I’m happy to be writing to you today with some news about Banktivity’s most popular feature, Direct Access. For those unfamiliar with “Direct Access” – it is the name of our technology that allows you to connect to your bank and automatically download transactions.

As many of you know, we partner with backend providers to make Direct Access work. The backend providers handle authentication with your bank and getting the data, and Banktivity handles all of the other components. For a long time, our only provider was Yodlee. In 2022, we added Salt Edge as another provider for banks in the United Kingdom and the European Union.

Today, I’m happy to announce that we are offering another provider for our customers in the United States – Plaid.

The banks Plaid supports overlap considerably with many of the banks supported by Yodlee. We are introducing Plaid so that our customers can pick the aggregator that works best for their specific banks.

Data Aggregation and Potential Problems

I do want to talk briefly about data aggregation. In short, it can be a very nasty technology. While many banks have moved to Open Banking, which generally results in better connections and higher quality, many banks still rely on older technologies, like screen scraping. Additionally, sometimes aggregators need special permission to connect to banks, and the site will fail if an agreement can’t be worked out. If you have used any personal finance app with automatic transaction downloads for a good amount of time, you’ve almost certainly experienced some kind of connection issue. I’m not promising that Plaid will solve every connection issue, but having more options is good for our customers.

Should you move your connections to Plaid?

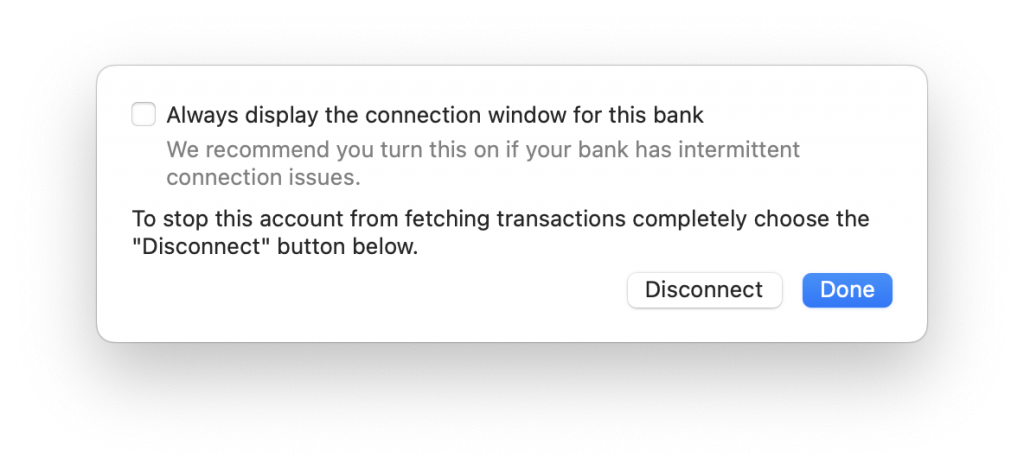

If your connections are working now, you will not want to move – don’t fix what isn’t broken. However, if you have some accounts that you’ve never connected or are failing regularly, you should consider connecting via Plaid. Please note that each account can have one and only one connection, either Yodlee, Salt Edge (for non-US customers), or Plaid. Before you can try to connect an account to Plaid, you’ll need to disable the existing connection. On Mac, this involves selecting the Account, then going to Account > Show Connection Status…> Options [Button] > Disconnect [Button]

Enable Direct Access Beta Sites

At the time of this writing, we still consider Plaid connections BETA. Suppose you want to try out a Plaid connection. In that case, you’ll need to enable access to beta sites by going to Banktivity > Settings > Advanced and then clicking the “Enable Direct Access sites under development” checkbox.

Set Up a New Connection

Once the beta sites are enabled and you have an account that has no connection, you can then proceed to set up a new connection. On Mac, select the account, and from the top menu, choose Account > Setup Automatic Download. In the sheet that comes down, search for your bank and continue forward. If Plaid supports your bank, you will see it listed as a connection option:

Conclusions

Easily getting your financial transactions into Banktivity is one of its pillar features. When this works, everyone is happy. When bank connections fail, frustration levels, understandably, grow pretty quickly. We are introducing Plaid so that customers have another option to connect to their bank. So far, the results of switching from Yodlee to Plaid have been very promising.

