I’ve already talked about some of the larger features in Banktivity 9 in these blog posts: Let’s look at the reports, Return of the single-line register and the original v9 announcement. But there are quite a few other changes to Banktivity 9 that are worthy of blogging about. So without any additional preamble let’s dive into some of the features, improvements and enhancements that made it into Banktivity 9.

Check document health

Sometimes, despite best efforts, data can get a little wonky. Over the years we’ve come across various cases with customer data files where data has gotten into a bad state. Sometimes this is from a bug in the past and sometimes we don’t understand how it happened. For the last several versions of Banktivity, we have offered a hidden way to force some code to run that looks for invalid data (e.g. one of the checks is to look for a transaction that does not have a date). However, in Banktivity 9 we improved upon the data verification process and exposed it in File > Check Document Health. When you run this, the app first checks for bad data and if a problem is found, it will give you an option to fix it.

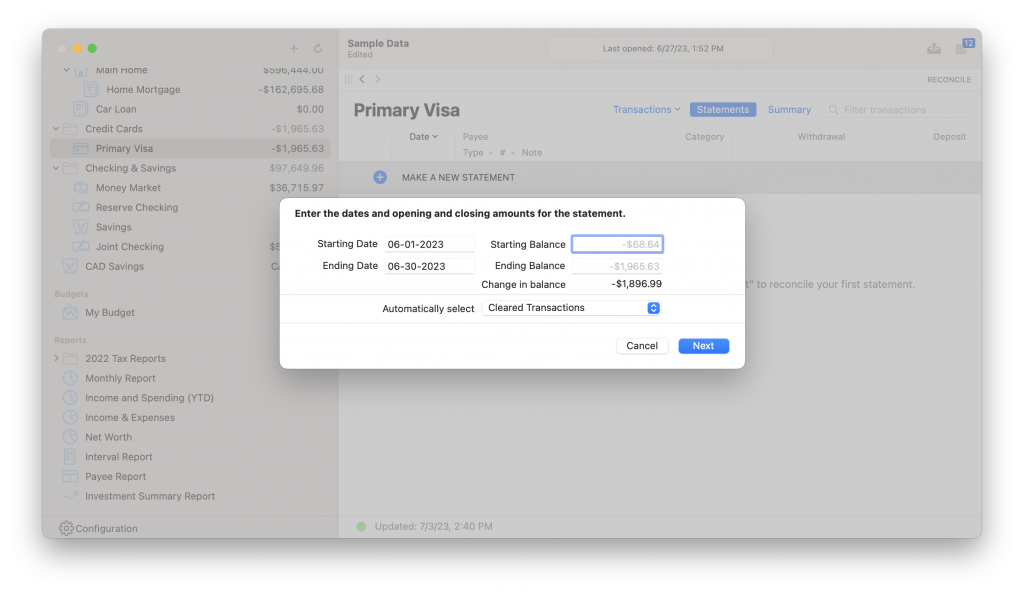

Improved reconcile behavior

Prior to version 9, when you created a statement, we would guess at the start and end dates of the statement (usually guessed to be the 1st and last day of the current month or month after the last existing statement) and then pre-populate the beginning and end balance on the dates. However, this behavior falls pretty short when reconciling your first statement because you will likely need to change your start and end dates. Of course, you’ve always been able to change the start and end dates, but prior to v9, when you did this, we didn’t change the beginning/end balances. Now, if you have not explicitly edited the balances, we populate the balances fields with gray placeholder text. This tells you what the balance of your account is for the date. When you change the date, we change the placeholder value.

Please note you can always just enter a different balance if the gray placeholder balance is incorrect. Please don’t try to edit the placeholder numbers by trying to insert the cursor between digits – just enter the amount.

