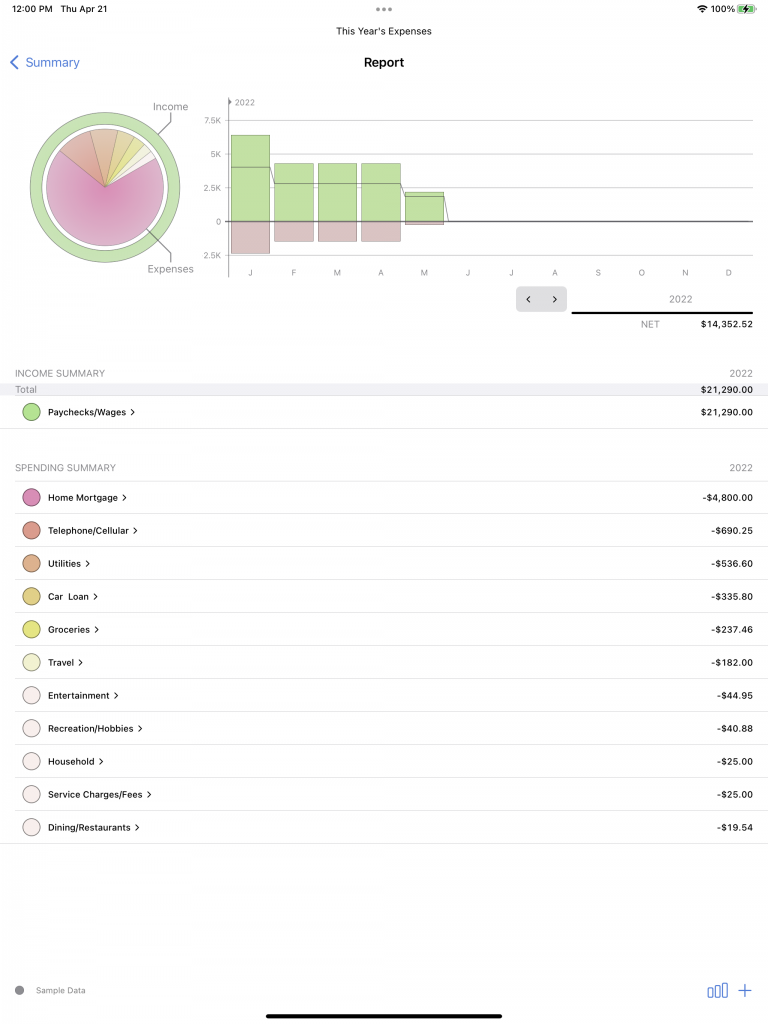

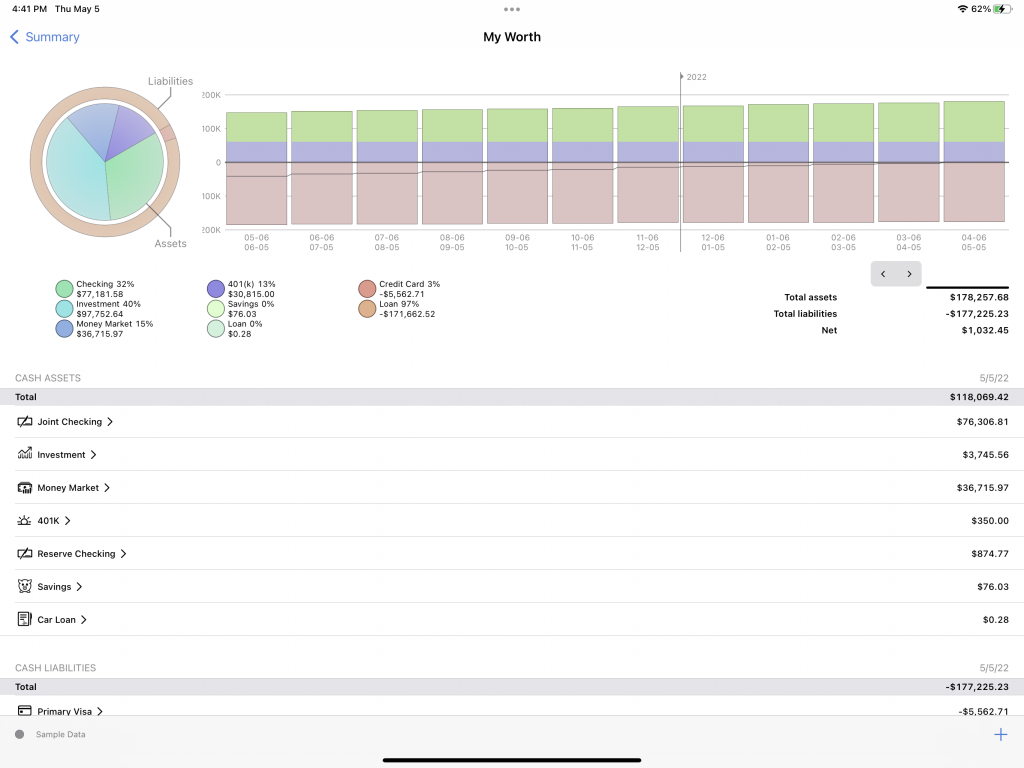

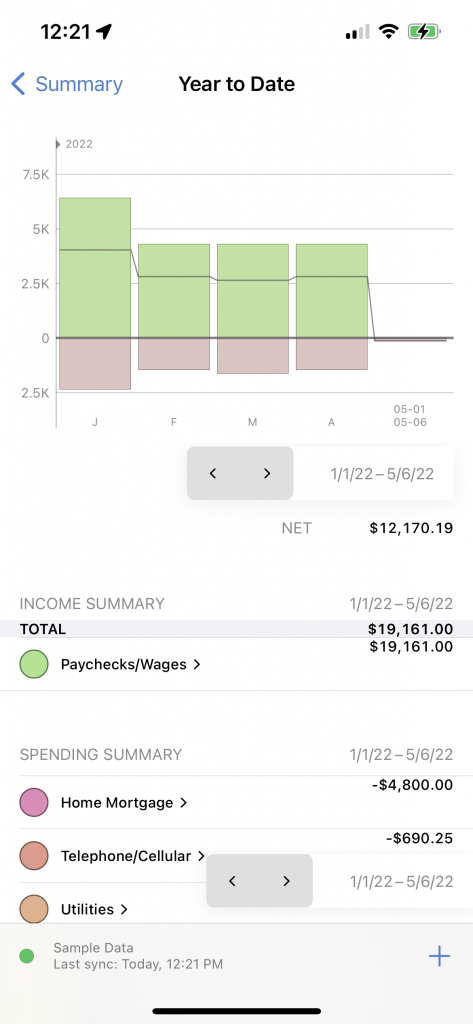

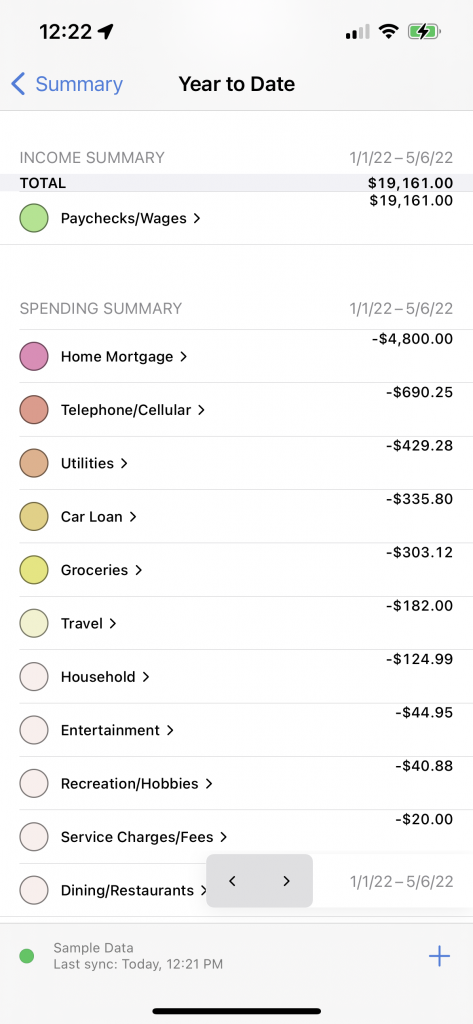

iOS Reports

We continue to make good progress on reports for iOS. While we still have a ways to go, I’m happy that we can share some screenshots with you all! (Please remember these screenshots are not final!)

Year to date income/expense on iPhone

Same report, scrolled down a bit

As you can see, the reports on iPadOS look very similar to Mac and we think you’ll feel right at home with them. For the initial release, we plan on having the following reports:

- Income and expense

- Net worth

- Payee

- Payee by category

- Category detail

- Payee detail

Bringing reports to iOS has brought some UI challenges given the large difference in screen sizes between a small iPhone and the largest iPad. Really, the largest iPad screens are pretty straightforward. It’s the smaller iPhone screen sizes that pose some, uh, difficulties, in fitting everything in a nice legible layout.