I also want to point out that we are rolling out this major feature without any giant update. Now that we are on subscription, we will typically release features as they are done and save the big updates for when we make larger changes to our codebase that span many subcomponents and potentially destabilize the system.

If you are one of the customers who has been struggling with a bank connection, I hope Plaid supports your bank and provides a better experience.

- Banktivity 9.5 and Monthly Subscriptions - October 18, 2024

- Coming soon: Banktivity 9.5 - July 19, 2024

- Continuing Investments in Direct Access - February 26, 2024

Adding Plaid was a real benefit. My bank connections have been failing for years and now finally work with Plaid. Thanks for the update!

Speaking of connectivity, will Banktivity be able to access Apple Card transactions in the near future like YNAB and other services?

We are looking into this. There is a rumor that it might be possible with iOS 17.4, but I can’t seem to confirm that.

Any more news on auto importing Apple credit card? This is very interesting to me.

https://9to5mac.com/2024/03/05/ios-17-4-lets-budgeting-apps-easily-access-apple-card-cash-and-savings-data/

Apparently it’s a new API called FinanceKit, and a number of apps all ready support it.

I’m really hoping this can be brought to Banktivity.

We are working on it.

it’s been over a month, other apps are ready with it. Your support team is positive that finance kit will not be supported… but yet the last update here is that you are working on it…. any hope?

We’ve applied to Apple for access. Still haven’t been approved, yet. Thanks for your patience.

On the Mac, Yodlee still tries to offer an Apple Card connection, but it fails every time ( and makes me very nervous entering my Apple ID/Password into a very “phishy” looking dialog.

Is Finance Kit available on MacOS and will desktop Banktivity ever be able to download Apple Card transactions?

Do you have access from Apple yet for FinanceKit API so you can import Apple credit card transactions?

This is actively being developed now. Just to be clear, this feature will only be available on iPhone as that is the only place where your Apple Wallet exists.

Do you know if UMB bank in Utah will connect with Plaid? MORGAN STANLEY uses it as its banking platform, and I have never been able to connect with it so I have stopped using Banktivity…

Ticket SR#12132540

No reply since Mid February

Had an online chat with tech on Monday April 2

She said the problem is on your end but NO REPLY

Why won’t anyone just reply to let me know it’s being worked on?

I’m a bit confused Mark. I chatted with you directly about this in late February and neither of us could get it to repeat. I was not under the impression you were waiting for an additional reply, sorry for any confusion!

the issue is, and the reason I opened a new discussion with your staff, that that my three fidelity accounts have yellow balls next to them now and the comment is TECH_ERROR. The tech support person said this is an error on YOUR end, not Fidelity and she would bring it to the attention of your team

I ve asked many time for updates and got nowhere

Thanks for the additional info. The issue from February I worked with you on had to do with security prices, but you are now referring to an issue with your Direct Access accounts not refreshing. It looks like this was brought up to our live chat team on April 1, then you re-opened the February ticket asking for an update. It is WAY cleaner to file a new ticket for the new issue. Re-opening a ticket the originated with a different issue can cause ticket/chat noodles which we try to avoid. I know our support rep is working on an update, I expect you’ll hear from her again today.

and just so you are aware since no one seems to solve problems I have not had a clean update for these accounts since 3/26

That should have given your tech guys the time to do something and not nothing

I DIDNT decide to use the old ticket – your SUPPORT person insisted on it

Why can’t they fix it?

Ian – Still no fix after over a month! There must be lots and lots of Fidelity users with the same problem.

I am the top ranked subscriber paying the top price.

Why can’t your engineers work on this?

HI. I’ve had continual challenges with Yoddle and banks. I just tried Plaid, and it worked like a charm. Thanks!

Me too! What a relief!