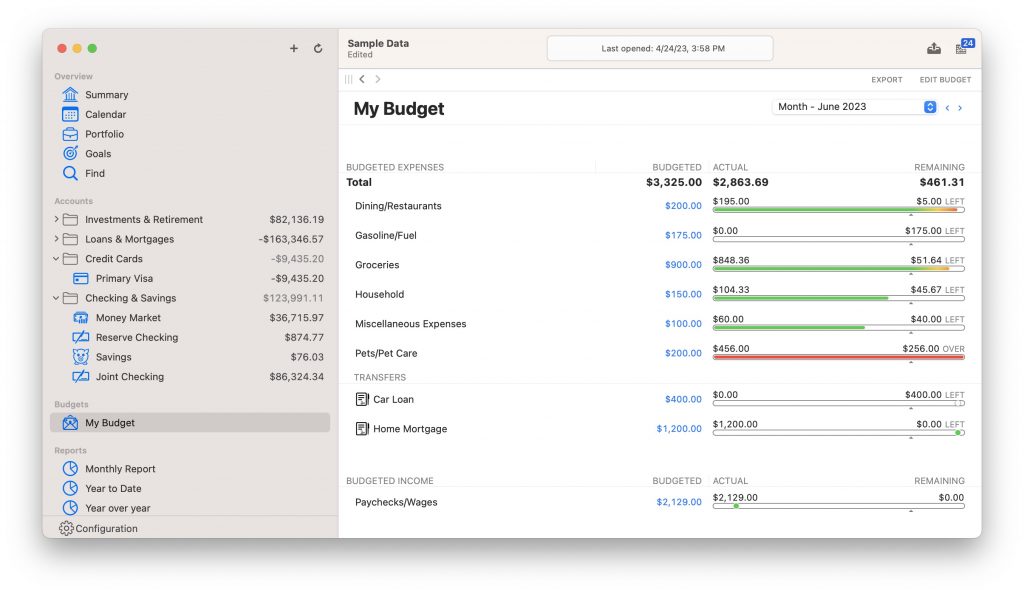

Budget changes

We made a few changes to budgets that are worth going over. First, we added the amount over or under a budgeted category. Before, we just showed the budgeted amount and the actual spent amount, but we didn’t do that last little bit of arithmetic to show you the difference. It’s worth noting that this shows up regardless of whether or not you use envelope budgeting.

Another change we made to the budget screen is that we now show you all of your unbudgeted categories. This was based on customer feedback where people wanted to budget for a previously unbudgeted category easily. Until this change, the only way to do so was to use the budget assistant.

Our budget progress bars also got some love. They are now more dynamic and do a better job of not just taking into account if you are over or under-spending, but they now also factor in the amount of time remaining in the month. So, for example, a category with a budgeted amount of $500 with $550 in spending has different implications depending on if it is the beginning of the month or near the end. The colors and gradients of bars now better reflect these types of situations.

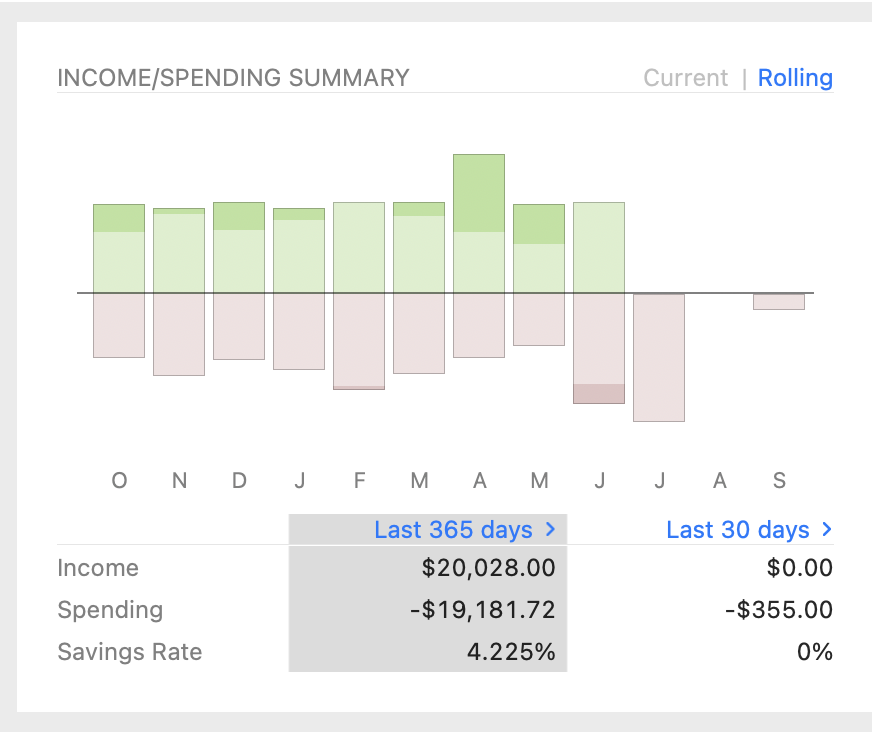

Better income/spending info in Summary

The Summary screen has been around for a few versions now. However, the income/spending panel has always caused some customers confusion about where the numbers are coming from below the bar graph and what to expect when you drill into the “Report >” button. Now, we give you two options to see the “current” full months of data or a rolling set of days, i.e. the last 30 days and the last 365 days. And importantly, we moved the drill-down option to be above this data so that when you drill down, you’ll always get the same results as from the previous screen. You can also click on any of the bars in the bar chart.