Document Spin Off

This is the feature we mentioned in our last blog post that allows you to purge old data from your document, and move forward with just relatively recent data.

We haven’t made as much progress on this feature as I would have liked, as we spent some time working on the improvements mentioned earlier in this post. We still will want to do this feature, but we’ve shifted gears a little bit and have begun work on improving scheduled transactions.

Improved schedule transactions

Banktivity has had the same scheduled transaction system for over a decade. It’s easy to model the majority of basic bills, things like a cellphone bill due on the same day of each month. Where our current system falls short is when you want to model something like the last Wednesday of the month or the last day of the month. Or the second Tuesday of the month.

We’ve decided to tackle this and we are currently revamping our scheduled transaction calendaring system. To be clear, this was not a last-minute decision, we’ve been planning on improving scheduled transactions for the last several months, I just didn’t mention it in the last blog post. Better to over-deliver and underpromise than the other way around.

UI Scaling on Mac

A big chunk of this feature is done. As you’ll see in the video below the main content area of our app scales up and down as I’m pressing some command +/-. I pause in the middle and then resume some scaling magic.

Summary

We’ve made some great progress on our roadmap, but there’s still lots more to do. Apple’s developer conference (WWDC or “dub-dub” for those in the know) is happening in early June and we fully expect them to announce new operating systems with new features and technologies. We’ve built some time into our schedules to make sure we can devote resources to making sure the next versions of Banktivity are fully ready to go with Apple’s new operating systems. Of course, you never really know what Apple is going to announce!

- Building the Future of Banktivity: Organizer Progress Report - October 17, 2025

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

I was one of those who was a little “critical” at the time of the Winter Update. Mainly because there was little mention of ironing out some long standing wrinkles.

So thank you very much for your work on Envelope Targeting, hidden accounts and schedules. It is appreciated!

Ian

As you know I’m a big user of scheduled transactions so improvements here are very welcome. One feature in MS Money I really liked was to schedule a transaction ‘Only Once’. This may seem an odd use of a ‘scheduled transaction’ but its invaluable when you are looking at cash-flow effects/timing of single, large one-off transactions.

My other plea for functional improvement on iOS is to enable groups of accounts. On my Mac I can group all my different savings, credit card, investment accounts into their respective groups and in one simple view get a summary, for example, of all my savings. Fantastic! But entirely absent on iOS. This is a big opportunity for functional iOS improvement.

One emerging problem – I think the last iOS update hoped to address the infamous and difficult to reproduce ‘blank screen’ problem. Whatever was done seems to have made things worse rather than better. I have moved from needing to restart the iPad app 2-3 times per month to 2-3 times per week – or even more frequently! Hope you can get to the bottom of this issue quickly!

Thanks.

My workaround for one off scheduled transactions is to set up the transaction and then use the provided setting to end it after one instance.

Paul – thanks – appreciate there is a workaround but have occasionally forgotten to set the number to ‘1’. Seems a simple usability improvement to have an ‘Only Once’ option that pre-populates the fields.

That scaling video is great, but can we PLEASE get single line mode? I prefer it SO much, it’s almost a deal breaker.

I couldn’t agree more. Each row currently takes up way too much vertical space and one single row is something I’ve asked for many times before.

I don’t know about Direct Access 2. What I do know is that in the current version 8.7.5 I have Direct Access problems with at least 1 account (Acorn) for over a month – with no date when it will be fixed – and the frequency of updates. Never see this issue on Quicken. Could it be that whatever 3rd party Banktivity uses has a low priority with the major banks?

Also, an “Only Once” option is a no brainer. Many of my new bills are once only payments. The workaround is clumsy.

When will I be able to schedule dividend transactions?

Any plans to improve the Import Rules matching from the payee field? My bank supplies a bunch of data in the payee field in addition to the payee name. The part that is a problem is the purchase date in ddMmm format. This means Banktivity can’t match these transaction because the date keeps changing. Banktivity’s current match method takes a year to compile all the variations (it’s the month change that throws it). This means I still spend a lot of time manually changing these to the correct payee.

I did find a regular expression that does work well, but it’s a manual process to add it to new payee’s Import Rules. Even for the regular payees, if they change their payee name (ie new business owner, but same “trading name”) I have to fix the expression.