Thank you for adding Plaid. After many months of entering transaction manually I am FINALLY able to download my transactions from my bank with Plaid.

thanks so much for the option.

How do you treat contingent or escrowed assets — for example accumulated credits held by an employer to pay specifically for a retiree’s health insurance premiums? And how about a paid up life insurance policy payable on the death of the holder? Are they not considered part of net worth?

Ian, Thankyou for this update, but I am writing to you because there is a bug which I notified your programmers about Ticket #NF52F in May and after 2 updates it still has not been fixed. I would appreciated you chasing it up for me

Hello Ian,

Long-time user, mostly happy although there have been a few significantly long times of non-connectivity with financial institutions. I will say that the support team has generally done a good job and have consistently been responsive on a timely basis.

My most recent issue is as follows. I am a Canadian user, with all my accounts being with Canadian financial institutions. Most of my accounts are Canadian $, but I do have a couple of US $ accounts (one US checking and one US credit card) at my primary Canadian financial institution.

Per your instruction, I subscribed Gold for one year so as to “activate” multi-currency functionality. I then downgraded my subscription to Bronze, with the full understanding that I would no longer get currency rate downloads but that my transactions would continue to download from my Canadian financial institution. Everything worked exactly as I was advised that it would, and I manually adjusted F/X rates periodically.

Recently, one of my accounts (US dollar checking account with my Canadian financial institution) stopped updating and the message was that the account appeared to be closed. Definitely not the case so I reached out to support. It was suggested that I needed to disconnect all accounts with that bank from Direct Access and then reconnect them. I tried that and the software indicated that I needed to have a gold subscription.

That is not consistent with what I had previously been advised (or at least what I understood I had been told) and was also not consistent with what had been happening. For the past couple of years, Direct Access had worked just fine, downloading transactions for my US dollar checking account and my US dollar credit card. Yes, I had to manually insert the F/X rate, but I understood and was fine with that as a limitation of my bronze subscription.

Now, I am being told that I have to upgrade to Gold in order to connect to the US dollar accounts. Not only is that inconsistent with prior advice, but also with my experience for the past couple of years. Furthermore, it does not make sense as the transactions for those accounts are the same notwithstanding currency. A $100 charge on my US credit card is no different than a $100 charge on my Canadian $ credit card since I am not expecting Banktivity to translate the US amount to Canadian dollars (which I acknowledge can be more complex given F/X fluctuations).

It seems unreasonable to charge an additional US$ 50 per year to download transactions from the same financial institution when I have no expectation that Banktivity will do any currency translation. Data is data when you are already downloading transactions from that particular financial institution and I am not expecting you to do anything more with it.

Do you agree? Or, do you think that a $50/year charge is reasonable for data which is essentially exactly the same, regardless of currency and for which I am not expecting Banktivity to do anything whatsoever??

You sir, must be a wizard.

As described in my earlier post, I have been unable to connect to my US $ checking account for a couple of weeks. And then I was unable to connect to my US $ credit card without a gold subscription after doing the disconnect and trying to reconnect.

Right after posting, I decided to try one more time, connecting each account separately and everything is now working perfectly (go figure).

All’s well that ends well and I remain a satisfied Banktivity user.

As an aside, Marcie is outstanding, in terms of response times, suggested solutions, and professionalism in communication.

Hello,

As a potential new customer, I did the trial and really liked the software, my concern is with the 3rd party data aggregators and what they do with my data. You may not sell my data, but will they? and do they have open access to my accounts? Thank you in advance for any clarification you can provide.

Thank you for doing direct download for Apple’s Credit Card – letting Plaid host your credentials is a non-option since your AppleID is your life and exposure could result is massive damage to all of your documents. But, request: please figure out a way to use Apple Credit Card / Wallet directly from the Mac. I don’t want to be forced to use Banktivity on my iPhone just to sync this one account.

There isn’t a way to do this now. Access to Apple Card transactions is locked down by Apple and is only available on iPhone (not even iPad). If Apple ever brings the Wallet app to Mac, maybe we will see support for it, but please don’t hold your breath as this is completely out of our control.