Check printing

When you set up check printing for an account, we now show you the printable area of the page based on your printer’s specifications.

IRR calculation change

The IRR calculation is pretty handy because it takes into account how well your investments have been performing while accounting for time. For example, you’ll get a higher IRR if you have a stock that has doubled in 2 years versus a stock that has doubled over 10 years. Our change here is quite minor, but our calculations should now match the XIRR formulas in Google Sheets and Numbers to more significant digits.

Why the .bank8 extension?

Alright, this one isn’t a feature or even a change. But I did want to take this opportunity to explain why we left the .bank8 file extension. In short, the less we can change the document extension, the more seamlessly people can update and downgrade. This was the first step in de-coupling the file extension of the version you are using. Always bumping the file extension with each big release isn’t a good approach for the long-term maintenance of the app. Yeah, I wish we used .bankx or something similar instead of .bank8…live and learn. Just remember, for now, .bank8 means you have a file meant for the subscription version of Banktivity.

Subscription info

We improved the subscription info screen fund under File > Subscription > View My Subscription so that it now shows upcoming invoice amounts, and you can see the last four digits of the credit card you have on file that will get billed.

Closing thoughts

I appreciate you taking the time to read the entire blog post! As you can see, much work and effort went into Banktivity 9. And if you are wondering if we are “done” – the answer is, of course not! We still have lots of improvements to make and a lot of work ahead of us. Onward and upward!

- Building the Future of Banktivity: Organizer Progress Report - October 17, 2025

- Filed Away Forever: Why We Built The Organizer - April 25, 2025

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

As a very pleased and long time user (started with iBank 4), I thank you for all the work you put into making this software. I was a MS Money version 1 user WAY WAY WAY back and personal financial software to me has always been the primary reason to even own a computer. 🙂

🙏

As my fellow user stated, MS Money was my old GO TO. Very happy I found your software several versions back and find Banktivity very useful to have all my financial accounts in one software package! My only hope for the future of this software is that the Direct Access connectivity vastly improves with all my financial institutions!!

Thank you for the update!

Do you guys have any plans to bring back the All Transactions view that was in previous versions? It was near the calendar view and allowed you to enter / clear transactions from any account in a single view. I really miss it.

I’d love to hear more of the details about how you used this feature.

I second Jason’s view on ALL Transactions register.

From my point of view It was my goto place to find UNCLEARED transactions across the whole document accurately. I use Banktivity for EVERY thing, including asset management, depreciation etc so often I do manual entries for those transactions and clear them at different times (eg year end).

Having the ALL register I found it easy to simply sort on UNCLEARED and get all the items that needed attention. As of now I have 4 reports that aim to do that data mine but it is not 100% accurate because of the way transfers work.

Yowser…. I don’t know what happened with 9.1 today but I’m not able to SEE any of my data in any windows.

The sidebar is there and is correct, but selecting items results in a blank workspace with the title & total…. and absolutely nothing else!

Also, the groups aren’t perfect on iOS – loans & associated assets are not linked like they are on the macOS version.

We are looking into the ‘blank screen’ issue. We currently believe this is only on the macOS Sonoma beta/RC builds.

As for groups, you might need to re-link the asset/liabilities on iOS as in developing this feature we found a bug where their relationship was not syncing correctly.

Yes, I’m running Sonoma RC and I’ve also submitted a bug report. Will re-link on iOS and see how it goes. Thanks Ian!

All fixed in 9.1.1 – thank you for the prompt update! I’m LOVING the groups on iOS (iPhone & iPad). ❤️

Hello, there is an inconsistency between the iOS and MacOS versions. If I have a liability account with a positive balance on MacOS Summary this is rather strangely summed with Assets. On iOS Summary this is kept apart as a liability which seems more logical to me! Anyway, at least can you make the two versions work the same way. Thanks.