I have some feedback on the envelope budgeting. First, I’m a recent retiree, so my budgeting needs are quite different now. All of my income is pulled from a retirement account. I pull money once a quarter. I don’t need a target envelope amount because I’m not going to pull money in March that I need in December. It would be nice if that was a preference.

Second, the budgeting amount is buggy if you switch between periods. At one point, I entered an annual amount for EV charging (based on last year’s data). At some point I realized that I was going to take some trips during the year and that’s when I’m going to encounter higher than normal charging costs. So I switched from “Every Year” to custom and added extra amounts in the months I knew I would be traveling. Now, depending on whether I’m looking at the full year budget or this quarter’s budget, I see different values for budget. The full year/ytd views still show $300 Every Year, but the quarter/month views show custom with different values for each month.

Finally, I track an extreme amount of categories. But I don’t really want to budget down to that level. It would be really nice if I could assign multiple categories to a single envelope and budget for the group.

Like Mr Weiss, I too have a major problem with DA 2. I have been unable to connect to my primary financial institution since last Fall! Is Yodlee the only aggregator out there? They are supposedly trying to work it out, but I never get any updates or requests for additional info. I’d be happy to do something on my end if I only knew what it might be.

Good prioritising, I do believe that the area where the most significant day to day usability could be improved is on the scheduled transaction logic. Last day of month is essential for me would like to see auto posting back too.

I have a bug going on ten years. I opened a new ticket QNSY6. There is a bug in the mortgage/loan tracking that appears once you update the loan. It throws the calendar out of whack. Often it fixes itself once the month rolls over but this is no longer the case. My loan tracking is seriously wrong. Support’s only comment is whoops – this is a bug and we are on it. TEN YEARS of tickets

Can you help?

I’ll take a look. Thanks for being a long term customer!

Thanks.

so this was fixed with the previous update ant it is now broken again

Ticked QNSY6

I am beyond frustrated

My mortgage schedule is hosed

Thanks for the ticket reference. I’ll take a look. Thanks for your patience.

it is incredibly frustrating

no one has responded to the ticked

Hi Mark, I looked at the code yesterday and found where our logic failed to increment the amortization schedule date. Apparently we fixed one issue awhile ago, but missed another potential manifestation of the same user experience. The new fix will be in our next release. Our support doesn’t work on weekends so I wouldn’t expect a reply to the ticket until later this week after the holiday. Like so many other businesses, we are running with a pretty lean support team these days as its been hard to find qualified applicants! Thanks for your patience.

thanks for the information about the fix you discovered. When will the next release be out?

thanks again

There are still issues with inconsistencies between the status of scheduled transactions on Mac, iPad OS and iPhone OS. These inconsistencies range from scheduled transactions processed on the Mac but remaining on iOS to certain scheduled transactions not appearing on iOS at all. Happens all the time so should be very apparent in QA ………. Seems to be associated with scheduled transactions that have been somehow changed since they were first created?

Another request for new scheduled transaction functionality – again, it existed on MS Money 10+ years ago. When setting up a scheduled transaction – over 10 months say – its often the case that the first or last transaction is not exactly the same as the other nine. For example, total 100.09 due over ten transactions, then the first is likely to 10.09 and the one remaining 10.

I have the same issue. I didn’t realize it could be related to old scheduled transactions, I’ll have to try that idea out. I did create a support ticket, but haven’t heard anything back. I want to go back to version 8.7.4. That’s the last update that didn’t have any bugs that I encountered.

8.7.9 should be going out this morning

Thanks. I’ll wait to update until it’s been tested by the masses.

Ok, I appreciate where you would want to get search results in hidden accounts, but what if you don’t want an account searched? Why not a setting like on the old iBank app, where when you hide the account, you can make it unsearchable?

And, I have a question about the Target Amounts in Envelope Budgeting. An example that I have in my budget is Cash Withdrawal. Since all my income is direct deposited, I can only go to the atm, or get cash back using my debit card. My budget has it in multiples of $20. Why is the target a weird number, such as $39.66? It’s budgeted the same amount every week.

This articlearticle explains how the target amounts are calculated.

Thank you. One mystery solved.

Hi,

About the Improved Scheduling. I guess you didn’t write about all the different scenarios of relative scheduling. I get my salary on the 25th every month unless it’s on a weekend or national holiday. If it is then it’s paid on the last workday preceding the 25th. Also, I pay my rent on the last workday (i.e. last bank day) of the month. Will you support that too?

We are aiming to support the same types of date patterns that you can set in the Calendar app – we won’t get every possible pattern out there. You will be able to do “last weekday of the month” for your rent, but we won’t be support “25th of every month unless it is on a weekend or national holiday”. Just trying to be clear and setting expectations appropriately.

I have a request that I had hope would be addressed by now. It has to do with Budgeting and Forecasting. Right now, it appears that only scheduled transactions are included in the Forecast, which leaves off all “other expenses” (e.g. Groceries, Entertainment, etc.). This makes the Forecast problematic because there could be a sizable part of monthly budget outflow not being accounted for. As a workaround, I’ve added up all “other expenses” and created an additional scheduled transaction in order to account for this. Doesnt make sense to me that all budget line items wouldn’t be included in forecast. Am I missing something? Thanks.

Thanks for the feedback. This is on our long list of features we would like to do, but we aren’t putting any resources toward at the moment. So much to do, so little time…

Weird bug using transaction downloads. Since the last update the vendor name has been incorrect. I don’t know whose fault but it is correct on the credit card website but not when it gets to my Mac.

Thanks

your Mac software no longer opens the data sheet when opening the app

You need to go to open/recent to open the data sheet

this never used to happen

While revamping the scheduled payments area, a vote here for being able to set up a scheduled payment in one currency for conversion and payment to an account in another currency. (I have regular Euro payments that are made to a GBP account)

Ticket QNSY6. Ian said this will be fixed in the next release.

The tech hasn’t responded to this question:

When will the release come out?

The problem is killing my mortgage tracking.

Thanks

We have this scheduled to go in 8.7.11. We don’t have a hard release date. My guess is likely next week assuming testing goes smoothly. (Tech support often doesn’t know exact dates of when something will be released.)

While you are working on calendar issues could you make Banktivity calendar default to OS default? I like first day of week to be Monday.

Could you also add “Debit Card” as an account type? Some DA connections to a Visa card only work if the account is selected as “Credit Card” – which doesn’t make sense in most of the world where credit cards don’t exist. It screws up reports as the visa account always gets listed as a liability, even if the account is in credit…

Is anyone else seeing very slow response times – more than 10 seconds – to enter a new transaction in a register on MacOS? I have a new MacBook M1Pro with 32Gb memory and am at the latest software releases for both MacOS and Banktivity so doesn’t seem likely to be anything else but an application issue. Am I alone?

No delays here on an M1 iMac (8gb memory).

On my Mac I usually have a second window open giving a graphic of actual versus budget. This report often takes a while to update. Hopefully the application has been designed to not delay task one, updating the account register, while processing a budget actual??

I have huge delays pretty much every time I make a move in the software. Moving to a new account could result in a spinning circle for 20-30 seconds before any data is displayed. I reached out a while ago and was told because I’m a long time user, it’s related to the amount of data I have. I manually archived (very painful process) a larger account, but didn’t really see much relief. I had hoped that the archive feature would be addressed in the near term but sadly it appears to have put on the back burner.

The “document spinoff” feature is still high priority, it isn’t on a back burner. It just takes time to implement features well and fully embrace Macs and iOS.

Correction – there is in fact a short delay whilst the transaction enters its.saved state – but not as much as you are seeing. I agree that this is new in the last month or. So.

I have been unable to connect to my primary financial institution since LAST OCTOBER, yet it continues to appear in the list of Yodlee supported institutions and does not appear in the list of KNOWN DA problem institutions. I get emails from time to time stating that the problem is being worked on, but after 9 months of non-performance I believe the subject institution should be removed from the list of supported institutions.

Several months ago I purchased a new MAC in order to download the new Banktivity software. I have been unable to download any activity. I called support and took the account off line and started over. That worked for a couple of days and was back at the same issue. Today I received an error msg that I have a problem at the bank. I logged in to my bank and looked around for a solution and finally found it….. I had to tell the bank to recognize this new computer! Maybe everyone know they have to do that but your tech

didn’t think of it and neither did I. Maybe this will help others?? I’m not a techie but love your software.

Thanks for the tip. With so many banks out there and their requirements changing frequently, we don’t always know the ins and outs of every bank.

Could introduce functionality to import categorized investment records (Buy/Sell/Dividends, ecc)

Love the Zoom feature but I still struggle to see the receipt itself. Any chance the Epson Receipt Scanner would be added to this app? That way my scanner can see the receipt and capture the boring info such as date and amount.