PS very pleased that in 9.1 you have at last fixed the weird way Investment change was calculated on OS…

My banktivity mobile no longer lists the closing balance of the checking account in the summary view. it only lists today’s balance. how can I change this back as I use it to calculate future finances by subtracting total credit card balance from closing bank balance to make sure I am staying in budget.

This was addressed in 9.1.2 which came out a couple of days ago.

9.1.1 for iOS is absolutely fantastic progress – delivers my two most wished for features – account groups and forecast reports. Very well done Team Banktivity.!!

👏

Yes! Ditto. Great work team!

9.1 for IOS : in the account groups, the summary shows the today’s balance instead of the recorded balance !

Fixed in 9.1.2 which came out last weekend.

Will there be an option on iOS (or is there already) in the budget overview to leave out not budgeted categories without any spending?

I noticed that, now after the update, summary balances do not include post dated transactions as before. This feature was very helpful in determining my balance after future expense. Is there a way to change summary balance to amount that includes post dated transactions?

This has been addressed in 9.1.2 which is out now.

In a future version could you please make the Calendar view follow System Preference for first day of the weeK? Calendar view is not so clear to me with Sunday as first day of week.

Working on this.

Not sure if it’s an intentional change or maybe a bug but with v9.1.3 on Mac OS 14 (Sonoma) I no longer see the small calendar widget with I click in the date field when editing a transaction.

PS: I love the recent addition of the 1-line register views!

… never mind the calendar issue – it was just fixed in the latest update! 🙂

This has been fixed now.

I haven’t upgraded to version 9 yet and am still on version 8. I enter my transactions on my Mac and use Banktivity on my ipad and iPhone to view/lookup transactions. I was hoping version 9 would have added the ability to sync transaction attachments. On the Mac lots of transactions I attach a pdf of a receipt but those don’t make it to my ipad where I have LOTS of available memory. Its my most desired feature and would be great if it was an upcoming feature.

I have been very pleased with Banktivity 9 , some small changes have made a heap of difference to my daily flow. The Reconciliation change you blogged about, the Calendar supporting OS default, the small budget calculation all make a big difference to my daily use.

I am a big user of attachments and I feel the product could do a better job managing them with a simple SHOW ATTACHMENTS filter in the register, many competitors have this filter.

I have a file dating back to 2011 and I have taken steps since V9 to cull dated attachments (ie legal lifespan is 3 years for our IRS) and this kind of filter would be very useful. Same with purchases and out of warranty items where the receipt no longer adds value to the transaction.

AND……. if the ALL Transactions register resurface combined with show attachments it would be the perfect housekeeping combo.

Hello, please can you fix connection issue to Crypto.com debit card accounts? The Crypto debit card shows up in my Saltedge interface on Banktivity, but the Banktivity account that I want to link to it is greyed out, so cannot be selected.

Please bring back the colored transaction option. For those of us with visual issues, the black and white color scheme is difficult and time consuming to work with. I know there are only a few of us out there, most people are probably fine with the display as is, but I have found it takes me much more time to find transactions and to visually focus when I cannot discern transactions by color/icon.

Thank you for a fabulous product.

Please can you add a Report that provides tabular output of granular assets and liabilities? Ideally with at least fields of date | account name | ticker | currency | amount (original currency).

Bonus fields may include ticker type | ticker risk (from securities reference data).

For context, a bit like the ‘Category’ report (wonderful income/expenses) but for assets/liabilities.

Is any one else seeing issues with ‘Upcoming’ scheduled transactions on iOS? I have transactions that I can see correctly scheduled and appearing correctly in ‘Confirm Scheduled Transactions’ in MacOS but that seem to disappear from ‘Upcoming’ on iOS on the date due; also, on iOS under Configuration/Schedules the effected monthly transactions are now showing with a next due date of December. So it’s as if they had been skipped? I use Scheduled Transactions a lot so would value any insights from other Banktivity users.

Done a bit more digging – I have a Forecast report on iOS and Mac for my two key accounts. The iOS report is missing multiple Scheduled Transactions.

Scheduled Transactions is definitely broken on iOS.

Anyone else encountering this problem?

One usability improvement? I manually enter all my transactions. On MacOS when I enter a date for a transaction, that date is retained for when I enter the next transaction – great for those times when I have 4-5 or more transactions to enter on the same date in the same account. Pretty much a daily occurrence. On iOS however, the date is not retained. So for every transaction I enter I have to edit the details to change the date. Annoying. Can iOS be altered to behave the same as the Mac?

I think you deleted my comment re:variance reporting? Is that possible?

Is no one working to discuss this issue?

Bad enough my original comments were unceremoniously deleted

I don’t think we deleted any of your comments. In full disclosure, we are not currently working on adding variance to a budget. I’m not saying it isn’t something worth adding, just letting you know we are working on other things now.

It was to allow the budget to auto fill to use prior year as budget

If auto fill on prior budget year is ever added can it please be very optional as it is a really bad way to budget which should always be based on money in-hand and outgoing needs before next income.

I can how see how a variance budget report to previous periods could be of some interest purely for comparison purposes.

No, I don’t believe it got deleted.

I’m constantly amazed how efficient Banktivity is. My data goes back to 1997 (via MS Money) and takes 80MB, but is still lightning fast. But my bucket list includes an upgrade of the stock price display, which remains primitive. I would like to see:

1. The closing price line extended from one update to the next (useful for when the price is updated once a month manually).

2. An option to repair the stock prices (for example when the price is reported in cents but imported every now and then as dollars).

3. The ability to zoom out and see a long term display of a stock price.

4. A display of historic exchange rates.

5. The use of historic exchange rates in the Portfolio view.

+1 for feature request #5 Use of historic fx rates in portfolio view (and all reports that show historical data)

Wishlist:

• Option for single-row register (which was part of iBank in the early days) – magical and worked

• iOS companion app that does not sync all data…rather enter transactions and photo or receipt

(one-way sync to desktop, not a 100% of all transactions 100% of the time.)

I would very much like to upgrade to V9, and whenever I fire it up I get the little window saying “It’s better”, however when I check the support articles I note that the number of institutions experiencing connectivity problems seems to be stuck at 129 more or less for months, including several financial institutions that I need, I did try to upgrade when V9 first came out and was a disaster with almost none of my financial institutions connecting. Had to recover from a TimeMachine backup. I am not about to try again until that list gets down to the odd few that was the case with V8. Can you provide any idea of when we can expect connectivity to get back to V8 levels? Thanks.

V8 and V9 use the same core technology for connecting to banks. V9 has gotten a little better at handing some errors and we are introducing a few features for DA in v9 that will help even more. The upgrade from v8 to v9 is free. If you are having connection issues with v8 or v9, I’d encourage you to come to our support.

Weird change on downloading transactions – the system has stopped downloading pending transactions. Any idea why?

See Settings (aka Preferences) > Import

You’ll want to enable import pending transactions if it is off

Any idea why Banktivity does not support opening a new browser window within the app when manually downloading transactions? I have to go outside the app for 2 of 3 of my financial institutions, including my primary one that changed their website in the last week or so. I gave up on DA2/Yodlee about a year ago, and the support pages show my primary institution failure rate at 75-100%.

How do you delete “reports” you create in version 9? I find nothing indicating procedure.

Thank you

Hi. You can select the report, hold down the Control key and click the mouse/trackpad. You’ll get a contextual menu with a “Delete…” item.

May I mention a couple of feature requests here?

(1) All my mutual funds are within one account (Vanguard). It would be nice to generate a graph for a fund individually, instead of the entire fund.

(2) Please add a shortcut key enabling paging forward and back through report years. Using the trackpad for this is difficult for me at my age.

https://imgur.com/a/1zGz94p

Hi

Hi, Ive been using Banktivity for about seven years now and I am pretty happy with it.

Is there a way to have category reports subtotal amounts by account. For example if I have an interest category that is in several accounts is there a way to see the total for each account in one report? If not then consider this my feature request. Thanks

Best way would probably be to make a separate report for each account. We typically total amounts across accounts.

Sounds like everyone here is ok with Banktivity 9 so maybe I’ll soon feel that way but right now it’s not going so well with the transition to 9 (from 7). The first screen, when following instructions, wanted me to allow access to key chains/. passwords, and there was no way to opt-out. I did set up another way but there were no clearcut directions how to do this and succeed. I’m right now trying to see why the summary page with the new version document has figures not exactly the same as the version 7 document. It looks like it’s only the investments that have this discrepancy, but there are no directions how to match the dates on the summary page. Right now the major problem is syncing / following the directions but they don’t match reality . When i go back to bantivity 7 to open my old document it now says unable to verify credentials/ or unauthorized, please try again. Is what’s wanted here, my id for version 7 which in this whole process I may have lost? As you can see this is not going well. Why isn’t there a step to step guide with instructions that actually relate to what u see on the screen?

If you got prompted for access to Keychain Access, that is just to allow v9 to read in the v7 passwords. It doesn’t get access to the entire keychain. We do have this article to help with moving to v9.

Changes look good. However, the new direct access method seems problematic. Duplicate entries. E800 errors and so on. Logged a case. Hopeful of a reply and resolution.

Is there any way in V9 Mac reports to select the ‘Last 12 months’ whatever the latest, rolling 12 month period is? I can find the last year and the last 6 months but not the latest 12 months? Appreciate any help please. Thanks.

Long time user here from iBank 4 days.

I’m hoping that one day we’ll be able to change the Register view preferences to include the Memo field instead of only the Note field. Maybe others use it differently, but nearly all my transactions use the Memo field instead of the Note field, which requires I “open” each transaction to be able to view the Memo field. We can see the tags in the Register, so hopefully Memo?

I second this. Also….make it possible to resize columns….

Just upgraded from Banktivity 7 to 9 in order to maintain the SYNC function. Disappointed that I have to subscribe to the top tier to maintain the check printing function .

Upgrade process was seamless…well done!

1 question: What do the icons on the column to the left of the Date column of each entry in an account window indicate – (paper stack – 3 cubes – check & pen)?

I have been an iBank/Banktivity user since iBank 3, and have depended on your products for management of my finances for many years. I continued using Banktivity 7 after Banktivity 8 came out, as I am not a fan of software subscriptions. However, in the case of Banktivity, there is ongoing value added that is an expense for IGG Software (e.g. Cloud sync, transaction downloads, currency exchange rate updates). So, after these services stopped working for the legacy Banktivity versions I decided to move to Banktivity 9. I am currently on a 30 day trial, and really like the fact that Direct Access is included with all the subscription tiers. I will probably settle on the Silver level, since it is hard for me to justify an additional $30.00 US (~$40.00 CDN) annually to keep the US/Canadian dollar exchange rate updated (I do not print cheques, and do not need cryptocurrency prices). I assume I can manually update the exchange rate as needed with a Silver tier subscription, but would be much happier if Silver included automatic exchange rate downloads.

One wish for Banktivity: Import Rules for Investment Account Transactions. Is there a reason they are not available for investment accounts?

Thanks for the comments. Do you want full import rules for investment transactions, or do you want to auto categorize investment transactions, like Dividends getting assigned a dividend category?

I would like the transaction populated with the type of transaction, the name or ticker symbol of the corporation from my list of Securities, as well as auto categorization of investment transactions. In the case of dividends, I categorize them as either taxable or non-taxable. Non-taxable dividends are further broken down depending on the type of investment account they are paid into (TFSA, RRSP, or RRIF).

One further comment on your subscription model. The one you have implemented is, in my opinion, the best I have encountered. As long as you subscribe at least once, you retain access to all your data, plus receive ongoing software updates. I refuse to use Adobe software because of their subscription only model that will not let you access your edited photographs if you terminate your subscription.

Long-time iBank/Banktivity user here. That means a data file that goes back a number of years.

I’ve had a recurring problem for some time now, one that has been making it difficult to use the program, and it’s simple: I want to add a transaction or edit an existing transaction, and Banktivity freezes. Activity Monitor shows Banktivity as “Not Responding,” which is obvious. This happens on either an M1 Pro MBP with 16 GB RAM or an M2 Max Studio with 64 GB RAM.

Usually these hangs are a few seconds. Sometimes I have to Force Quit the program. Web searches have turned up a few suggestions, one of which is that attachments on transactions slow everything down. But some clarity from Banktivity here would be really helpful. I really don’t want to archive older transactions, and I really don’t want to wipe out the attachments.

This needs to be a priority at IGG because if the program hangs when entering or changing transactions, it can’t be used.

Hello

Please make the iOS app respect the correct start of the fiscal year as the desktop version does. This should work with any date/period object not just reporting

I am from Australia and out final year begins on July 1.

Thanks

Really enjoy Banktivity; but am also experiencing a short- three second- pauses every few days, but do not consider that a problem. 2014 iMac!! Banktivity Support said keep .bank8 under 40MB, but as my file was already much larger- at 1.11GB, I then asked Support whether anything sinister would happen- NO reply that time.

My file .bank8 package has a sub-folder ‘TransactionAttachmentCache’ at 1.06GB.

Attachment mean much to me. As a backup for the Banktivity attachments I label each Banktivity transaction with a manual number (old fashioned mechanical number stamp- uses ink!–on the document also and use it for attachment file name) and keep a PDF copy of the attachments in a separate folder. Very useful when I moved from Moneydance years ago and lost the connections to the attachments. Alt-Command-Spacebar and the number gets the attachment in a flash.

Agree with you Andy “…some clarity from Banktivity here would be really helpful.”

1 GB of file attachments is quite a bit, especially for a 10 year old computer. I would upgrade to v9 if you haven’t already (it’s free if you are subscribed or have subscribed in the past). Then use the Remove Historical Data feature to cull out your old data. The old data will stick around in a separate file if you need to reference it. That is the approach I would take.

Ian: this might be better in a forum- is there one?

I am on v9.2.4- current subscriber.

My average scanned PDF document size is approx 400K bytes (a single iPhone photo is approx 2MB).

Banktivity looks designed to have an attachment on each transaction.

Your help desk suggests keeping .bank8 under 40MB- ie 100 documents, which is one a day for three months! Where have I gone wrong?

🇦🇹 1439 NAB Transaction Account

😇 1888 ubank SAVE

Cut and paste emoji or symbols can make accounts easier to find.

Not certain if it is legit tho’.

Returning to Banktivity after 8 years after Intuit Mint is no longer available. Paid the Bankittvity subscription since it has been a great software for 8 years but not using it. The fundamental problem with Banktivity was the import and clean-up algorithm. Unfortunately, I see no improvement in the algorithm compared to Mint software, and hope I can help to improve Banktivity with my feedback.

Fundamentally, the original Payee information is golden and needs to be copied into the Note session so that we can compare it to the cleaned version of Payee. The “i” bottom is great, but not practical to compare/change many transactions at the same time.

The auto clean-up is always on even if I turn it off in the settings and way too short like removing the important location. Furthermore, even if the auto clean-up is off the payee MERCEDES BAR & GRILLE changed to Mercedes-Benz. Fundamentally, short and clean are secondary, accuracy is the most important. Another example MESA VERDE CAR WASH converted to Mesa Verde Restaurant & Smoking Lounge and overwrote my manual fixes.

Please contact me for more feedback since I love Banktivity’s other features and would like to make it work

Ian, are there plans for a v10 and when do you see it being released?

I echo this, what is the roadmap, heck what is even the vision for Banktivity to enhance the

Why not post a long-term vision?

Let’s have some enhancements, the releases are more around minor improvements and fixes, which is important, but we are looking for some more quality-of-life enhancements.

Hi. Would it be possible to pop up a warning any time a Category is left blank? Or at least provide an option to pop up warnings for blank categories? I do have a Missing Categories report but I’d prefer to find out immediately when it happens.

Of course this would exclude certain investment transaction types for which a category is not needed.

The one change to Banktivity that I would most appreciate is to allow multiple currencies for investments in a single broker account. For example, allow stocks from both US and Canadian stock exchanges in a single account.

I have to split each of my 8 brokerage accounts into a US$ and a CDN$ account, resulting in 16 accounts. Reconciliation of the accounts requires me to jump back and forth between accounts, depending on whether the investment is in US$ or CDN$. If I had investments in additional international exchanges, it would get worse.

Other apps can do it… see SEE Finance.

Banktivity is fantastic! One improvement would be enhanced time zone support. Existing transaction dates shift by 1 day when I’m traveling. I’ve noticed when I travel from Eastern Time to Central Time, for example, the dates of all my transactions shift. Returning to Eastern Time requires lots of fixes to transaction dates. The only workaround I’ve found is to turn off automatic time zone setting feature on my devices BEFORE I travel (which is not a terrific option). Possibly something for version 10?

How do I get Banktivity to stop suggesting amount inputs? They get in the way of entering information.

Thank-you.